- Home

Blog Blog

Payments Resources Payments Resources

Local Payment Methods in Thailand: How PromptPay Works In an International Payment Gateway

Local Payment Methods in Thailand: How PromptPay Works In an International Payment Gateway

Thailand is entering the dawn of an era of digital payments after being a cash-reliant economy for so long. Over the past six years, the country has worked hard to roll out financial technology services and the penetration of said services into their populace¹. This is evident with the 2022 statistics regarding the percentage of internet users in Thailand which reports that 77.8% of the country’s population of 70.01 million are avid users of the internet and presumably digitally literate². One of the key contributors in Thailand’s adoption of digitalisation appears to be PromptPay, the interbank real-time payment system developed as part of their National e-Payment Master Plan¹.

Making the leap to digitising your business is an exciting and daunting move. But worry not! With Omoney, you can gain access to over 173 markets worldwide and utilise powerful tools all in a single account. Make your digitised business frictionless with our payment gateway to enhance your checkout experience.

What Is PromptPay?

PromptPay is an interbank real-time near-instant payment system that enables users to easily receive and transfer funds using either their Citizen ID or mobile phone number, making it similar to India’s UPI and Singapore’s PayNow in that respect⁶. This payment system is developed with the cooperation of the major Thai banks and Vocalink, a Mastercard company, to help the government’s transformation of their cash-dependent economy into a digital economy⁵.

User Trends in PromptPay

Real-time payments in Thailand are expected to help generate 2.08% of the country’s GDP by 2026, states a report by ACI Worldwide which also states that in 2021, 24.7% of total payments volume were transacted through its real-time payments network, putting just shy of paper-based payments in second place⁴. The report also credits the adoption of PromptPay for this growth, which itself was pushed by the large presence of mobile phones in the country⁴. The forecast made by the report holds even more water when looking at the volume of PromptPay transactions between 2017 and 2021, exploding from a meagre 88.07 million transactions to 10.067 billion transactions⁷.

However, current forecasted trends may not necessarily reflect the actual sentiment of the Thai people as while Thailand saw widespread use of digital payment apps especially during the pandemic, a survey conducted by the Bank of Thailand found that the majority of people that adopted digital payments have returned to using cash, citing convenience and lack of added fees as reasons for doing so⁸. In fact, the survey also found that over 50% of the respondents from all age groups prefer using cash in their day-to-day transactions, with only 27% of the 6020 respondents across seven regions opting to continue using digital payment apps⁹.

Payment security is serious business. With the ever-looming threat of fraud and other cybersecurity concerns, our digital escrow services can help ensure that your international payments are secure. Have a look at our escrow offerings here:

