- Home

Blog Blog

Payments Resources Payments Resources

Why Multiple Localised Payment Methods Matter For International Payment Gateways

Why Multiple Localised Payment Methods Matter For International Payment Gateways

The growth of online B2B transactions is nothing to sneeze at, with a global market value of 14.9 trillion USD in 2020, which puts it at over 5 times that of the B2C market¹. What’s more is that it’s only going to grow even larger with a report from Businesswire stating that it would reach an astounding 25.65 trillion USD by 2028, a projected 172% increase within the coming years². However, many online businesses, payment providers included, sometimes fail to address localisation at certain markets. This failure detracts from the user experience especially if they’re forced to go through these ordeals just to conduct business:

- Adopt a payment method that isn’t favourable to them due to factors such as high platform costs that eat into profit margins

- Subjected to FX fluctuations if they have to convert currencies before making payments, especially for cross-border payments

- Be forced to open accounts in different banks due to the platform not providing other payment methods that utilise their usual bank

Failing to address localisation in this manner is a shame since it’s a clear indication that the opportunity to break into a potentially lucrative market is being squandered, especially in the Asia-Pacific region which holds 60% of the global B2B eCommerce market share³. It also increases the risk of being overtaken by competitors in an environment that’s only becoming more competitive as small to mid-sized companies vie to catch up to ever-growing demand from digital customers, a customer base that has only expanded in number since the pandemic hit⁴.

Therefore, to effectively localise in a given market, it is recommended that your business offer multiple payment options and methods to ensure a smooth localisation process.

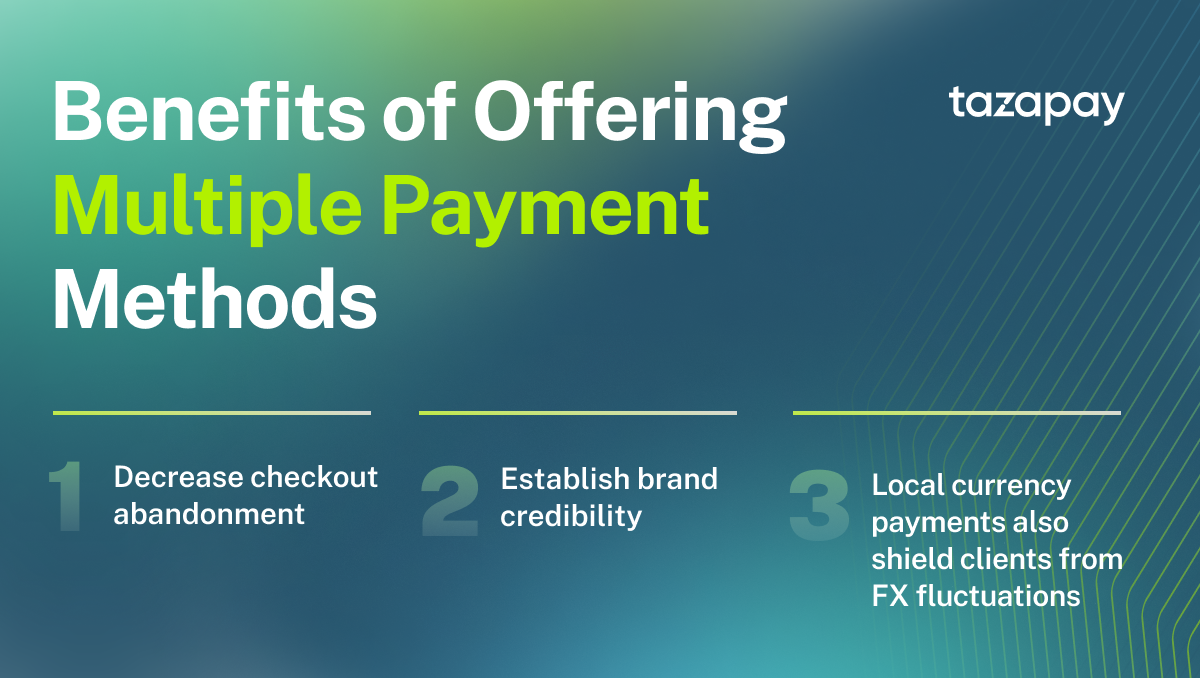

Why does offering multiple payment methods matter?

