- Home

Blog Blog

Payments Resources Payments Resources

Local Payment Methods in Philippines: How Dragonpay Works In an International Payment Gateway

Local Payment Methods in Philippines: How Dragonpay Works In an International Payment Gateway

Out of all the nations in the Asia-Pacific region, the Philippines was counted among the lowest when it came to its banked population¹. However, the significantly high unbanked population also made the country one of the earliest adopters of digital payments, which saw mobile payments and digital wallets being popular payment methods as far back as 2001¹. Now, the adoption rate of cashless payments in the Philippines sits at a high 92%, with an impressive total digital payment transaction value of USD28.6B¹. Contributing to this figure is the nationwide online payment platform, Dragonpay, one of the most popular digital payment platforms in the country.

One of the most daunting aspects in choosing payment solutions for your business is pricing. That’s why you shouldn’t fear any of that with Omoney! Starting from 0%, we keep our pricing simple and transparent. Our FX rates are competitive too! Take us for a spin and see for yourself, contact us today.

What Is Dragonpay?

Dragonpay is an online payment platform that offers payment solutions for both individuals and businesses around the Philippines². In a market where only 10% of the population uses card payments, Dragonpay offers various payment methods for users to choose from to help bridge the gap between the banked and the unbanked populace, especially in e-commerce where they allow those without cards to make purchases².

User Trends in Dragonpay

While the Philippines e-commerce market has been consistently lower than the other Tiger Cub economies despite continuous growth, it is slated to outperform India and Indonesia in terms of retail e-commerce sales growth due to its high potential for digital penetration stemming from the country having the highest average daily internet usage in the region³. This is backed up by the constant growth in smartphone penetration amongst the populace and the emergence of a burgeoning social commerce scene in the country, seeing as how there is a recorded figure of 78.5 million social network users that could easily facilitate such as industry.³

Low banking penetration and slow internet coverage nationwide are constant issues that stymie this growth potential, along with fraud, which could undermine the digitisation process and subsequently affect Dragonpay’s prospects³. However, optimism may prevail as the government is currently implementing an e-commerce roadmap that seeks to onboard 70% of adults into the financial system and convert at least 50% of all payments in the country into digital, thereby improving Dragonpay’s future prospects as a local payment gateway⁴.

Get payments from anywhere in the world with our payment links. We offer some of the best FX rates out there to provide the most optimised fees for your high-value transactional needs! Click here to take our services for a spin:

