- Home

Blog Blog

Payments Resources Payments Resources

The Actual Costs in Using a Payment Gateway

The Actual Costs in Using a Payment Gateway

As the eCommerce market continues to grow, so does the ever-growing selection of payment platforms for merchants to choose from for their businesses. It is tempting for many merchants to go for a payment platform that is supposedly free or low-cost because they think that they’ve struck a good deal.

However, everything comes at a price and the costs of using payment platforms and associated payment gateways only become apparent once they start transacting with them. If one is not careful, their profit margins will be affected.

Looking for simple payment solutions for complex business needs? Omoney might just be for you! With a global network spanning 173 countries and an array of fully digitised solutions for marketplaces, & platforms, make the world your market with Omoney today!

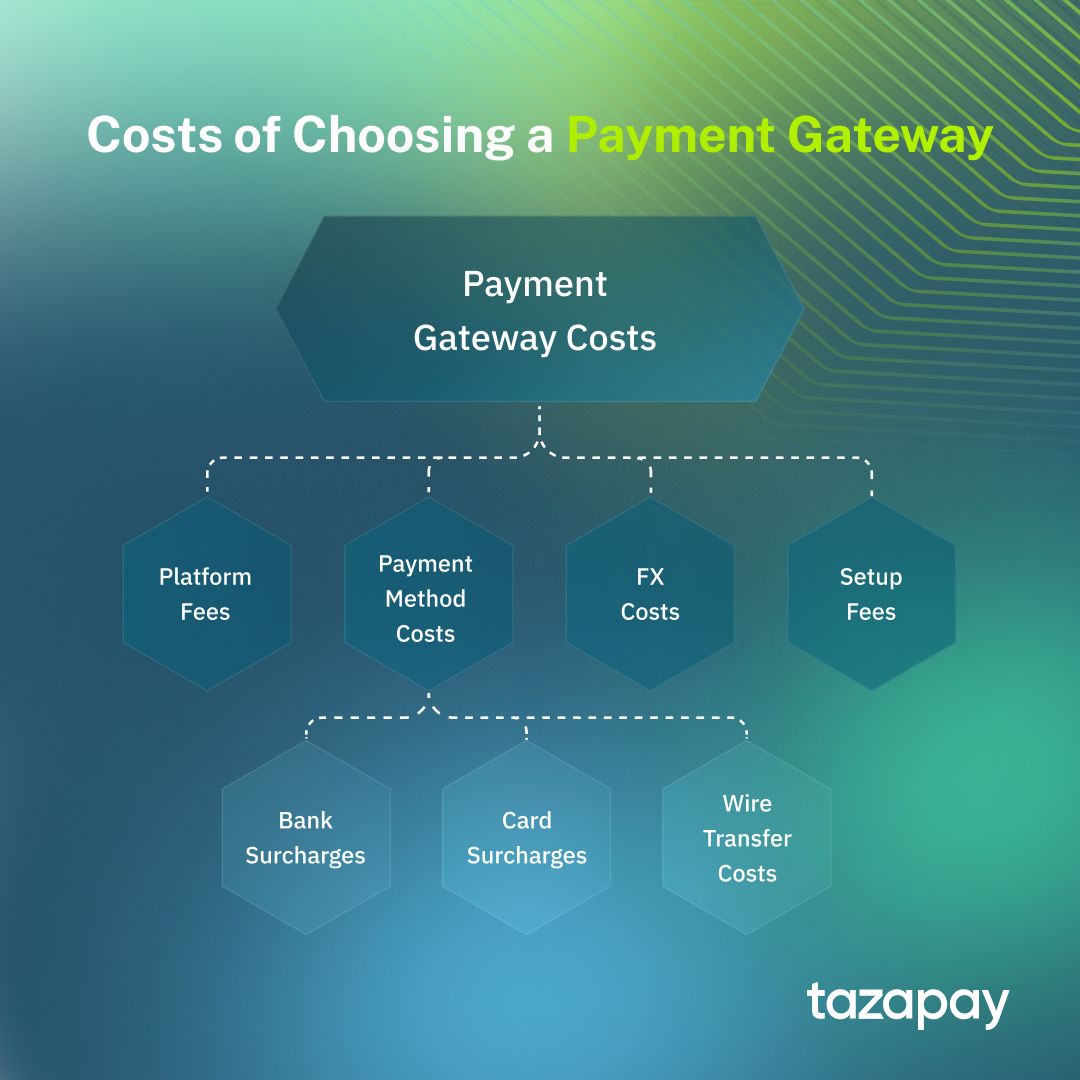

To help you navigate through this issue, let us run through the common costs and fees of using payment gateways especially for cross-border payments, beginning with:

