- Home

Blog Blog

Payments Resources Payments Resources

Payment Gateway Rails: How Does Cross Border Checkout from Singapore to Thailand Work?

Payment Gateway Rails: How Does Cross Border Checkout from Singapore to Thailand Work?

Every day, every hour, every minute, money gets swapped around internationally across borders in the form of cross-border transactions. The amount of money that can be found within this market is expected to reach a whopping $156 trillion USD by the end of this year¹. It is also being shaken up by new entrants as time goes on.

One such entrant is the Southeast Asian nation of Thailand, which holds the title being the 30th most complex economy in the world by the Economic Complexity Index (ECI), a holistic measure of the productive capabilities of large economic systems². The country is best known for its export market of machinery, motor vehicles and gold, exporting mainly to the United States, China, Japan, and Vietnam².

With regards to her bilateral trade with fellow ASEAN member, Singapore, gold, refined petroleum, and integrated circuits make up roughly 60% of her total exports; usually importing Singaporean blank audio media, scented mixtures and gas turbines, though the country finds itself exporting more than it imports³. Also notably, Singaporean consumers like to purchase tailored clothes from Thailand, contributing to the export share for the Land of Smiles.

Unlock localised payment methods like bank redirect, local bank transfer, voucher payments and more over 70 countries just in a single checkout integration. Wanna learn more? Contact us today!

That being said, how does the online checkout process work whenever a cross-border transaction between these countries takes place?

Online Checkout - Accepting the Singaporean Buyer’s Payment

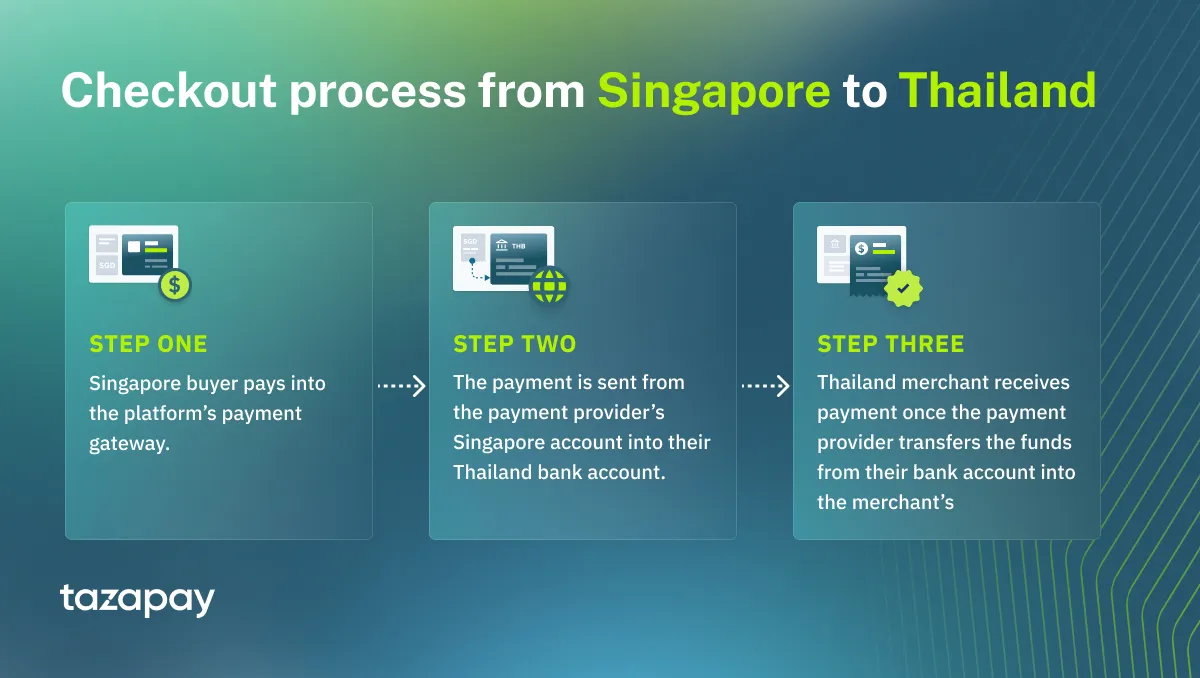

The checkout process for a cross-border eCommerce transaction between a Singaporean buyer and a Thai merchant begins like any other: when the buyer pays into the platform’s payment gateway. Assuming that the merchant is one that has localised well into the Singaporean market, then the buyer should be able to choose from a selection of local collections which include PayNow QR, PayLah, and a slew of local bank redirects.

