- Home

Blog Blog

Product Info Product Info

What Should You Look for in a B2B Payment Gateway’s API?

What Should You Look for in a B2B Payment Gateway’s API?

With more businesses taking to the online space to transact, it’s more important than ever to remove as much friction between you and your clients as possible in order to make a great first impression. This is where having a payment gateway API that aligns with what you need in terms of features is key.

Before diving into what features to look out for, it first helps to know what an API is and how it works in the context of B2B online payment gateways.

Are you looking for a payment provider that can support complex B2B transactions on your platform? Look no further than Omoney. Contact us to find out how we can integrate with your business!

What is an Application Programming Interface (API)?

An API, which stands for Application Programming Interface, is an intermediary that connects application software by sending and retrieving data to a server.

If the application has a shared data library, then the API is able to connect between the two software and display the desired results to the end-users.

How is an API used in the Context of B2B Payments?

Before diving into the context of B2B payments, it helps to illustrate the use of APIs with a simpler example.

Imagine you’re an online shopper trying to place an order. The eCommerce merchant has a storefront that displays the items you want. However, in order for the transaction to take place, there must be someone taking the order from you and notifying the merchant to ship the item to your address.

This is where an API comes into play.

An API can take your order at the merchant’s checkout page by getting your payment information and storing that into the eCommerce merchant’s server. It will also tell you that your payment is successful and the merchant will update the status of your shipment once they have sent the item with a logistics provider.

On the merchant’s side, the API displays the information that you’ve paid for the item and they would need to ship the item in question. They would retrieve the information you’ve given in the checkout page so that they can send the item to your address, and they can update the status of your shipment using API calls.

When it comes to B2B payments, the checkout may go through additional steps to account for the complexities in fulfilling large ticket orders. These may include uploading shipping documents like the Air Waybill or Bill of Lading, any additional invoices, or even milestone disbursements.

For instance, if you’re trying to order 200 rolls of fabric for your clothes manufacturing business, your B2B payments processor’s API will request your seller to show a Commercial Invoice and Air Waybill or Bill of Lading. Once these documents are uploaded, the platform will receive the data and the API will automatically disburse 30% of the payment to the seller if this was the amount agreed upon. When the goods finally arrive at your doorstep, that’s when you can confirm the receipt of goods and the platform’s API will release the remaining 70%.

As illustrated, the B2B checkout process requires more steps in between compared to the typical B2C checkout process. B2C payments tend to treat the transfer of money as a one and done deal, whereas B2B transactions have more steps and tracking required.

If you’d like a deeper dive into the International B2B Payments Landscape, feel free to check out our guide.

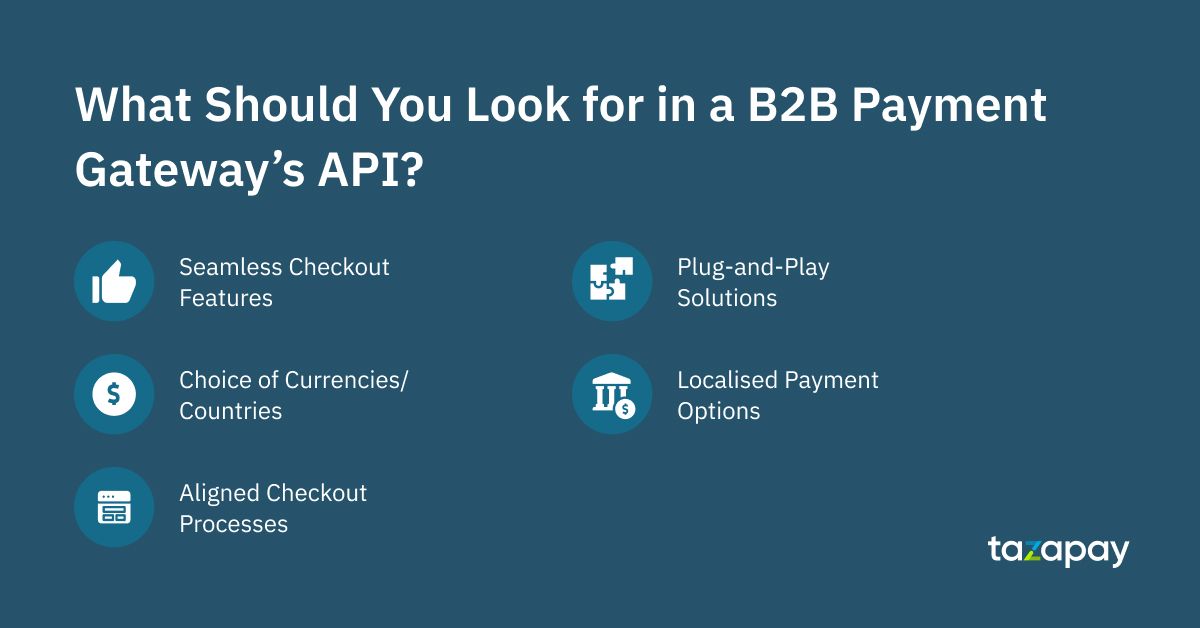

API Features and Data to Look For when Choosing a B2B Payment Provider

When choosing the right payment provider for your business, it helps to take stock of the following features and data requirements on your end.