Offering multiple payment methods matter because doing so will help you establish a positive reputation amongst the local community, something that is definitely helpful when conducting international online B2B trade, among other things. Here are also a few additional reasons why doing this should matter to you:

Decrease checkout abandonment

- Much like addressing B2C cart abandonments, new clients are less likely to abandon a deal if your business includes payment methods that they prefer

- Recurring clients are also more likely to stick around if they’re able to conduct transactions with their preferred payment method

- This is a crucial aspect to consider since the average cart abandonment rate across all industries, including B2B eCommerce, is a sobering 69.57%. In March 2021, this has only grown to 80%⁶. However, by optimising checkout processes, whether it be via improving web design or by including a payment provider that your clientele often use, conversions can increase by up to 35.62%⁵.

Establish brand credibility

- By offering a selection of payment methods, you’re more likely to stand out as a business that is serious about entering any market of choice

- If the payment you offer is tied to the most predominant payment method of that market, your image of trustworthiness strengthens. A good example would be opting to include B2B payment processes that involve card payments and digital wallets in Singapore since it sends a strong signal to potential clients that you’re not only committed to localising your business but also keeping up to date with local market trends⁷. A payment provider like Omoney, which operates in over 173 countries and provides local and global payment methods may be a good fit for your needs here.

Local currency payments also shield clients from FX fluctuations

- With local currencies & payment methods on the table, clients can afford a greater degree of certainty of how much cash flow they have on hand each month

- It also helps to have a multi-currency account so that your business can also offset any FX instability especially if you make regular payments within that market.

What payment methods should you include in your cross border payment gateway?

Taking the steps necessary to offer multiple localised payment methods already puts your business several bounds ahead of the competition. However, whether the steps taken are the correct steps to take is dependent on the market you go to, as alluded to in the previous section. Thus, the best way that will set you up for success in that specific market is to find a payment platform that integrates with the dominant payment method.

