- Home

Blog Blog

Export & Import Export & Import

The Movement of Money and Documents in International Letter of Credit

The Movement of Money and Documents in International Letter of Credit

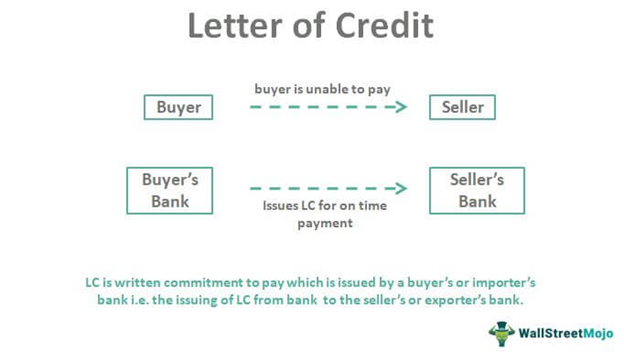

A Letter of Credit is a popular mode of payment used by exporters and importers for international trade. A bank issues it, and the bank takes the guarantee that the buyer will pay the seller on time for the services rendered. Therefore, the onus of making the payment – be it partial or full lies on the bank if, for any reason, the buyer cannot fulfil this financial responsibility.

The bank Letter of Credit is an international trade facilitator as it showcases the importer’s intention and ability to pay – this document mitigates the risk for sellers. Moreover, it accelerates cross-border trade.

A Letter of credit is all about moving money and documents amongst the various entities involved. The list consists of the buyer, the seller, the issuing bank, the advising bank, a beneficiary, etc. Therefore, let us understand the step-by-step movement of the money and documents by getting acquainted with the letter of credit procedure.

Steps involved in the Letter of Credit

Before the importer approaches their bank to issue the Letter of Credit, there is a contractual agreement between the buyer and seller. This agreement is significant as details from this contract are a part of the Letter of Credit. Since this sales agreement has a list of obligations – the Letter of Credit relies on it.

Step 1: Issuance of the Letter of Credit

The importer seeks a Letter of Credit from their bank, also known as the issuing bank. The issuing bank usually operates out of the importer's country. Therefore, certain information from the contract is provided to the bank. Information includes:

The payment details

- Contact information

- Delivery date

- Mode of transport

- Natural calamity clause

- The quantity of goods shipped

- Price

- Other such details

These details set the foundation for this legally binding bank Letter of Credit and must be scrutinized to ensure the information is correct.

The issuing bank sends the Letter of Credit to the seller's bank, also known as the advising bank, mostly based on the seller's country. The issuing bank verifies the Letter of Credit and passes it on to the seller. The exporter then vets that the Letter of Credit is according to the terms of the sales agreement agreed upon by the buyer and seller. Furthermore, the exporter also confirms the buyer's capability to fulfil the obligations as stated.

If everyone is in sync with this Letter of Credit, the exporter moves onto the next step.

Step 2 - Shipment of goods and documents

Once the seller has confirmed that the Letter of Credit is satisfactory, they start shipping the goods to the buyer. Additionally, certain documents need to be sent to the advising bank by a certain date once the goods are shipped. These documents confirm the fulfilment of the contractual obligation.

These are the contractual commitments as per the Letter of Credit. In addition, the contractual commitments include the date of shipment, an inspection of goods, shipment method to and from the port as specified in the Letter of Credit.

Once the seller has fulfilled their transfer of goods and documents as per the Letter of Credit guideline, they can be sure that they will receive the payment, regardless of what goes on at the buyer’s side. This instils a sense of confidence in the seller.

Step 3: Transfer of money and receipt of payment

When the documents arrive at the seller's bank and confirm that everything is as per the bank Letter of credit terms and conditions, the seller is paid.

Then, the buyer's bank will obtain the documents to check for any discrepancies. If everything conforms to the terms of the Letter of Credit, they release the payment to the seller's bank. The documents are then sent to the importer to obtain the goods on arrival.

The payment to the seller is made instantly if the buyer's funds are already lying with the issuing bank. However, sometimes the vetted documents are sent to the buyer for confirmation before releasing the payment. Then, the buyer can make payment to the seller's bank. The Letter of Credit will clearly state the terms of payment.

Why does one go for a letter of credit?

An exporter chooses the bank letter of credit to make sure that they will definitely receive their payment. It is a way to mitigate any risk associated with non-payment possibilities that could arise. At the last moment, anything can happen – the buyer can go bankrupt, or some legal issue can arise due to which the importer’s assets get seized – the seller does not want to risk their receipt of payment and therefore goes for this option.

Is there any viable alternative to the Letter of Credit?

Yes, in fact, Escrow Services are a preferred alternative for cross-border trade by many. Financial platforms like Omoney offer online escrow services that are a safe and cost-effective alternative that protects both parties.

Like we read above, the buyer and seller have a contract between them stating the terms and conditions of the trade deal – here is when they mutually decide on an escrow service provider that is reputed and reliable.

Escrow works because the buyer deposits the agreed amount with the Escrow provider, like Omoney, making their intent & capability to pay evident. Then, once the seller fulfils the obligations as per the agreement, Omoney or any escrow service provider transfers the amount to the seller’s account.

Category

Export & Import

The Movement of Money and Documents in International Letter of Credit

Related Articles

Why Do B2B Businesses Need Escrow Services

Problems Escrow Is Intended to Solve