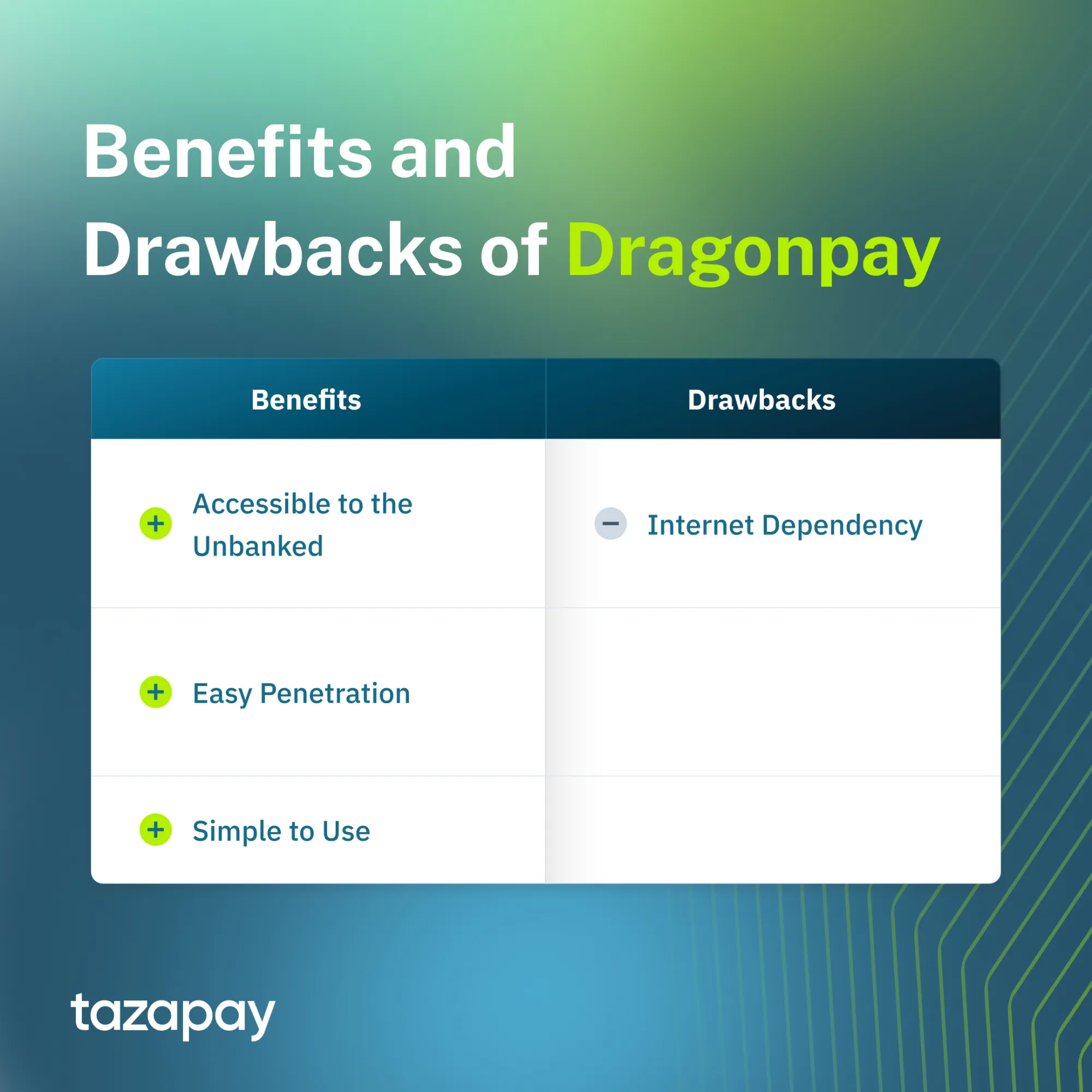

Benefits and Drawbacks of Using Dragonpay for Online Payment Gateways

No payment gateway is perfect, and each has their own sets of benefits and drawbacks. Here are Dragonpay’s pros and cons:

Benefits

- Accessible to the Unbanked: Dragonpay’s capacity to accommodate for cash payments in brick-and-mortar locations allows for those who are unbanked and/or sticky with cash to pay for their purchases.

- Easy Penetration: Being a payment gateway that offers a variety of payment methods ranging from bank redirects, e-wallets, and cash makes it easier for Dragonpay to penetrate into the 72.7% of the population that is connected to the internet⁵.

- Simple to Use: Conducting payments with Dragonpay is just a matter of selecting the payment gateway upon checkout via any smart device that can access the internet.

Drawbacks

- Internet Dependency: Despite having an internet penetration rate of 72.7%, the internet infrastructure throughout the country remains poor and prone to slow connection issues⁵. This poses a major problem to the mainly online-based payment gateway since most of the payment methods offered are cashless. However, this can be mitigated by payment gateways which optimise their checkout page.

