- Home

Blog Blog

Payments Resources Payments Resources

Local Payment Methods in Nigeria: Top Banks You Should Know for Your Online Payment Gateway

Local Payment Methods in Nigeria: Top Banks You Should Know for Your Online Payment Gateway

Global trends towards digitisation have led many to explore more effective ways to do business online. This trend does not escape the African region, and in spite of the volatile currency fluctuations of the Naira, Nigeria is emerging as an attractive contender for expanding one’s eCommerce business.

Digitisation has led to Nigerians innovating and adopting new payment methods in spite of infrastructural setbacks. Some of these banks have even adopted pioneering technologies to empower their users and keep their accounts secure. As an international eCommerce business, it helps to know the names of these banks as these are what your buyers are likely to use if they’re based in Nigeria.

Before learning about what the top banks are in Nigeria, it helps to know the banking and payments landscape in this country.

Volatile FX can be a pain to keep track of, especially in markets where conversion costs aren’t transparent and you’re unable to hold multiple currencies to offset any loss in valuation. Why not say goodbye to those pains with Omoney? With operations in over 173 countries, collect, hold, and payout with a single account to keep your cash flow going! Wanna know more? Contact us today:

Banking & Payments Landscape in Nigeria

According to the Central Bank of Nigeria, the West African nation has achieved a 64% financial inclusion rate as of 2022, and is aiming for 95% by 2024¹. This bodes well for more business as this opens up a new market of potential customers and businesses alike since more people have more means to make payments.

While cash is still king in the region, the Central Bank of Nigeria has enacted financial inclusion initiatives. These include the likes of licensing mobile money operators (MMO) and payment services banks (PSB)². Banks, technology, and financial services companies currently dominate the country in terms of being a mobile money operator, but expect to see more telcos to start applying for MMO licences, following the lead of MTN who obtained their licence in April 2022³.

