- Home

Blog Blog

eCommerce Tips eCommerce Tips

Payment Gateway Features: Hosted Checkout API for Beginning Online Businesses

Payment Gateway Features: Hosted Checkout API for Beginning Online Businesses

The UX of any online business is vital to its success. A smooth and pain-free UX can make the difference between making a profit and seeing a rise in cart abandonment. This is compounded further as businesses look to scale up since they would need to improve upon the bells and whistles that they have, with priority given to their payment gateways. A fledgling online business might be able to make do with a simple payment link due to its simplicity and normally fast payment processing speed, useful features for anyone just starting out in eCommerce or beginning their own transition towards digitisation. However, if it wishes to expand and scale up, eventually it must turn to a more robust and refined solution: integrated payment gateways or payment APIs.

The prospect may seem daunting to those more accustomed to plug-and-play payment apps, particularly the fledgling online businesses, since integrated payment gateways generally require a certain degree of skill to implement on one’s own due to their nature being an intermediary software that connects other payment-facilitating software with each other for a quick, automated payment process. Fortunately, that is only an issue if one opts for a native payment API. Hosted payment APIs, as the name suggests, are hosted by whichever third-party provider the business chooses. Since most third-party payment gateways allow for integration with their checkout systems, this saves the online business time from actually needing to develop their own payment system from the ground up, and requires little from the merchant’s behalf to integrate since most of the necessary services are hosted by the third party provider.

That being said, it is important for any fledgling online business to know more about online checkouts and how hosted payment APIs work to prepare for the day when they grow.

Looking for a payment platform that offers seamless checkout and escrow protection? Come give Omoney’s API a spin! With a global network spanning over 173 countries that can be accessed with a single account, let Omoney be the key that will open the door to the greater global market today!

What is an Online Checkout?

