- Home

Blog Blog

Payments Resources Payments Resources

Signs to Look for to Avoid Online Payment Platform Fraud

Signs to Look for to Avoid Online Payment Platform Fraud

Online fraud is about as old as the internet itself. It evolves and adapts at roughly the same pace as the internet’s own changes and updates. Often, fraudsters are one step ahead of developments in cybersecurity. Therefore, when it comes to finding an online payment gateway, it can be a daunting task to choose between getting the services of an established and trusted provider or those from newer providers that offer competitive features such as lower platform and FX rates, escrow protection, customizable solutions, and increased transaction transparency.

Should you be interested in taking the plunge and trying out a new payment provider for your B2B needs, it helps to practice vigilance in identifying the tell-tale signs of a potentially fraudulent platform.

Omoney is committed towards being an online payment provider that you can trust with keeping your transactions secure. Contact us to find out more

Indicators of a trustworthy online payment provider

Historically, payment companies with escrow services are known for being a measure of protection against fraud by being reliable, neutral and secure third party middle-men for the primary transacting parties. Online, these are some of the indicators that a payment provider can be trusted:

SSL Certificates

An SSL certificate, or a secure socket layer certificate, is an encryption-based Internet security protocol that connects the website’s identity to a cryptographic key pair which consists of a public key and a private key. A website that has an SSL certificate is guaranteed to keep your transaction safe as the digital document not only ensures that the server in which business is conducted is authentic, it also does so through an encrypted connection.

The easiest way to determine whether a payment provider is utilizing an SSL certificate is to pay attention to its URL. Since the HTTPS protocol is considered the most common form of the SSL certificate, just look out for the HTTPS in the website’s URL. An example of an SSL-secured website would be this URL here:

A website that lacks an SSL certificate displays only HTTP in the URL. The reason for this is because the S in HTTPS refers to the Secure part of Hypertext Transfer Protocol Secure. A website that uses HTTP as opposed to HTTPS can still function as usual but lacks the security of an encrypted connection to prevent potential hackers from accessing its contents. Websites that frequently handle sensitive information like online payment providers must have an SSL certificate to keep its data safe.

Should the website URL display HTTP as opposed to HTTPS, there is a high chance that it is a fraudulent website.

Accreditation

This is a simple yet easily overlooked aspect of identifying safe payment platforms since it might slip through your mind amidst the flurry of seemingly attractive rates and useful features. This is especially important for B2B payments since large ticket items might raise flags for anti-money laundering authorities. Take some time to browse through the website and check if the company’s accreditation is listed anywhere. Most authentic and secure payment platforms would feature it on multiple relevant pages of their website to reassure potential users that their service has met industry standards of quality. For instance, Omoney is licensed in Canada through its wholly owned subsidiary Omoney Canada Corp, while its payment partner in Singapore, Rapyd, is licensed and regulated by the Monteary Authority of Singapore.

Proactive in Maintaining a Safe Payment Ecosystem

As mentioned earlier, the Internet is a dynamic environment that is ever changing, including its dangers. Thus, a good sign of a reliable payment provider is one that is constantly up to date in keeping its users and itself in a secure ecosystem. This includes utilizing an array of anti-fraud solutions which might consist of the aforementioned SSL certificate, maintaining PCI compliance, and regular site security audits. This can be further enhanced by implementing software specifically tailored towards fraud prevention such as IP geolocation-based transaction verification and protections against new account fraud.

These measures are just some of the ways a trustworthy payment platform can provide services via processes that protect both the buyer and the seller equally. Ideally, it should also be integrating Know Your Business/Know Your Customer (KYB/KYC) processes as well.

To briefly define what KYB/KYC processes are, they are processes that serve to identify and verify the legal representative of a business and the customer respectively. KYB/KYC processes are vital since they help prevent not just fraud but also money laundering as well.

In addition, such a payment platform would also have a dispute resolution process in place in the event of friction between the transacting parties involved.

Creating Milestone Payments via Escrow

Milestone payments are a form of payment in which a client agrees to pay a service provider in stages or ‘milestones’ of progress throughout the course of a project. You might notice that newer payment providers may also provide this as a feature to ensure that the buyers and sellers are protected as well as minimizing losses.

This is usually done via escrow or a contractual agreement where the transacting parties make use of a third party to receive and disburse money for them in accordance with the conditions agreed upon by the primary transacting parties. In simpler terms, it is using a third-party entity to hold on to their money to ensure that both parties agree to complete their transaction and will only release that money once the transaction is verified. Often, the third-party in question is usually the payment provider themselves via cooperating with associated banks with the accrediting body. On top of that, the payment platform will verify documents against trusted authorities before releasing payments, thereby removing the burden of compliance and regulatory overhead from the parties involved in the transaction.

Signs of Fraudulent Payment Providers

Given the robust nature of trustworthy payment providers, this means that it should be easier to look for their fraudulent counterparts. On top of missing the trustworthy indicators mentioned, these unsavory actors commonly rely on phishing scams to prey upon unsuspecting victims, buyers and sellers alike.

To those unfamiliar with cybersecurity terminology, phishing is a type of cyber-attack to trick the recipient into either providing sensitive information willingly or clicking a link that would install malware that would compromise their important data. These commonly take place in the form of fake emails that would then direct the recipient to a fake website. These fake websites could be either the fraudulent payment provider itself or an impersonation of a legitimate payment provider.