Platform Fees

These are pretty straightforward to define–they are the fees or costs of using a given payment platform. Most reputable payment platforms charge fees for using them. There are several ways that a payment platform may charge a customer but they usually manifest as either a flat fee + percentage combo or solely a percentage charge.

Some payment platforms utilise the former with variations on the percentage charge based on the payment method used such as 0.3USD + 2.9% or 0.11USD + 3.95%. Others, like Omoney, charge clients based on the former, usually at 1.8% or 3% depending on whether it’s a non-card transaction. A simple way to illustrate how the two platform fee types differ is by comparing how much it would cost to make a small transaction like $50 against a larger transaction such as $1000.

For the flat fee + percentage combo, using the 0.3USD +2.9% variant listed, the $50 transaction would cost $1.75 whereas the $1000 would set one back by $29.5.By comparison, the 1.8% as listed in the percentage charge only example would only cost $0.9 and $18 respectively.

Comparing and contrasting different payment platforms’ fee structures can go a long way in helping one make an informed decision. In this particular instance, it would be more prudent to choose the sole percentage fee structure over the flat fee + percentage combo since not only is the percentage charge lower but it is also cheaper by virtue of no additional flat fees.

Payment Method Costs

Payment method costs refer to the costs incurred when using any given payment method. Payment platforms could choose to absorb these fees and factor them into their platform fees or have some of these costs be pushed onto the consumer or client.

- Bank Surcharges

Bank surcharges affect payment methods that are directly linked to the banks themselves such as local bank transfers and bank redirects. For the most part, local bank transfers usually only have a surcharge if the transaction is between two different accounts from different banks as opposed to transactions between two accounts within the same bank. Bank redirects on the other hand normally have either a low processing fee or no additional charges, and operate on the same principles as local bank transfers though this may be subject to a given country’s policies regarding eCommerce.

For example, Singapore’s PayNow was fully subsidised from its launch in July 2017 until January 2021, allowing its QR payments to be free of charge throughout the entire subsidy duration before having to impose a SGD0.22 flat fee from 2022 onwards¹. - Card Surcharges

Card surcharges, as the name suggests, affect card payments. This encompasses both debit and credit cards. This surcharge is normally imposed by the merchant choosing to adopt a given card network such as Mastercard or Visa to process transaction communications. For instance, from January 2013 onwards, US merchants may implement a surcharge on payments made with Mastercard up to a maximum of 4%². - Wire Transfer Costs

Wire transfer costs are the costs incurred when making a transaction via wire transfer. Wire transfers between domestic banks usually cost far less than those made internationally, and are naturally faster to process³. How much these costs vary from bank to bank.

FX Costs

If a transaction is being made between two geographical locations and made in different currencies, currency exchange costs (FX costs), are bound to be incurred. Payment gateways and platforms can charge an FX fee by implementing it as a percentage fee on top of the market’s FX rate or providing their own buy/sell rate

Setup Fees

Setup fees or costs are more common for online payment methods such as payment links and payment APIs. This is due to the fact that some require a degree of skill to be properly implemented and third-party solutions may also add on to those costs as well, especially for more complex configurations found in online marketplaces and platforms. In Malaysia, the top ten online payment methods can have setup fees that range from being absolutely free to RM300 per year⁴.

Bearing all of these different costs and surcharges in mind, you can now have the luxury of being more mindful and informed in selecting a payment gateway or payment method with the most bang for your buck. While you’re at it, why not try Omoney? Not only do they offer 1.8% platform fees for non-card payments and 3.0% for card transactions, but they also offer the lowest FX rates and are willing to match any rates you find that are better.

Sources

Category

Payments Resources

The Actual Costs in Using a Payment Gateway

Related Articles

Local Payment Methods in Indonesia: How Dana Works in an International Payment Gateway