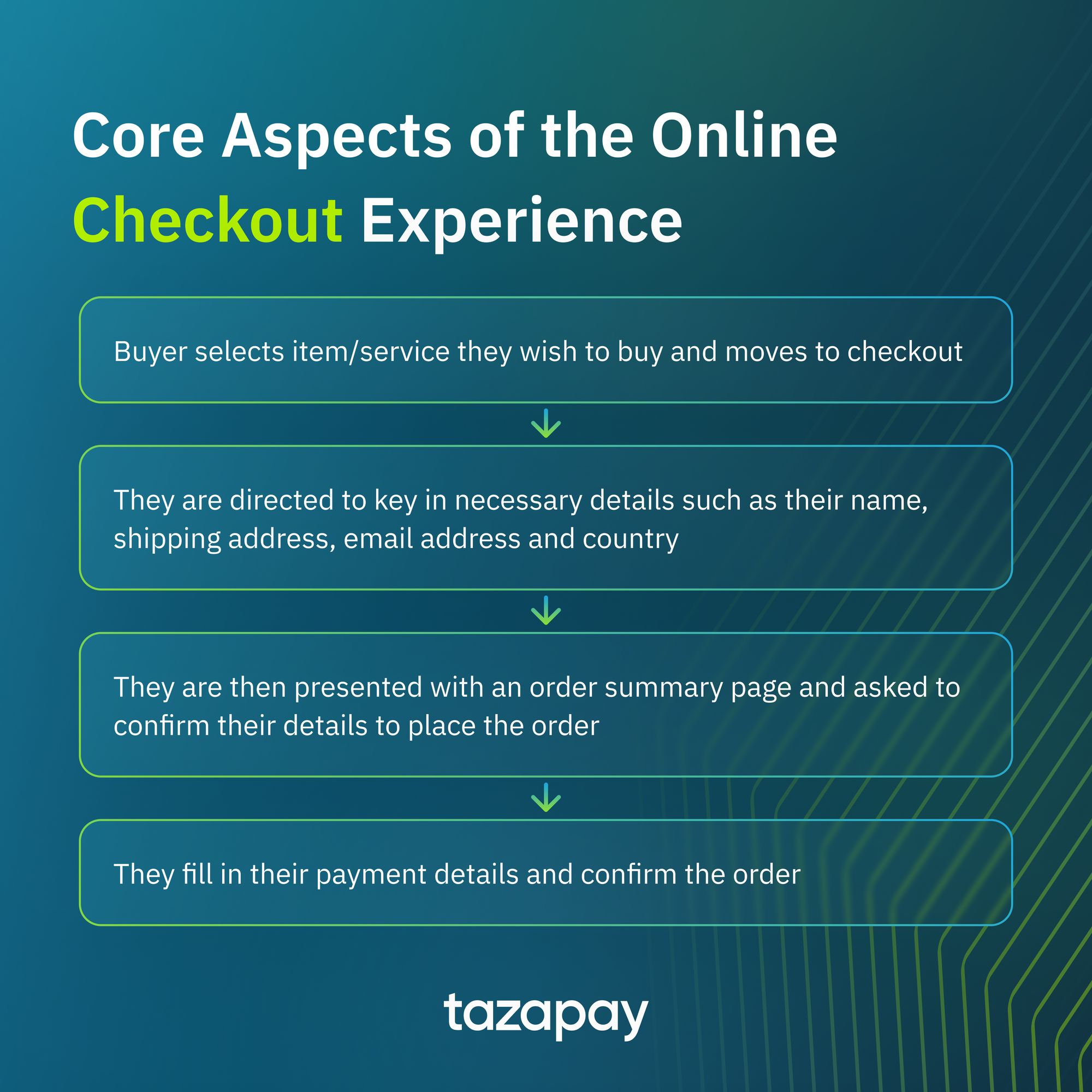

The concept of online checkout is rather straightforward: it is the designated ‘area’ in any eCommerce store where the buyer finalises their purchase of a given good or service¹. This normally manifests as its own checkout page, often with a list of payment methods to choose from. While there exist countless eCommerce businesses that cater to all sorts of clients regardless of B2C or B2B, the typical user experience of going through an online checkout is fundamentally the same and usually looks like this:

- User selects the item(s) that they wish to buy and proceeds to checkout.

- They are asked to key in necessary details such as their name, email address, shipping address, and country.

- Once done, the user is shown the order summary page and asked to confirm their details before the order is placed.

- They are then asked to enter their payment details and finally confirm the order.

These core aspects of the online checkout experience remain largely the same in eCommerce stores the world over, with the selection of payment methods available often being one of the key deciding factors in securing a successful sale. One of the reasons for this being the case is because of user preference and user stickiness towards any given payment method. Some may prefer card payments for their ubiquity and convenience, some may prefer bank redirects because of the direct link to local banks. Either way, having multiple payment methods, especially localised ones, help address concerns of user stickiness for a given payment method.

Preparing User Data on the Payments API

Transactions typically happen between two parties, the one selling the product/service, and the one buying it. The commonality between the two, aside from the mutual exchange of legal tender and product, is the need for information on the other. Verification of a seller’s legitimacy for the buyer, and verification of a buyer’s identity for the seller. With the inherent remoteness and anonymity of cyberspace, this need for information becomes a necessity for any successful eCommerce transaction.

As the seller using a hosted payment API, you can set your data up on your chosen payment gateway’s database with only a few commands or calls as prescribed in the API documentation that comes with it . If a buyer is new, then you can use the API call function that creates a new user to be logged into the payment gateway database. If a buyer is a returning customer, then use a ‘get user’ call function that retrieves the details of this buyer from the database. Additionally, buyer data can be saved into the database as they enter their details as part of the first checkout step via the same ‘create user’ API call.

Creating the Underlying Transaction for Checkout

Once both your data (as the seller) and the customer’s data (as the buyer) have been set up and ready, the underlying transaction for checkout can be created. The process of creating this underlying transaction varies depending on the payment provider so always make sure to be well-acquainted with your payment provider’s nomenclature. For checkout, refer to the nomenclature for creating a unit of transaction vs paying for transactions. Omoney, for example, has their unit of transactions be known as escrow, hence create escrow.

From here, you can proceed to integrate the data of your inventory to the payment gateway so that the fixed cart amount is logged correctly.

Redirecting Buyers to the Hosted Payment Page

By this point, the buyer should be at the last step in the checkout process as listed earlier. While the entire process may appear to be cumbersome up until now, it is important to remember that most of these are handled by the API’s own set of protocols, requiring very little, if any, input from the seller in real time. After all, the goal is for a painless, smooth UX.

That being said, once the buyer clicks the button to purchase, it should trigger an API call to create a payment page. Again, how these calls are referred to and how they function varies from payment provider to payment provider. Using Omoney as an example, theirs is called ‘create payment’ since their unit of generating a payment page is called ‘payment’. Regardless of the specifics of the API call, the newly-generated payment page is where the buyer makes their payment via any of the payment methods offered by the payment gateway.

Depending on the payment gateway, you may even freely enable or disable payment methods if you think you would end up with payment options that give you more margins. If everything goes well, the buyer will have made their payment and you, the seller, can now proceed with the necessary steps to fulfil their order, such as shipping the item bought by the buyer to their address in a timely manner.

Now that you know more about the workings of a hosted API, you can now have more confidence in looking for one of your own to help scale and expand your business. Perhaps you’ve already found one and are now certain enough to use the tools you have to ease your customers’ UX with a few API calls. If not, why not give Omoney a go? With local and global payment methods readily available and easy API integration, grow your business with their fully digital solutions today!

Sources

Category

eCommerce Tips

Payment Gateway Features: Hosted Checkout API for Beginning Online Businesses

Related Articles

Navigating Cross-Border Chargebacks – Tips for Merchants