- Home

Blog Blog

Product Info Product Info

Payment Links vs Payment APIs: Which is Better for your Online B2B Business?

Payment Links vs Payment APIs: Which is Better for your Online B2B Business?

It is a given that all online businesses would want to have a seamless checkout experience. Providing such an experience would act as a testament to their impeccable service capabilities and cement themselves a reputation of reliability. However, some websites use payment links, some use payment APIs. What are they and which would best suit your needs?

Payment Links

There’s a fair bit of confusion over what a ‘payment link’ is due to the ambiguity of the term and the fact that payment providers often call it by different variations of the term. These include ‘pay by link’ or ‘pay button’ among others. In essence, payment links are simply any link or button that has to be clicked by the individual in order to send money to a specific receiver. This money being sent is specific to a transaction, usually in the purchase of a product or service, as opposed to the standard “Buy Now” button or “Donate” button.

Given that different payment providers often have their own interpretation of a payment link, here are some of the different variants that you may come across:

- One-time link via SMS, email, chat message, social media

- Email invoice link

Payment links appear simple to implement and simple to use. But how would they fit your business needs? Here are the pros and cons you may need to consider:

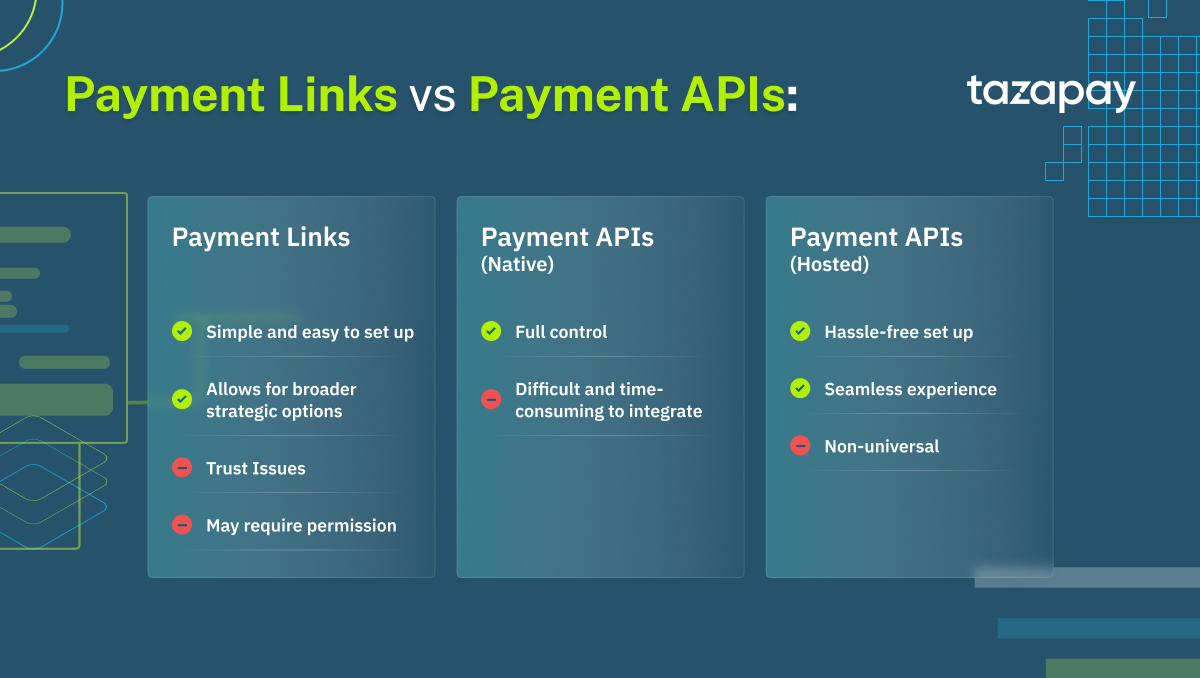

Pros of Payment Links

- Simple and easy - Payment links are easy to set up since they only require details about the transaction and allow you to send it via any form of digital communication. Involves high touch communication between buyer and seller and can be easily amended if need be.

- Payment process takes place in real-time - Often, the payment is instantly registered from the moment the transaction is concluded.

- Broader strategic options - The variety of forms that payment links can take provide ample opportunity for businesses to try different approaches to customer engagement ranging from emails to chatbots.

