- Home

Blog Blog

Payments Resources Payments Resources

Local Payment Methods in India: How UPI Works In an International Payment Gateway

Local Payment Methods in India: How UPI Works In an International Payment Gateway

One of the most dynamic and burgeoning marketplaces in the world is India. Given the current global trend of digital integration, it is no surprise that India is also in on the ball too, seeing as how it is also recognised as one of the fastest growing digital economies in the world¹.it has recorded over 88.4 billion digital payment transactions between 2021 and 2022, and has tracked an astonishing 284 million digital transactions per day as of July this year¹. This is all due the country’s move towards rapid adoption of digitalisation and one of the measures that are instrumental in achieving this goal is the Unified Payment Interface (UPI), developed by the National Payments Corporation of India (NPCI).

Let’s face it: handling payments is hard. There are so many things to think about like how much a payment method charges? Is it easy to integrate on your website? Are there any hidden fees? Omoney is the answer you need. Not only is integration a hassle-free matter, pricing is also straightforward with no hidden costs. Sounds too good to be true? Contact us today and see for yourself.

What Is UPI?

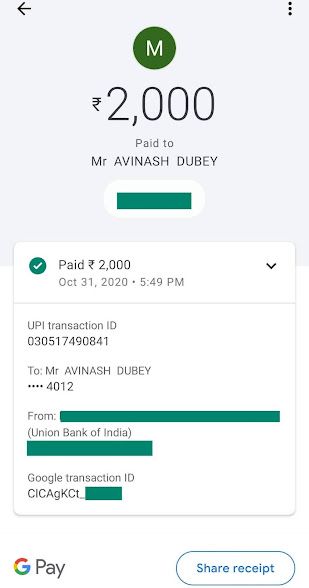

As mentioned above, UPI stands for the Unified Payment Interface. It is a real-time payment system designed to enable inter-bank P2P payment transfers through a two-click factor authentication process². The interface itself is used in the form of a smartphone application and is regulated by India's central bank, the Reserve Bank of India².

The discerning reader may notice that it may bear some similarity to Singapore’s own inter-bank P2P real-time payment system, PayNow. This is primarily due to the fact that both are government-led initiatives meant to encourage accelerated adoption of digitalisation, employ a network of participating banks and NFIs, and utilise VPAs in the form of the user’s mobile number³. Much like its Singaporean counterpart, UPI can also make transactions via QR code payments and even barcode payments². UPI’s network also includes compatibility with many digital wallets and payment applications such as GoogleTez, Paytm, and PhonePe³.

User Trends in UPI

UPI is slowly but surely set to become India’s preferred method of cashless digital payment method, as evidenced by the remarkable 519% increase in transactional volume between January 2020 and September 2022, with the number of banks live on UPI jumping from 144 to 358 within that same time period⁴. This growth is forecasted to grow by a whopping $65.49T between 2022 till 2026, with its CAGR decelerating by 132.98% throughout⁴. This might be due to the fact that by then, a significant majority of the population will have adopted UPI as their preferred payment method.

UPIs users, much like PayNow users, are diverse in age. However, unlike in Singapore which has the advantage of a small landmass and significantly smaller population, most UPI users tend to be those from the more urban areas where the infrastructure for widespread internet connectivity exists as opposed to the greater number of people that live in the rural parts of the country.

Think that your business is incompatible with our services? Don’t worry, we have a solution for every business use case, including those in the export-import business! Still unconvinced? Why not check it out for yourself here:

