- Home

Blog Blog

Export & Import Export & Import

Types of Documentary Credit: A Guide

Types of Documentary Credit: A Guide

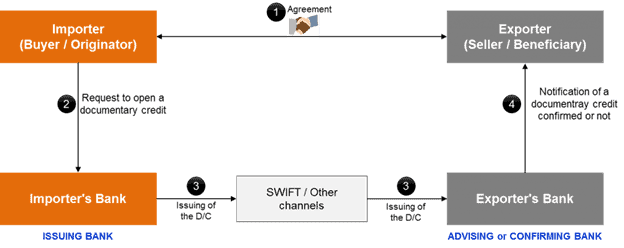

A documentary letter of credit is a type of written undertaking issued by a bank to the beneficiary (the seller) on the instructions given by the applicant (the buyer) to pay the decided amount of money at a pre-decided future date or at sight. Moreover, there are several types of Documentary letter of credits. Hence, it is crucial to understand the differences to maximise advantage and utilise them under the right circumstances. The most common types of documentary letter of credits and potential risks are covered here

Types of Documentary Credit

1. Irrevocable (and Revocable)

It is an undertaking that guarantees the bank’s issued payment for any services or goods purchased. To add on, it is non-cancellable during a specified period. Any cancellation or amendment of the documentary credit can only be made when the beneficiary has agreed. A credit, by default, is irrevocable. Revocable credits, however, are the ones that can be cancelled without the beneficiary’s consent at any time and do not offer any adequate security. Typically, banks do not authorize a revocable credit.

2. Silent Confirmation

It is the private arrangement between the seller and the bank in which the bank adds a guarantee of payment to the seller without the issuing bank’s knowledge on certain set conditions. It is an advising bank’s commitment to pay or accept with silent confirmation. Contrary to the confirmed letter of credit, it involves no confirmation instruction by the issuing bank. Therefore, these are pure agreements between the ‘silently confirming’ bank and the beneficiary.

3. Confirmed

Confirmation refers to a definite undertaking by the confirming and issuing bank for honouring or negotiating a complying representation. It is a pre-condition included in the sale contract and requested by the seller at the time of agreeing to the sale of goods or services. The seller usually request this under the following circumstances:

- • Documentary risk

- • Country risk

- • The risk of issuing bank

4. Red & Green Clause

These credits include an exclusive clause, allowing the seller to draw the credit before the goods are shipped and the document submitted. If we go by history, this clause gets its name by the way it was written, i.e., red or green ink.

- • Clean or Unsecured Red Clause: Doesn’t require any proof of goods.

- • Documentary Or Secured Red Clause: It includes advances made against bestowal of warehouse receipts or other similar types of documents along with the seller’s undertaking of delivering the bill of lading and other documents.

- • Green Clause: Advance payment is allowed but offers storing of the goods on the bank’s behalf as security.

5. Revolving

A credit covering multiple transactions over a long period is called a revolving letter of credit. If you wish to increase the value of a partially or fully utilized credit, an amendment is generally required. However, a useful and better way of utilizing the same is through a revolving credit. It can reduce the administrative workload often associated with repetitive purchases of goods of the same type from the same supplier regularly. The credit might revolve in relation to time and will be either cumulative (carrying forward of any sum not utilized during one month) or non-cumulative (an explicit shipment each month). It can also revolve in relation to value.

6. Transferable

Under this credit, the seller can transfer the credit in full or partial to one or more third parties. It is essential for the credit to state that it is transferable for such practice to be fully effective. All the transfers must be made along with similar terms and conditions of the credit. The only exceptions are:

- •The credit amount

- • The expiry date

- • Any unit price stated therein

- • The period for presentation, or

- • The latest shipment date or given period for shipment

7. Standby Letter of Credit

It is similar to demand guarantees which are also known as bank guarantees. It is a legal document that guarantees payment to the seller even when the bank or bank’s client defaults on the agreement. Contrary to the normal documentary credit, it offers security against non-performance. In other words, the seller can claim if an unexpected action, as covered by the standby, doesn’t take place.

8. Back-to-Back

Traders who intermediate between the final buyer and the source supplier usually utilized this type of credit. It involves issuing two different credits:

- • A Master Credit favours the ‘middleman’, while,

- • A Back-to-Back Credit favours the source supplier.

The terms and conditions of both are similar except for certain things such as the presentation period, the credit amount, the latest shipment date, the expiry date etc.

While the letter of credit might be compelling, considering the risks involved, it is safer to go with trusted and reliable options such as Escrow. Omoney is a trusted third-party platform that holds the money until both the seller and the buyer meet all the obligations.

Category

Export & Import

Types of Documentary Credit: A Guide

Related Articles

Why Do B2B Businesses Need Escrow Services

Problems Escrow Is Intended to Solve