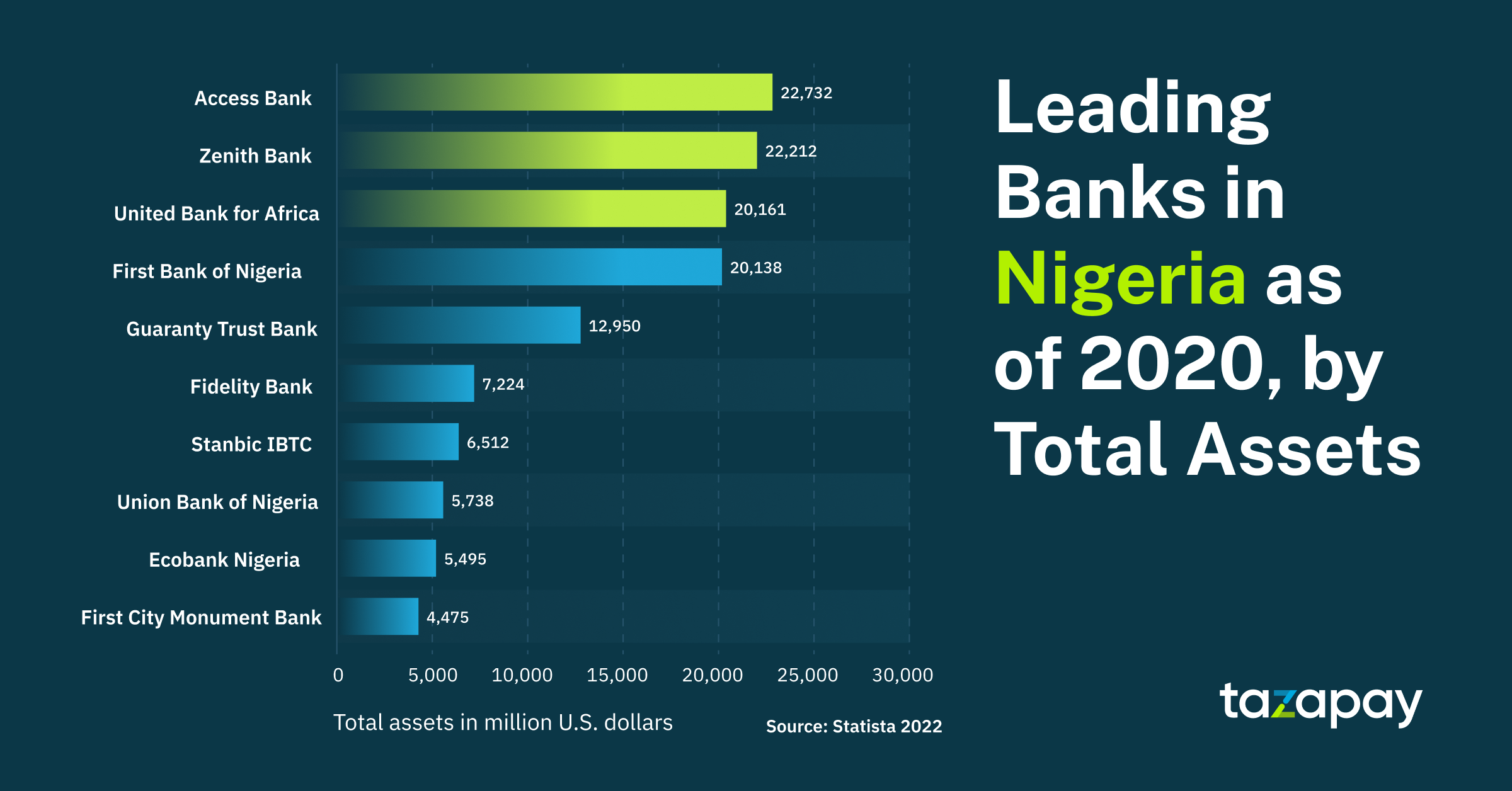

Top Banks in Nigeria by Total Assets

- Access Bank

- Zenith Bank

- United Bank for Africa

- First Bank of Nigeria

- Guaranty Trust Bank

- Fidelity Bank

- Stanbic IBTC

- Union Bank of Nigeria

- Ecobank Nigeria

- First City Monument Bank

Access Bank and its Payment Methods

Founded in 1989, Access Bank first started as a corporate bank, which then expanded to include personal and business banking in 2012. As of 2021, its total assets are worth 25.5 billion USD, making it the leading bank in Nigeria in terms of its worth.

When making purchases, users of Access Bank can make payments using the following methods:

- Internet & mobile banking

- Card, credit & debit

- Bank transfers

- Mobile money

- *901#, which is a number that users can dial to manage their bank account when there’s no internet access

- Facepay, which authorises payments with biometrics, etc.

Most third-party international payment gateways should be able to support online bank redirects and card payments for eCommerce transactions. However, some payment gateways, like Omoney, have started to adopt mobile money as a payment method to help businesses localise their presence in Nigeria.

The world is now your market - unlock local payment methods like QR Codes, voucher-based payments, mobile money, and more for your eCommerce website using our API integration. Wanna know more? Find out here:

Zenith Bank and its Payment Methods

Zenith bank has been operational since 1990, founded as a financial services provider and licensed as a commercial bank. According to Statista, Zenith bank has a total asset worth of 22.2 billion USD in 2020, trailing behind Access bank’s total assets in 2020 at 22.7 billion USD⁴.

In terms of payment methods. Zenith bank users are able to pay via the following:

- Internet & mobile banking

- Cards, credit & debit

- Scan to pay QR codes

- *966#, a phone line that users can dial to manage and pay with their bank account

- Bank transfers, etc.

United Bank for Africa (UBA) and its Payment Methods

Headquartered in Lagos, Nigeria, the United Bank for Africa (UBA) is one of the older banks founded in the country, dating back to 1949. It is a multinational pan-African financial group with subsidiaries in 20 African countries and operations in the USA, UK, and more recently, UAE.

As of December 2021, the financial group’s total assets are worth USD 20.1 billion according to UBA’s 2022 annual report.

Account holders of UBA can make use of the following payment methods when making their purchases:

- Internet & mobile banking

- Bank transfer

- Cards, debit & credit

- Mobile money

- Scan to pay QR codes, etc.