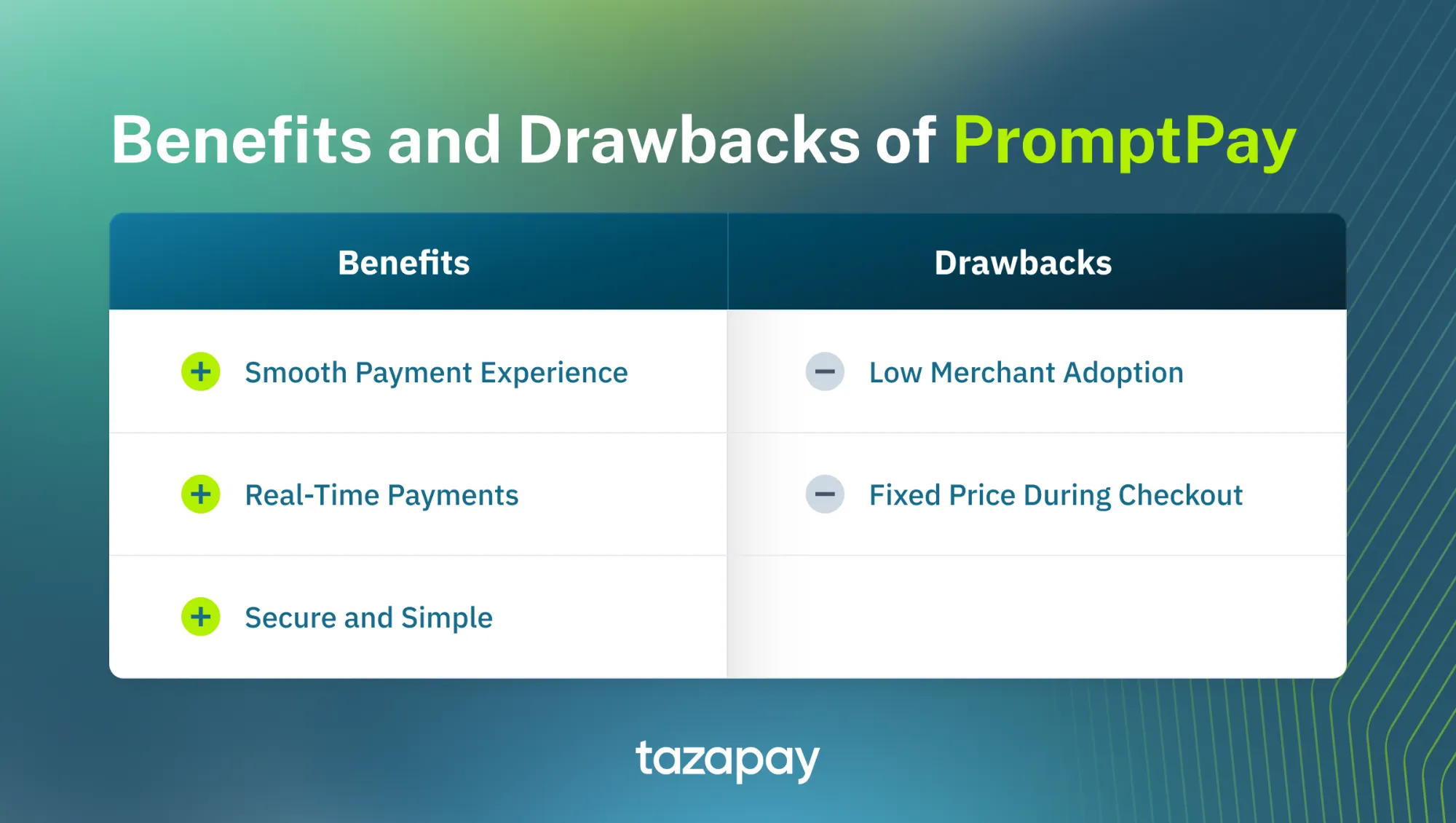

Benefits and Drawbacks of Using PromptPay for Online Payment Gateways

As alluded to by the above segment, PromptPay certainly is not the perfect digital payment solution. Nonetheless, it is still experiencing growth, so here are its benefits and drawbacks:

Benefits

Smooth Checkout Experience: PromptPay being an interbank payment system ensures that users can make purchases regardless of what bank they use in Thailand.

Real-time Payment: Transactions are processed in real-time and near-instantaneously, thereby making most transactions a speedy affair that takes less than a minute.

Secure and Simple: So long as a user has a mobile phone and an internet connection, PromptPay users can conduct transactions whenever and wherever. It is also secure as each account can only be linked to one Citizen ID.

Drawbacks

Low Merchant Adoption in Thailand: Thailand being a predominantly cash-based society means that most vendors, especially those deemed ‘grassroots’ vendors, would largely stick to cash over digital, leading to higher chances of PromptPay users needing to have cash on hand as opposed to paying with the payment system. For international online businesses who offer PromptPay, this means you'll have a chance of standing out from other local businesses in front of digitally savvy buyers.

Fixed Price During Checkout: The cash dominance of Thailand also means that most consumers prefer the savings that come with the ability to haggle, as opposed to the fixed nature of digital payments in conjunction with the fees that come with it. However, social commerce through social media such as LINE has helped implement the haggling element into the digital payment sphere, making products such as payment links useful in generating checkout links with haggled prices¹º.

