- Home

Blog Blog

Payments Resources Payments Resources

Pros and Cons of Using Credit Cards for B2B Transactions

Pros and Cons of Using Credit Cards for B2B Transactions

The pandemic has changed the way businesses interact financially giving way to a more digital route for B2B payment methods. Modes of B2B payments such as cash and cheques were going down and being replaced by other modes of payments such as credit cards, opening an escrow account, wire transfers, and other online modes of B2B payments. This digital trend is only growing by the day and appears to be staying on for a while.

Having said that, the B2B payments landscape, especially internationally is quite complex. Along with the existing intricacies, the traders also need to keep in mind the various software and payment technology stacks that differ from company to company & can create confusion if the seller and buyer are not on the same wavelength or there has been a lack of communication. Each buyer may have a different payment method and even a seller may need a different payment method depending on the kind of business they are in.

In such scenarios, it is ideal to have the terms of the contract agreed upon and money secured before the transaction which is made possible by Escrow providers such as Omoney. By ensuring everything is clarified and all the parties involved are on the same page, Omoney protects and secures international B2B payments. Another option that one could consider is using credit card payments. Though on the face of it, credit card B2B payments may seem seamless and instant, they do have a downside and are a preferred choice for lower value B2C payments.

Evaluating Credit Cards for International B2B Payments

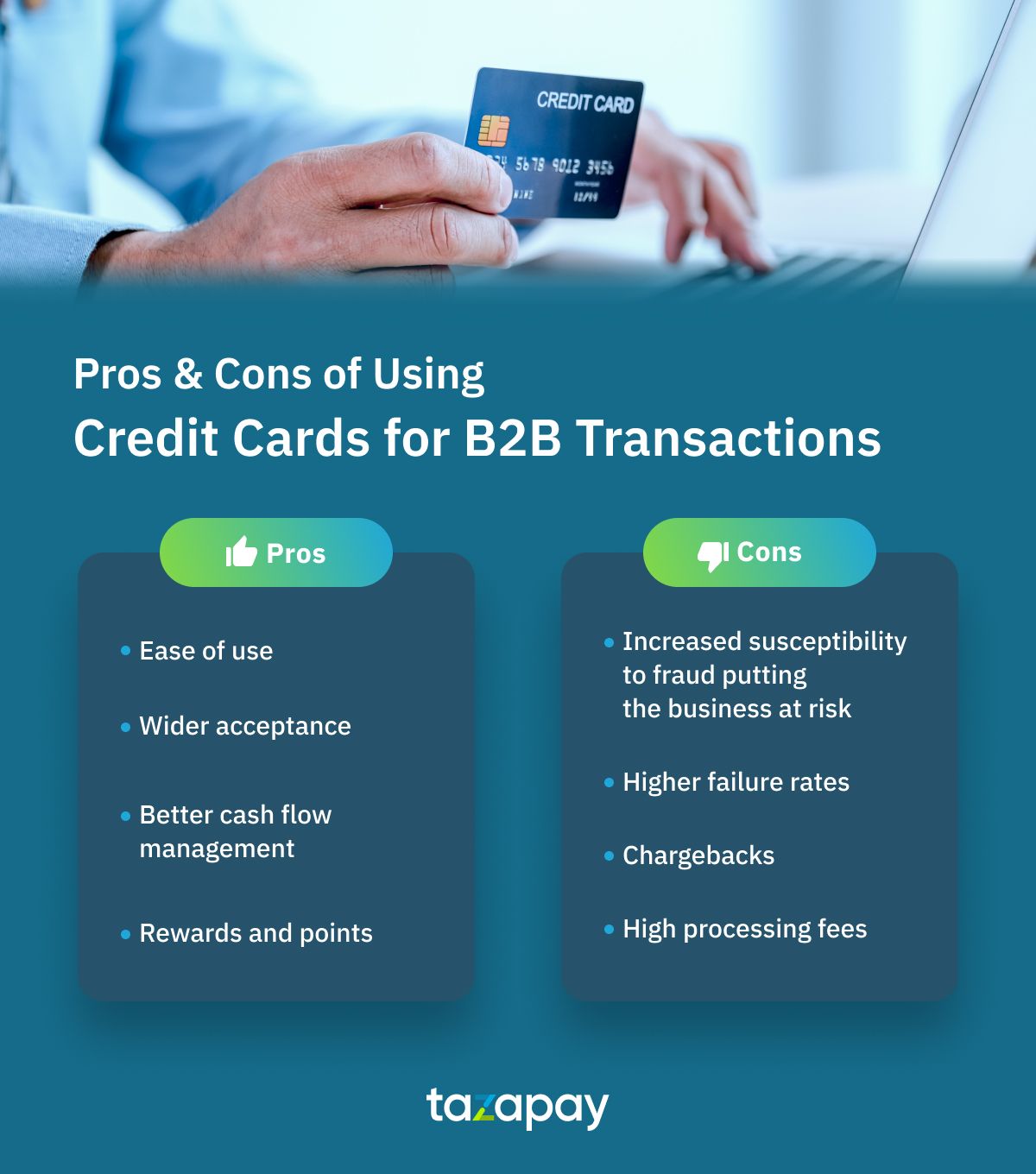

The B2B trade is super lucrative but the B2B payments network has its own pain points, inadequacies, increased costs, and restricted capabilities. Thus, no matter what form of international B2B payment you select, you must weigh the pros and cons of each. Since credit cards are increasingly becoming popular modes of payment, here are the pros of using them:

Pros

1. Ease of use

Credit cards are increasingly being accepted as a form of payment by multiple businesses that are using credit cards for the speed and convenience they offer to business transactions.

2. Wider acceptance

Credit cards are an accepted form of B2B payments both locally and globally. It is a suitable way for traders to engage in B2B payment transactions, primarily for B2B e-commerce.

3. Better cash flow management

Since credit card payments are faster, it increases cash flow as compared to traditional and sluggish methods such as cheques. Since they enable quick transfer of money and keep the working capital up to date, they are preferred.

4. Rewards and points

Credit cards also offer multiple cashback and points as privileges to their customer base.

Companies choose credit cards as an electronic B2B payment option due to the benefits being offered. Additionally, using credit cards to make payments is low-burden, as the payer is not accountable for fees.

Though credit cards have many pros there are downsides as well.

Cons

1. Increased susceptibility to fraud putting the business at risk