Cons of Payment Links

- Trust issues - Companies often need to maintain that their emails are consistent with brand of voice lest their payment links be mistaken for spam or potential phishing attempts. More often than not, this brand inconsistency comes from using a third party payment provider hence the importance of communicating upfront about this.

- Permission - Depending on region, particularly in Europe, sending out invoices is not something that companies can easily do from one day to the next due to legal restrictions such as the EU’s GDPR, which requires that a company attain a customer’s permission before sending out email invoices.

What Type of Business Would Payment Links Be Good For?

Generally speaking, given the simplicity of payment links, it’s great if you’ve yet to integrate online checkout into your website. An example of this would be a freelancer’s portfolio site. Payment links are also suitable for businesses that have not fully digitised their experience yet and brokers facilitating transactions between two parties since they’re not only easy to implement but transactions are guaranteed to be quick and simple.

Payment API

The ‘API’ in ‘payment API’ stands for Application Programming Interface. In layman’s terms, it is the intermediary connecting application software with each other via data sending and retrieval to a server. If the application in question possesses a shared data library, the API is then able to link the software and display the desired results to end-users.

A payment API is therefore the connector between software that facilitates payments, usually as a set of protocols for pushing data for making payments, holding funds and various other use cases involving monetary transactions. They’re essentially the virtual equivalent of the store workers that take the customer’s orders and notify the merchant when, where and what to ship. APIs generally come in two different variants: hosted and native. An API that is mainly integrated into the website is generally deemed to be ‘native’ whereas one that mostly directs customers to third party services is ‘hosted’.

A good payment API is one that provides a variety of configurations to allow varying levels of integration depending on how the website is designed. That being said, here are the pros and cons of hosted APIs and native APIs:

Pros of Hosted Payment APIs

- Hassle-free setup - Having most of the necessary services being handled by third party providers takes the burden of integration away from the business owner as opposed to a native API which requires significantly more effort in integrating.

- Seamless experience - For the most part, the nature of a hosted API also means that it can help bridge the gap between payment links and checkout.

Cons of Hosted Payment APIs

- Non-universal - Not all hosted experiences are fully customizable since there’s a high chance that the UX provided will remain as-is. Moreover, they may have redirects which could add extra steps during checkout.

Pros of Native Payment APIs

- Full control - By having the API be fully integrated into the website, it allows you free reign to design the checkout experience however you see fit on top of adjusting for other features you might want to implement down the line like milestone payments and fee structures.

Cons of Native Payment APIs

- Difficult and time consuming to integrate - Full integration usually translates into hours undertaken to complete the setup process on your end, though this can be alleviated if the payment platform has a good tech ops team dedicated to supporting you in the integration process.

What Type of Business Would Payment APIs Be Good For?

Payment APIs normally see use in platforms with an integrated online checkout since they largely go hand-in-hand with each other. Marketplaces seeking flexible fee adjustments also utilise payment APIs to simplify the process on their end such as when processing commission cuts in transactions. Another type of business that extensively makes use of payment APIs are Software-as-a-Service (SaaS) platforms that need to handle large amounts of recurring payments.

Payment APIs may seem daunting, but much like any other tool at your disposal, it’s all about knowing how to use it and if it is suitable for your business needs. Of course, the only person that knows how your business operates and what it needs is yourself. Thus, by knowing the difference between the API types and taking stock of your online presence, you now know more about the product features that are the best fit for your business.

It can therefore be concluded that payment links are more suitable for businesses that have little need for a fully integrated digital payment system or those that are in the process of digitising their business because of their simplicity and reliability in processing transactions quickly, which also makes them ideal for brokers facilitating transactions between two parties. Payment APIs on the other hand are recommended for businesses with an integrated online checkout system or marketplaces in need of flexible fee adjustments as well as SaaS platforms that process large amounts of recurring payments, since the protocols in a payment API help simplify the payment process greatly to ensure a smooth experience for both parties involved.

That being said, looking for a possible solution for your B2B needs can be challenging. One such option that you could consider is Omoney, which has both hosted and native APIs for your escrow needs that are easy to integrate and fully transparent in any transactions made.

Interested to learn more about payment solutions for your business? Contact us today!

Category

Product Info

Payment Links vs Payment APIs: Which is Better for your Online B2B Business?

Related Articles

Omoney Named to the 2023 CB Insights' Fintech 100 List

Omoney Secures MPI Licence from Singapore's MAS, Bolstering Its Cross-Border Payment Capabilities