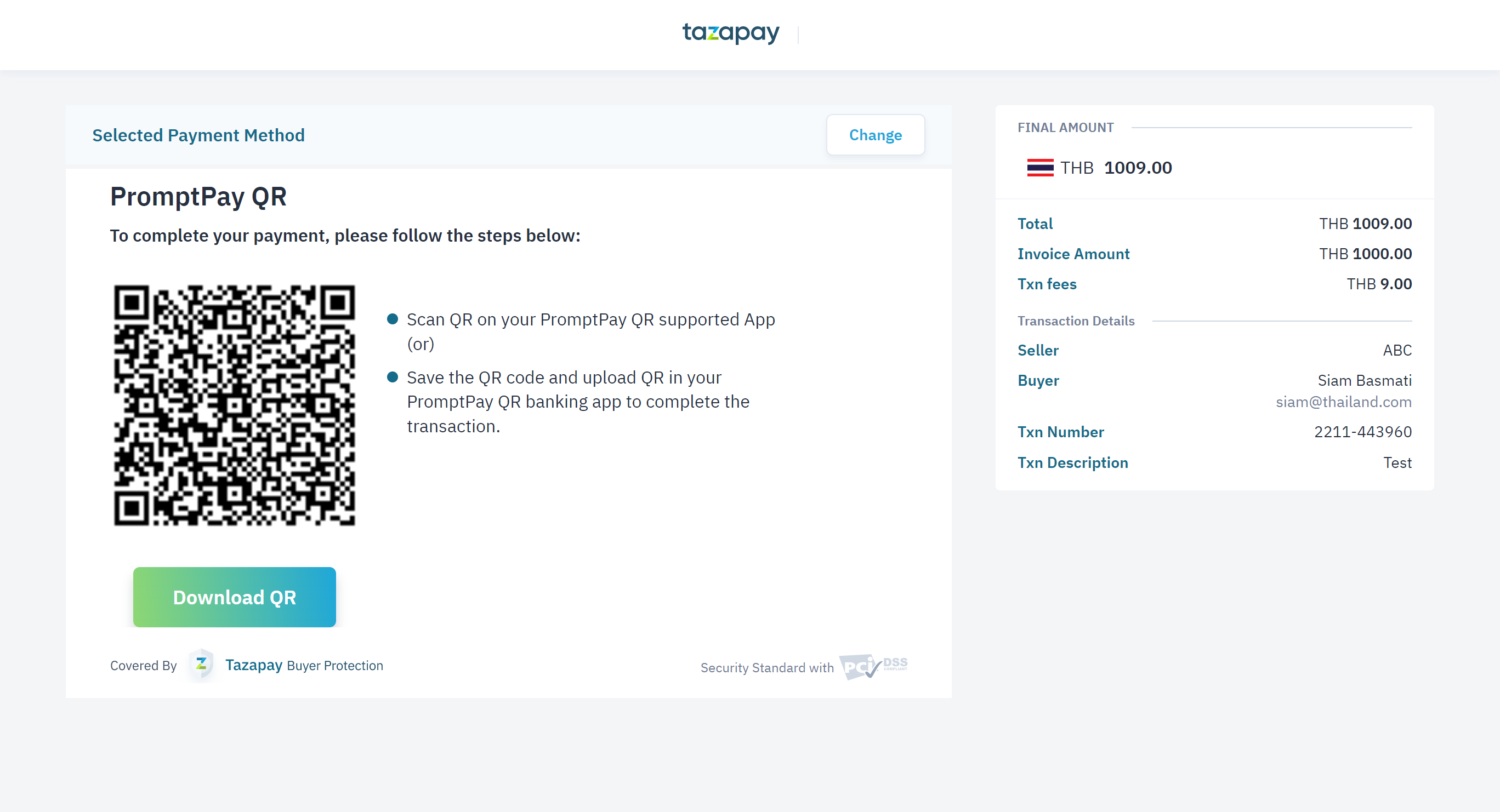

How PromptPay Works in an International Payment Gateway

Currently, PromptPay remains a local payment system though the Thai government has already made moves to establish arrangements with its counterparts in Malaysia and Singapore. This means that any payment made with PromptPay across borders must be done through a third-party payment provider to act as the international payment gateway.

How such a payment would work is that the funds from the user would be transferred into the payment provider’s Thai bank account via PromptPay.

This can be done through either scanning the QR code or inputting the recipient’s Citizen ID or phone number, leading to the checkout amount being paid by the user within the PromptPay app.