If a card is stolen or an unauthorized transaction is incurred, the customer ends up disputing it and demands a refund. The adverse financial impact of this falls on the seller. These days, due to increasing cyber fraud such as phishing and data theft, one may charge illegally on the card putting both the cardmember and the merchant at a risk. At the end of the day, the business bears the financial brunt.

2. Higher failure rates

If one enters incorrect details such as expiry date, CVV, or the card has been canceled, payments fail and this

3. Chargebacks

Credit cards are prone to both physical theft and the physical use of the card, as well cyber thefts that steal financial information and personal data. In case a suspicious activity takes place on the card, or the card is being used illegally, customers dispute the charge with credit card issuers. The banks may raise a chargeback and the merchant bears the financial implication.

4. High processing fees

Processing fees is one of the main downsides of credit cards usage. Especially in international B2B payments, the value of the transactions tends to be higher leading to revenue losses. It may be a minor amount when indulging in B2C payments but for large-ticket items, a processing fee of above 3% of the price can add significantly to the amount.

Apart from the above disadvantages of using credit card interchange fees, foreign exchange rate and the cost of PoS machines also renders credit cards a costlier method of B2B payments.

Omoney’s Escrow Service is a great alternative to credit cards for B2B payments

It is ideal to leverage a secure global payments option such as Omoney’s Escrow services to simplify and ease B2B payments. Omoney’s escrow service secures both the buyer and seller and protects them in accordance with the terms and conditions of the contract, across industries and regions. To add to the benefits, Omoney only charges a 1.8% processing fee for non-card payment methods and 3% for card payment methods, thereby making it more affordable as your import and export value grows. Omoney also offers the best foreign exchange rate and matches it if you find something more economical.

The way an Escrow account works is that the money from the buyer is secured in the escrow account. Once the contractual obligations have been fulfilled by the seller and the shipment is complete, the money is released. This protects both the seller by ensuring the buyer’s intent and ability to pay as well as the buyer by ensuring all the responsibilities are duly fulfilled.

Omoney aims at achieving seamless B2B digitization by finding solutions for cross-border trade complexities such as the ability to vet partners, holding money in the escrow account, managing cross-border terms & regulations, and conducting KYC and AML. While credit card seems like a great B2C payments option that offers instant working capital, ease of use, and convenience; for international B2B payments that involve high-value transactions, a more all-encompassing payments provider such as Omoney would be ideal.

Category

Payments Resources

Pros and Cons of Using Credit Cards for B2B Transactions

Related Articles

Local Payment Methods in Indonesia: How Dana Works in an International Payment Gateway