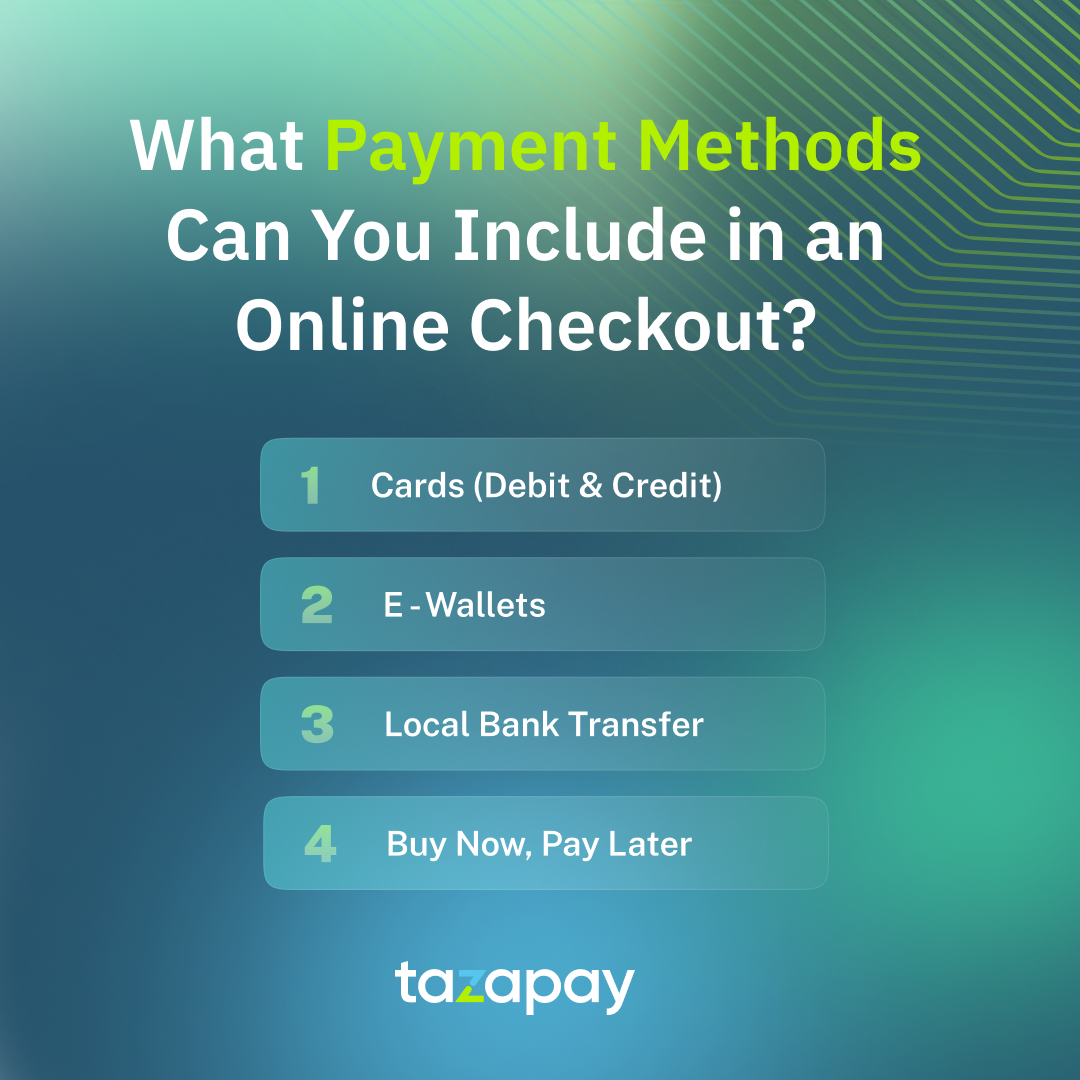

Here are some payment methods that you should consider:

Cards

- Initially offered during the Dot Com Bubble of the 90s when eBay and Amazon first made themselves known, it’s hard to go wrong with the most predominant method of payment for online transactions.

- Developed markets across the world such as Canada, the United States, the European Union and Singapore tend to have high card penetration⁸, with Singapore seeing card payments dwarf every other payment methods by making up more than 75% of all electronic transactions in the island nation in 2020⁷.

- Debit cards are seeing more adoption due to the COVID pandemic necessitating changes in purchasing habits according to the 2020 McKinsey Global Payments Report, which mentions the resulting rise of merchant services due to the massive shift towards electronic transactions⁹. Moreover, they’re also the dominant payment method in the most populous markets like India and China¹⁰.

E-Wallets

- More predominant in growing markets in SEA and India with popular wallet applications such as GrabPay in SEA, QR code payments in SG and India via PayNow and UPI respectively.

Local Bank Transfer

- Reliable and readily available, holding in the local currency also aids in cash flow. Their settlement times are often faster than SWIFT/Wire transfers. Here is where you can consider looking for payment platforms that can open virtual named accounts while they handle the collection and disbursement like what Omoney does.

- This method of payment is especially popular in Singapore, Thailand and Malaysia since they boast the highest penetration rate per number of social media users for eCommerce in the SEA region based on findings by Deloitte¹¹. This is further compounded by the efforts by their respective governments to digitise the experience

Buy Now, Pay Later Arrangements (BNPL)

- Helps with cash flow, usually common in markets where businesses are willing to be in credit like the US, Canada¹², and most of the EU which happens to have eight out of 10 of the major BNPL markets in the world¹³.

With that being said, these reasons are why you should consider offering multiple payment methods whenever you expand your business into a new country. Every little bit counts, after all. Fortunately, there’s no need for you to expend precious resources setting up the payment infrastructures yourself since you can easily outsource this to Omoney, which covers payments in 173 countries as well as offers localised payment methods in 56 major markets.

If you are interested in finding out more about how we can assist you in your B2B endeavours, contact us today.

Sources:

- • In-depth Report: B2B e-Commerce 2021 | Statista

- The Global B2B E-Commerce Market Size is Estimated to Reach USD 25.65 Trillion, Expanding at a CAGR of 18.7% from 2021 to 2028. - ResearchAndMarkets.com | Business Wire

- Global Business-to-Business E-commerce Market Size, Share & Trends Analysis Report by Deployment Model (Intermediary-oriented, Supplier-oriented), by Application, by Region, and Segment Forecasts, 2021-2028 (researchandmarkets.com)

- Looking ahead: The 2021 B2B Ecommerce Market Report (digitalcommerce360.com)

- 15 Cart Abandonment Statistics You Must Know in 2022 (sleeknote.com)

- • Shopping cart abandonment rate by industry 2021 | Statista

- E-Commerce Payment Trends in Southeast Asia | Fintech Singapore (fintechnews.sg)

- • Credit card usage by country | Statista

- The 2020 McKinsey Global Payments Report

- Credit and debit card usage globally - ThePaypers

- Deloitte-cn-tmt-inclusion-en-200924.pdf

- • Top countries in online buy now, pay later 2020 | Statista

- • Canada: online consumers interest in BNPL 2020 | Statista

Category

Payments Resources

Why Multiple Localised Payment Methods Matter For International Payment Gateways

Related Articles

Local Payment Methods in Indonesia: How Dana Works in an International Payment Gateway