First Bank of Nigeria

As an established financial institution since 1894, the First Bank of Nigeria is the oldest bank in the country and also boasts a multinational presence across West African nations, the UK, and France. Its total assets as of 2020 is worth USD 20.1 billion, according to Statista.

By using the First Bank of Nigeria, buyers can make payments using the following methods:

- Internet & mobile banking

- Cards, debit & credit

- Bank transfer, etc.

Guaranty Trust Bank

Guaranty Trust Bank was founded in 1990, offering retail banking, investment banking, pension management, asset management, and payment services. According to Statista’s 2020 report, Guaranty Trust Bank has USD 12.9 billion of total assets.

Their offering of digital banking and payment services allows their users to pay via:

- Internet & mobile banking

- Cards, debit & credit

- Bank transfer, etc.

Fidelity Bank

This Nigerian commercial bank was founded in 1988, having 7.2 billion USD in total assets as of 2020 by Statista’s accounts.

Users of Fidelity bank can make payments using:

- Internet banking

- Cards, debit & credit

- Bank transfer, etc.

Stanbic IBTC

Stanbic IBTC Bank is a merger between Stanbic Bank Nigeria Limited and IBTC Chartered Bank. The former was founded in 1991 and the latter in 1989. The entities merged in 2007 and now offers commercial banking for individuals and businesses, pension management, among other financial services. Its total assets as of 2020 stands at USD 6.5 billion.

Like its other banking counterparts, you can expect users of Stanbic IBTC to be able to pay using:

- Internet banking

- Cards, debit & credit

- Bank transfer, etc.

Union Bank of Nigeria

Union Bank of Nigeria is also one of the older banks in the country, with its founding year in 1917. According to Statista, it has total assets worth USD 5.7 billion.

Users of Union Bank of Nigeria can pay and manage their account with the following methods:

- Internet & mobile banking

- Cards, debit & credit

- *826#, to allow users to dial in and manage their accounts

- Bank transfer, etc.

Ecobank Nigeria

This bank began its Nigerian operations in 1989, and is a part of the pan-African Ecobank conglomerate which is headquartered in Togo. The parent company has operations across 36 African nations and has subsidiaries in France, UK, UAE, and China.

Ecobank Nigeria, as of 2020, has total assets worth USD 5.4 billion. However, the group as a whole has USD 26.3 billion in total assets in 2021.

The pan-African bank is able to offer the following payment methods for its users:

- Internet & mobile banking

- Mobile money

- Cards, debit & credit

- Bank transfer, etc.

First City Monument Bank

Also belonging to a pan-African banking group, First City Monument Bank was founded in 1982 with its headquarters based in Lagos, Nigeria. It also has a branch in the UK and as of 2020, holds total assets worth USD 5 billion according to its annual report. (Statista’s 2020 report, however, pegs that number at USD 4.5 billion).

FCMB users can make payments via the following methods:

- Internet banking

- Cards, debit & credit

- Scan to pay QR codes

- Bank transfer, etc.

With this knowledge in mind, you may find it hard to choose between these banks to offer multiple localised payment methods for buyers based in Nigeria. Why not let a third party payment gateway take the hassle out of integrating with various banks and offer these payment options on your behalf?

Omoney can help you reach the burgeoning Nigerian market by offering localised payment options, collecting in Naira and paying out at your local currency or in USD, EUR, or GBP at the most competitive rates. What’s more, enable local bank transfers for your cross-border transactions with Omoney as your trusted intermediary and enjoy a 0% fee for that payment method! What are you waiting for? Contact us now:

Sources

- Nigeria attains 64% financial inclusion, targets 95% in 2024 — CBN Deputy Gov

- Financial inclusion in Nigeria: mobile money services, payment services, banks and telecoms operators | International Bar Association

- MTN's Mobile Money (MoMo) receives banking license in Nigeria - ThePaypers

- Leading banks in Nigeria 2020, by total assets | Statista

Category

Payments Resources

Local Payment Methods in Nigeria: Top Banks You Should Know for Your Online Payment Gateway

Related Articles

Local Payment Methods in Indonesia: How Dana Works in an International Payment Gateway