How Seamless is Their Checkout Process?

When designing your checkout process, it is important to make sure that the experience is as user friendly as possible to increase conversion and prevent dropouts. This may mean deciding how much to integrate the payment solution on your website (native) and how much to direct your customers to the third party service (hosted).

A good payments API would provide many different configurations to allow different levels of integration depending on how your website is designed. These features can reduce friction during checkout, such as:

- No Sign Up for Buyers

If the payment gateway is able to skip the signup process for your clients, then the friction is removed for them as they don’t need to manually key in their personal details during the checkout process.

This will help to increase conversions upfront and potentially keep them as a recurring client later down the line.

- Displaying All Costs Upfront

By displaying all of the costs associated with your transaction, such as FOREX rates, shipping fees, platform fees, and who pays the share of these, this will set expectations up front with your clients so that they aren’t shocked by any hidden charges later on.

Your payment gateway’s API should have an option to allow you to do this.

- Minimal Redirects during Payment

The more optimised the payment gateway is, the better it is for you and your clients. By reducing the number of redirects during checkout, it also makes the transfer of payment and loading the final checkout page quicker.

This is essential to keep in mind if you’re dealing in developing countries where their internet speeds aren’t the best.

If the payment gateway’s API documentation doesn’t wholly illustrate all of their use cases, speaking to the customer success team would reveal whether they have the features you’re looking for and the capability to integrate into your system seamlessly.

Is There a Plug-and-Play Solution Available?

B2B platforms that utilise eCommerce platform builders such as WooCommerce and Magento may find that their built-in checkout solution too elementary to handle the processes in a B2B checkout.

This is where finding a payment provider that has a plug-and-play solution for these platforms would help in getting the features needed whilst also making the implementation smooth for the online business.

Omoney also has checkouts for WooCommerce & Magento built online platforms. Request for your API access from your dashboard!

Do They Support Your Choice of Currencies and Countries?

Payment providers have to obtain licenses and go through rigorous compliance checks to operate in specific countries, especially if they are dealing with businesses that have large volumes of transactions.

Even then, some global payment providers may find that operating in specific countries won’t make economic sense from not having enough demand in that country to warrant a license.

For example, certain global payments providers still do not carry the Indian Rupee (INR) and Indonesian Rupiah (IDR). While the alternative for transactions in these markets would be to use the United States Dollar (USD), this means that buyers and sellers in that region would have to bear the burden of fluctuating forex costs and it may deter them from dealing with cross border merchants.

How Localised are Their Payment Options?

On top of supporting the currencies and countries you operate in, it helps if the payment provider also allows for more localised payment options in terms of sending and receiving transactions.

For instance, Singaporeans favour using credit cards and direct bank transfers, as evidenced in the Statista study in 2019 where 77% of transactions in Singapore are done via credit card, and 35% of transactions are done with direct debit. Additionally, PayNow, a mobile wallet, also has QR code payment links which makes transacting with local Singaporean entities easier.

Other markets however, may not have a high debt or credit card penetration rate. These include the Philippines, where debit and credit cards only form 21.7% of the preferred payment options compared to cash at 51.3% in Statista’s 2019 study.

Hence, it helps to know if your payment provider supports payment options that are localised, making checkouts easier for you and your clients.

Does the Checkout Process Align with Your Business Transactions?

Depending on your B2B dealings, you may need additional features in the checkout API in order to have your bases covered.

For businesses that deal with goods, check to see if the payment gateway supports buyer and seller credit. For service based B2B businesses, you may want to consider how the payment provider implements milestone payments, whether they provide escrow accounts that are legally binding, and how the payout settlements are done.

On top of all that, it helps to find out if the payment platform’s API is flexible in providing different settlement times, conditions of disbursement, and more. This will help your clients ease into your payment provider’s platform when transacting with your business.

By keeping these points in mind, you’ll be able to make your B2B checkout process easier for you and your clients. B2B payment providers like Omoney would have their checkout pages designed with transactional complexities and payment localisation in mind, especially in emerging markets like India and Southeast Asia where there is low credit card penetration.

Ultimately, taking stock of your business processes first will help you narrow down on the right payment provider for B2B checkout. If you would like to find out more about Omoney’s API integration, you may contact us here.

Category

Product Info

What Should You Look for in a B2B Payment Gateway’s API?

Related Articles

Omoney Named to the 2023 CB Insights' Fintech 100 List

Omoney Secures MPI Licence from Singapore's MAS, Bolstering Its Cross-Border Payment Capabilities