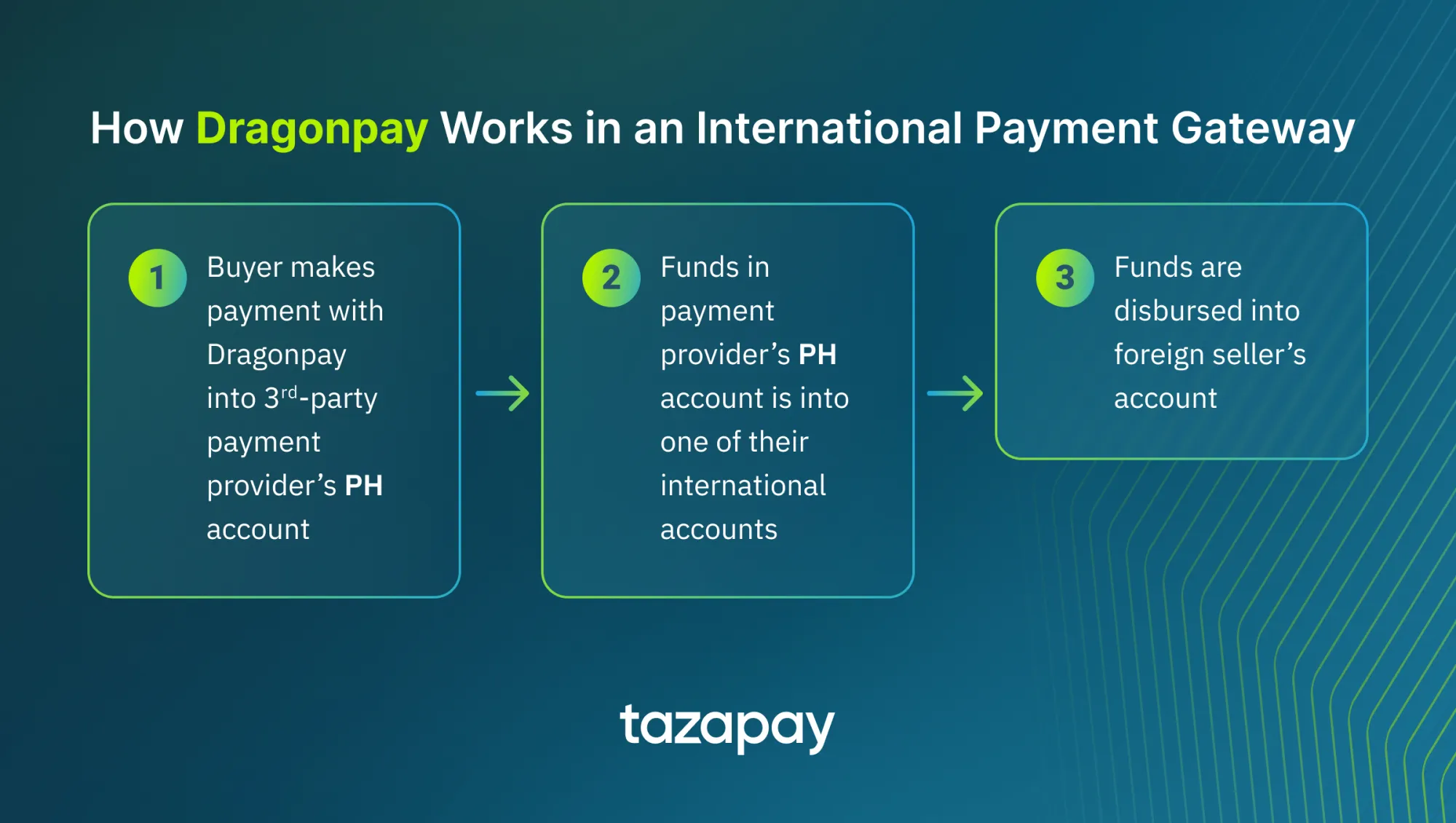

How Dragonpay Works in an International Payment Gateway

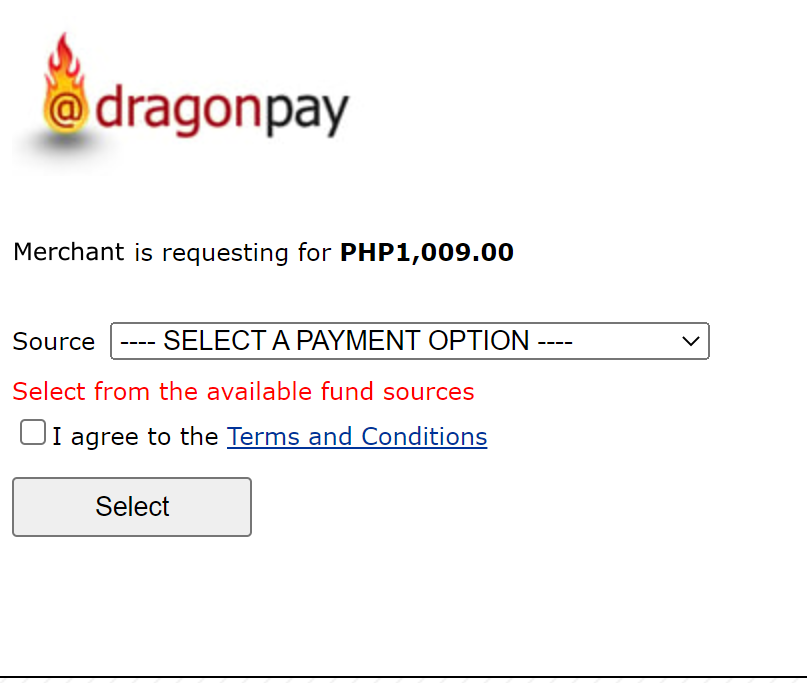

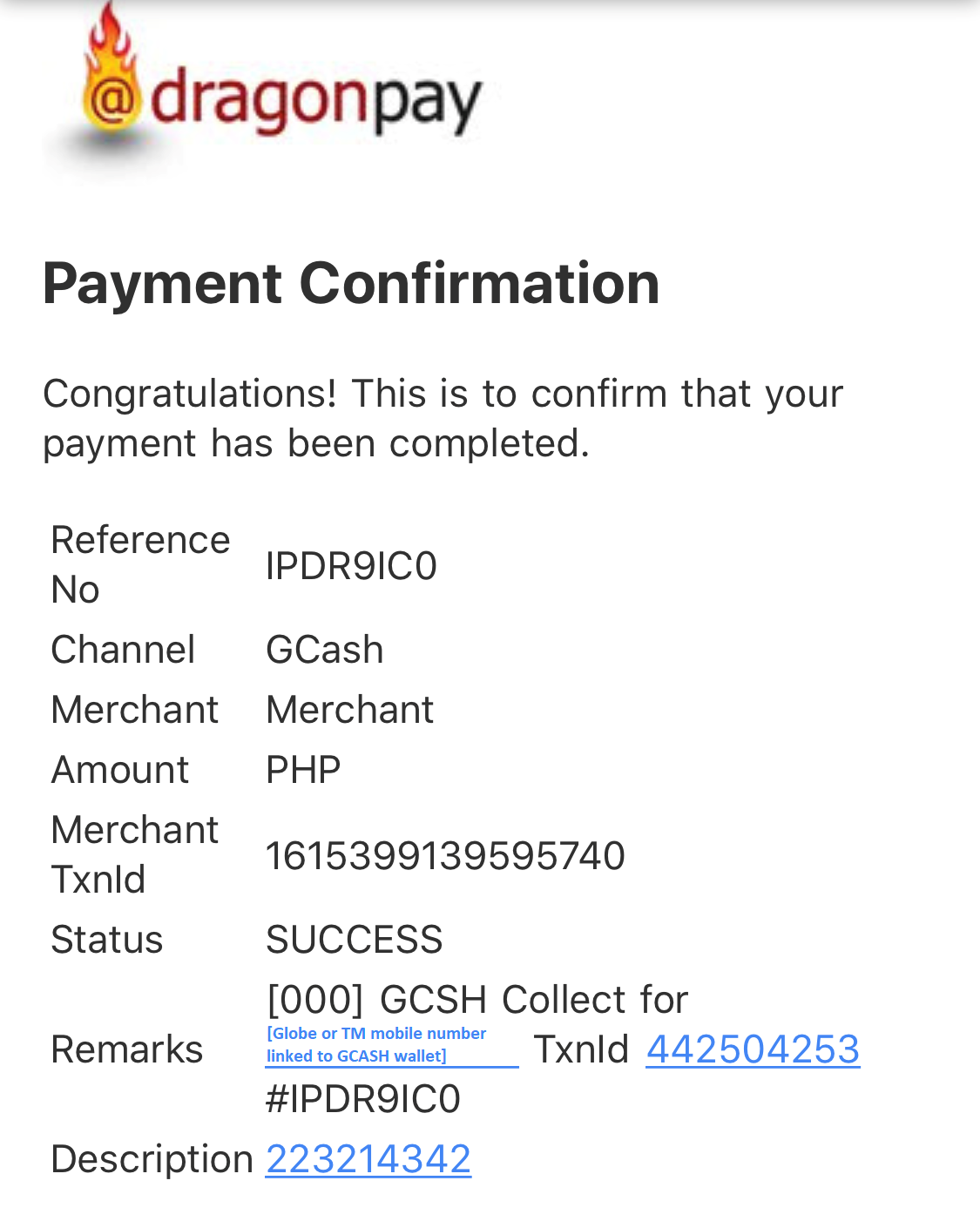

At the time of writing, Dragonpay has yet to expand beyond the Philippines so any cross-border transactions involving it must use a third-party payment provider to act as the international payment provider. To do this, a user would need to use one such payment provider that offers Dragonpay as a payment option upon checkout.

From there, they would proceed to conduct the transaction in any of Dragonpay’s available fund sources.

Once the payment is made, the funds will be transferred from the third-party payment provider’s PH account to one of its international accounts before being disbursed to the foreign seller.

What are the Fees Required in Using Dragonpay?

Currently, Dragonpay imposes transaction fees depending on the business type, service offered, and credit level. For online payments, online banking incurs PHP 10, over-the-counter banking incurs PHP 15, and payment centers incur PHP 20. E-wallet payments and card payments can range anywhere between 3% and 10%, whereas payments made at 7-11 range between PHP 15 to PHP 20⁶.

However, for cross-border payments, all costs that come with using third-party payment providers, such as setup fees (if any) and FX costs apply and will vary depending on choice of payment provider.

Now that you know more about Dragonpay, you can now think about localising into the Philippines with more confidence. However, it wouldn’t hurt for you to consider taking a look into robust payment gateways that offer a slew of localisation options like Omoney to help increase your odds of success.

Sources

- Digital payments in the Philippines - statistics & facts | Statista

- What is Dragonpay? Full Payment Method Description | Ikajo

- E-commerce in the Philippines - statistics & facts | Statista

- The Philippine Digital Payments Sector (trade.gov)

- Dragonpay | ECOMMPAY Documentation

- Dragonpay Pricing | Discover different payment channels

- How to sign-up and use Dragonpay

Category

Payments Resources

Local Payment Methods in Philippines: How Dragonpay Works In an International Payment Gateway

Related Articles

Local Payment Methods in Indonesia: How Dana Works in an International Payment Gateway