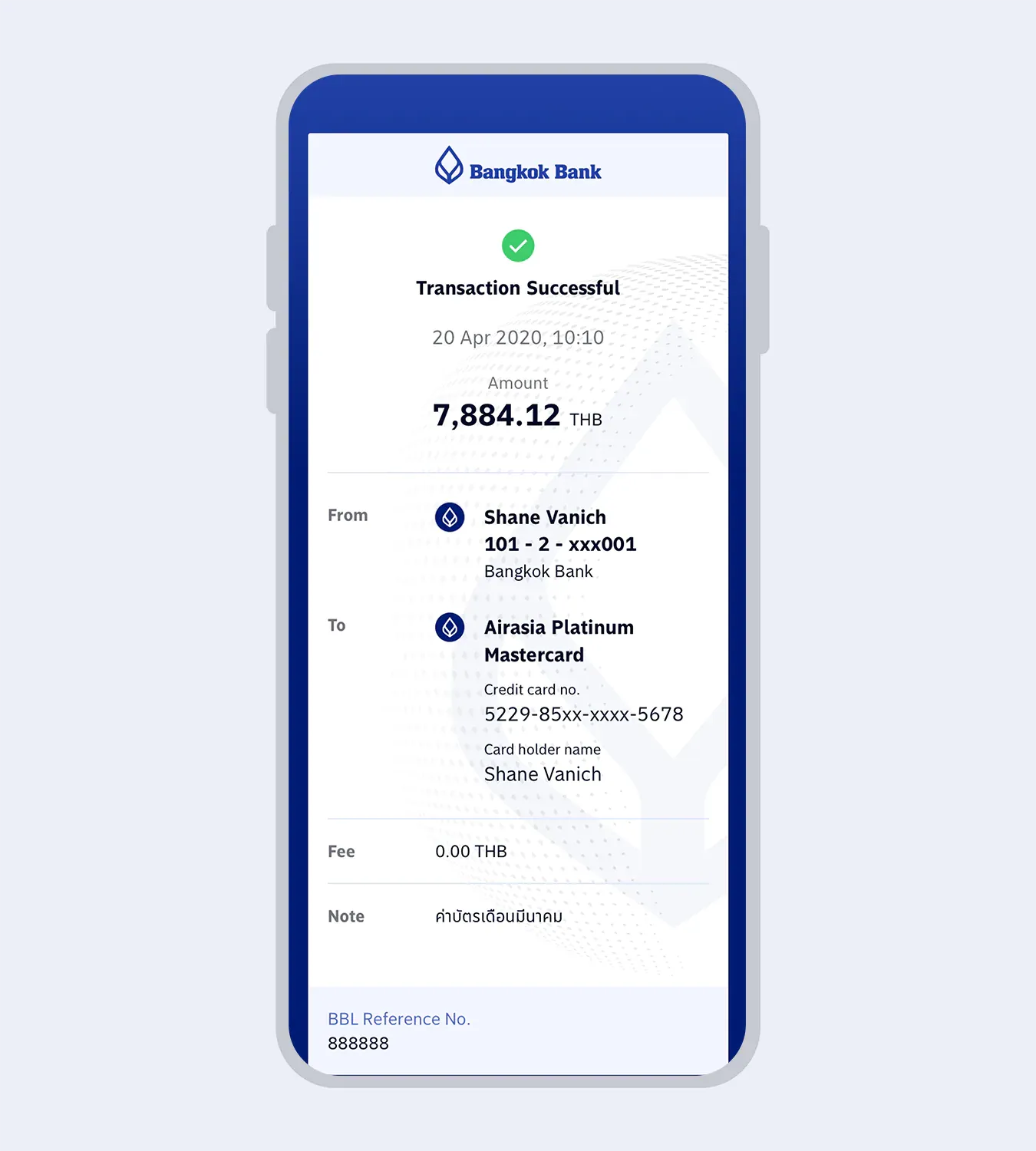

The Promptpay app should display a message once the funds transfer is successful.

Then, these funds are moved into one of many international accounts owned by the payment provider before being disbursed to the foreign seller’s bank account. No two third party payment providers are the same so keep an eye out for one that offers an extensive list of localised markets to choose from.

What are the Fees Required in Using PromptPay?

At the time of writing, all transactions made with PromptPay locally under 5,000 baht are free. Transactions between 5,001 and 30,000 baht incur a 2 baht fee, transactions between 30,001 and 100,000 baht incur a 5 baht fee, and transactions between 100,001 and 200,000 baht incur a 10 baht fee.

As for transactions that are cross-borders made with a third-party payment provider, all the usual fees and costs that come with using such services apply such as FX costs, platform fees, and setup fees. Be sure to look for a proper and secure payment provider when choosing one for your own business needs.

Now that you are more knowledgeable about PromptPay, your efforts in penetrating the Thai market should go much smoother. If you’re still looking for a solution to improve your chances, why not give Omoney a try? With payment solutions tailored for everyone from eCommerce platforms to exporters and importers, Omoney will have a solution that suits your needs.

Sources

- The Dawn of Thailand’s e-Payment Era - Thailand NOW

- Digital 2022: Thailand — DataReportal – Global Digital Insights

- Thailand | The Global Payments Report

- ACI Worldwide — GLOBAL PAYMENT TRENDS — Charting the growth of 'immediate payments'

- Transforming Thailand to a digital economy | Mastercard

- Bangkok Bank PromptPay

- Thailand: PromptPay transactions volume 2021 | Statista

- Thailand Rejects Digital Payments in Favour of Cash (cashmatters.org)

- Cash still king, people reject app payments - Thai Examiner

- Social commerce in Thailand - statistics & facts | Statista

Category

Payments Resources

Local Payment Methods in Thailand: How PromptPay Works In an International Payment Gateway

Related Articles

Local Payment Methods in Indonesia: How Dana Works in an International Payment Gateway