Fortunately, you can prevent yourself and others from becoming a victim of such a scam if you look out for the following:

· Misspelled websites with poor grammar

· Unnecessary urgency in communications

· Unknown or Strange email addresses

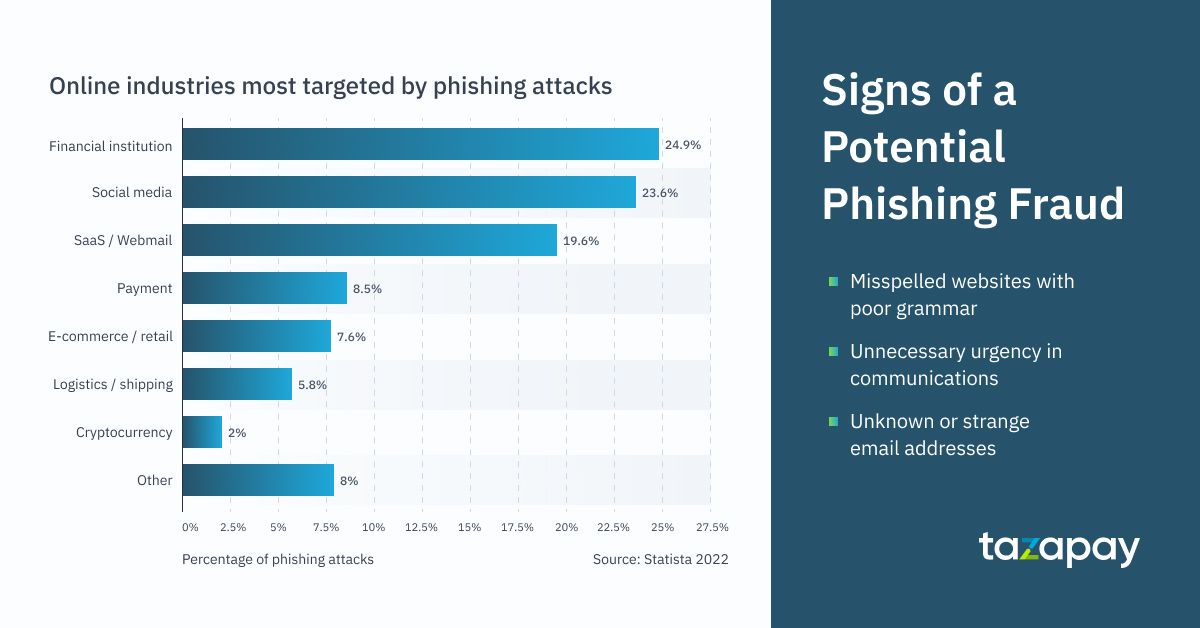

Some cybersecurity solutions can bypass this altogether by blocking suspicious emails and websites before they can harm the user. However, it is worth noting that the list provided is a general outline of what to look out for since this type of scam grows more complex constantly. According to Statista, financial institutions and e-commerce make up 24.9% and 7.6% of the total global statistics of recorded phishing attacks in the first quarter of 2021 alone. In the 2021 Verizon Data Breach Investigations Report, phishing remains the number one cause of compromised data, being responsible for over 36% of all data breaches around the world this year.

Should you find yourself stumbling upon a potentially fraudulent payment provider, however, check to see if it has a significant amount of web presence since most of these rarely do have any beyond their own site. They might have inactive social pages or have none. It also pays to check the website’s reputation on review sites since not only would there be people warning against using the website, but the provider might neglect to address the bad reviews proactively. Alternatively, you might find the reviews to be suspiciously positive and in large volume, which is a major indicator of bot usage to spam review sites to trick people into thinking they are reputable.

What Should Users Do When They Are Unsure About a Payment Provider?

Even with everything that has been said and mentioned, there is no guarantee that you are 100% safe from being a victim of fraud. You might come across a website that you think is a reputable online payment provider only for you to realize that it is a very well-done imitation of the actual payment platform.

Therefore, the cardinal rule for any user that wishes to peruse a financial service is to always remember that payment providers will never be pushy in their communications unless you’ve already initiated a transaction with them first. Even then, they would never ask for any sensitive information beyond what is absolutely needed for the transaction to begin with.

If you are still unclear, verify the payment instructions for your transaction. Most official reputable payment providers would require you to make your payment through their listed methods and not through additional third-party websites.

If at any given point you ever feel unsure, call their customer service. This is usually listed on their website as an email address and a hotline. If the official payment provider was imitated or you think you have been dealing with an imitator, the customer service team will clarify with the customer and yourself. However, if it is their own unofficial hotline, then chances are they are mostly inactive.

Vigilance is ultimately the best way to avoid being a victim of online payment platform fraud. It is better to keep yourself abreast of the latest developments in online security to ensure that you know that the online payment provider you are using has your best interests in mind. One example would be Omoney’s payment service, which is accredited by MAS and safeguards your funds with leading banks under MAS jurisdiction, so you can be assured that your money will be safe throughout. On top of that, it is protected with 256-bit encryption and has SSL certification. As a trusted platform for B2B payments in over 80 countries, Omoney is committed to ensuring that transactions are as smooth and safe as possible.

Still not convinced? We’ll be happy to answer any questions you may have.

Category

Payments Resources

Signs to Look for to Avoid Online Payment Platform Fraud

Related Articles

Local Payment Methods in Indonesia: How Dana Works in an International Payment Gateway