From there, the payment gateway accepts the payment into their own local bank account if the buyer has opted for a bank redirect or bank transfer. However, if the banks the buyer uses has entered into a partnership with alternative payment methods, then it is likely that the funds would instead be directly transferred to their foreign account in Thailand, such as via the PayNow-PromptPay funds transfer service if it is a consumer to consumer (C2C) transfer⁴. Buyers paying via card and wire transfer also forgo the need to have their funds held in the local bank account since they also transfer the funds directly via the payment rails into Thailand.

Cross-Border Payment - Sending the Payment from Singapore to Thailand

Once the buyer has completed the transaction on their end, the funds are then transferred from the payment provider’s Singaporean bank account to their Thai bank account. However, should the transaction be conducted via the aforementioned payment rails such as card, or wire transfer, then the funds would be done directly on the payment rail.

For smaller transactions between individuals and/or small merchants, there’s also alternative payment solutions such as PayNow-PromptPay, a mobile device-based funds transfer service available between participating banks. This mode of payment has its limitations, as the rail only allows transfers up to SGD 1000 per day, which means individuals or small merchants wanting to scale up will be limited by the payment method.

On the other hand, transactions between businesses, if by bank, will see the payment sent from the payment provider’s bank account in Singapore to their bank account in Thailand via more conventional rails like the SWIFT wire transfer. Though, payments sent on these rails tend to be where fees would be added as part of a payment platform’s costs.

Due to the transaction itself being a cross-border transaction though, FX costs are unfortunately unavoidable and will be levied regardless of payment methods chosen. However, it is possible for the seller to hedge against FX fluctuations of their own currency by having a multi-currency account with which to pay international suppliers with, and opt to receive their payment in USD.

Some payment providers, like Omoney, may even have specialised local payment partners in the markets they operate in to ensure that costs are kept low, thereby transferring the savings from the payment platform to the users.

Payout - Paying the Thai Merchant

Payments made via bank redirects and cards tend to be instantaneous, while bank transfers take at most a day, and the payment method with the longest transfer time is wire transfers, taking up to 2-4 days. But before the merchant can receive their payout, the payment platform would need to process the receipt of the payment transfer itself.

Once that’s done, a brand.com owner or eCommerce shop merchant can expect to receive payments anywhere between a day to a week after the payment has made its way across the rail. Some payment platforms may provide an option to give daily or weekly payouts, but this depends on the volume of transactions the online business is able to provide, or whether they are willing to incur extra payout processing fees with their provider.

On the other hand, if the payout is orchestrated by a marketplace or platform, then the funds first get sent to the marketplace or platform’s bank account before being transferred to the seller based on the date of payout as outlined in their terms and conditions. Localised payment methods usually involve the most common banks in Thailand, namely:

- Kasikorn Bank

- Siam Commercial Bank

- Bangkok Bank

- TMB Bank

- Krungthai Bank

Now that you know, as an eCommerce business, having a payment provider with multiple payment solutions ranging from multiple payment options to checkout to having local payment partners to pass the savings to you will help in making the eCommerce experience seamless for your buyers, while also enjoying a higher margin with your business dealings. One such payment provider that fits this criteria is Omoney, which boasts over 70 localised markets in which they operate, and have operations in 173 countries the world over.

If you’re curious to see if we're a good fit for your payment needs, then why not contact us and give it a try?

Sources

- Three trends redefining the global cross-border payments market (paymentscardsandmobile.com)

- Thailand (THA) Exports, Imports, and Trade Partners | OEC - The Observatory of Economic Complexity

- Singapore (SGP) and Thailand (THA) Trade | OEC - The Observatory of Economic Complexity

- Say Sawadee to instant transfers | POSB Singapore

Category

Payments Resources

Payment Gateway Rails: How Does Cross Border Checkout from Singapore to Thailand Work?

Related Articles

Local Payment Methods in Indonesia: How Dana Works in an International Payment Gateway