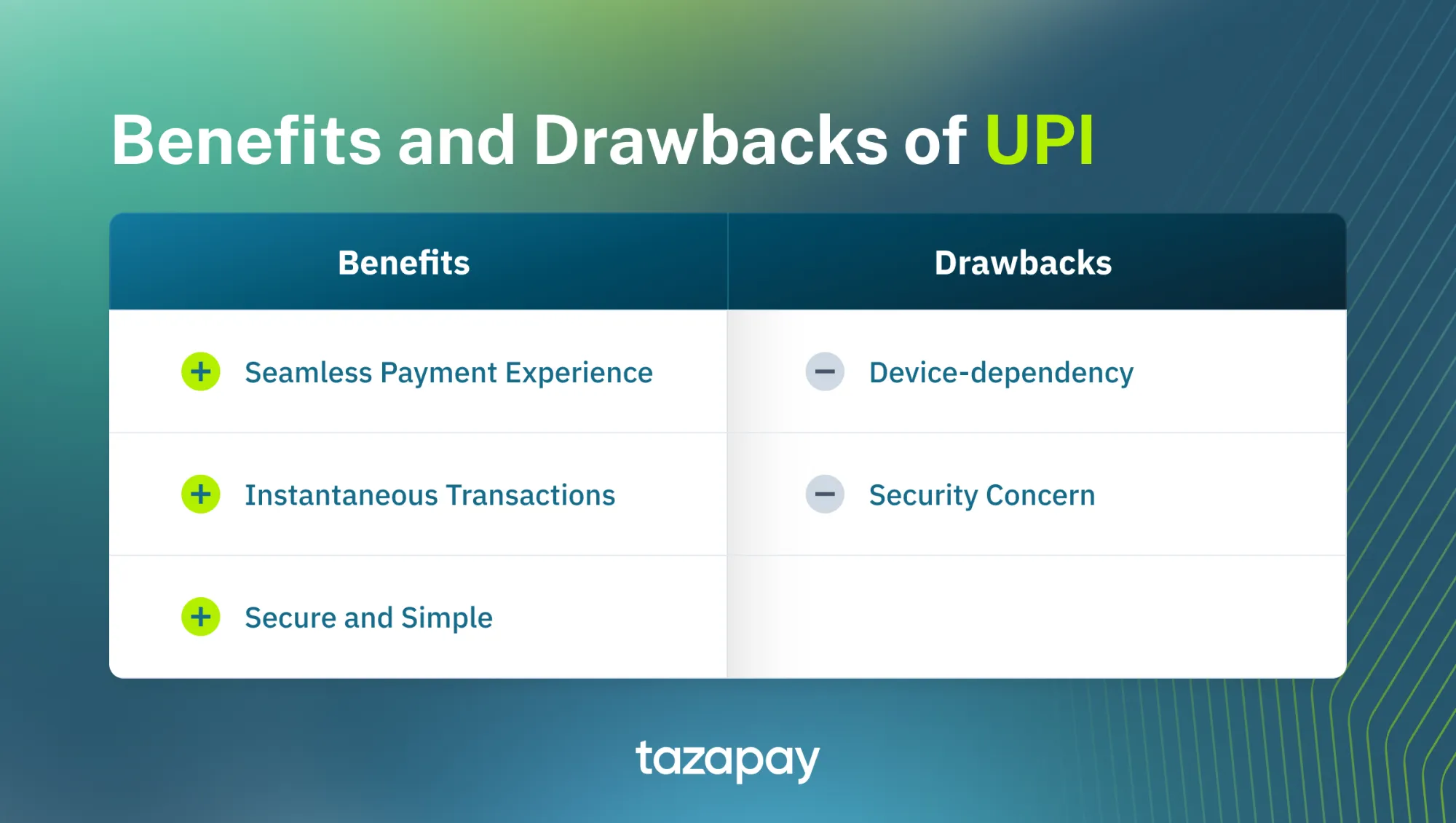

Benefits and Drawbacks of Using UPI for Online Payment Gateways

Every payment method and system has its ups and downs, benefits and drawbacks. Here are UPI’s:

Benefits of UPI

- Seamless Payment Experience: UPI’s compatibility with many payment applications and digital wallets, as well as its elaborate network of participating banks and NFIs, ensure a mostly hassle-free checkout experience for both the buyer and the merchant by allowing payments to be made regardless of bank. Their ability to conduct transactions via QR code payments, VPA-based funds transfer, and barcode payments means that users need not worry about an incompatible payment method ever.

- Instantaneous Transactions: All UPI transactions take place synchronously in real-time, allowing for transactions to be conducted in a matter of seconds.

- Secure and Simple: On top of having a two-click authentication process or two-factor authentication (2FA) similar to OTP, UPI also utilises a highly secure encryption format along with the UPI ID, a unique ID for each user that requires a PIN for user verification. This means that accessing UPI is both secure and simple. The PIN also allows for cross-operability of authentication across all UPI-participating entities, including third-party applications such as Google Pay⁵.

Drawbacks of UPI

- Device-dependency: UPI being a payment system that is accessible via internet-capable smart devices means that it is practically unusable in areas where internet access is either difficult or non-existent. Furthermore, this requirement may also alienate potential users that do not have the means to purchase a smartphone.

- Security Concern: UPI’s PIN being cross-operable across all participating bodies also means that anyone with access to said PIN can potentially use it as well. While this is technically addressed by their 2FA, it still falls to the human factor to remain vigilant of phishing and other forms of fraud to prevent having their accounts compromised.

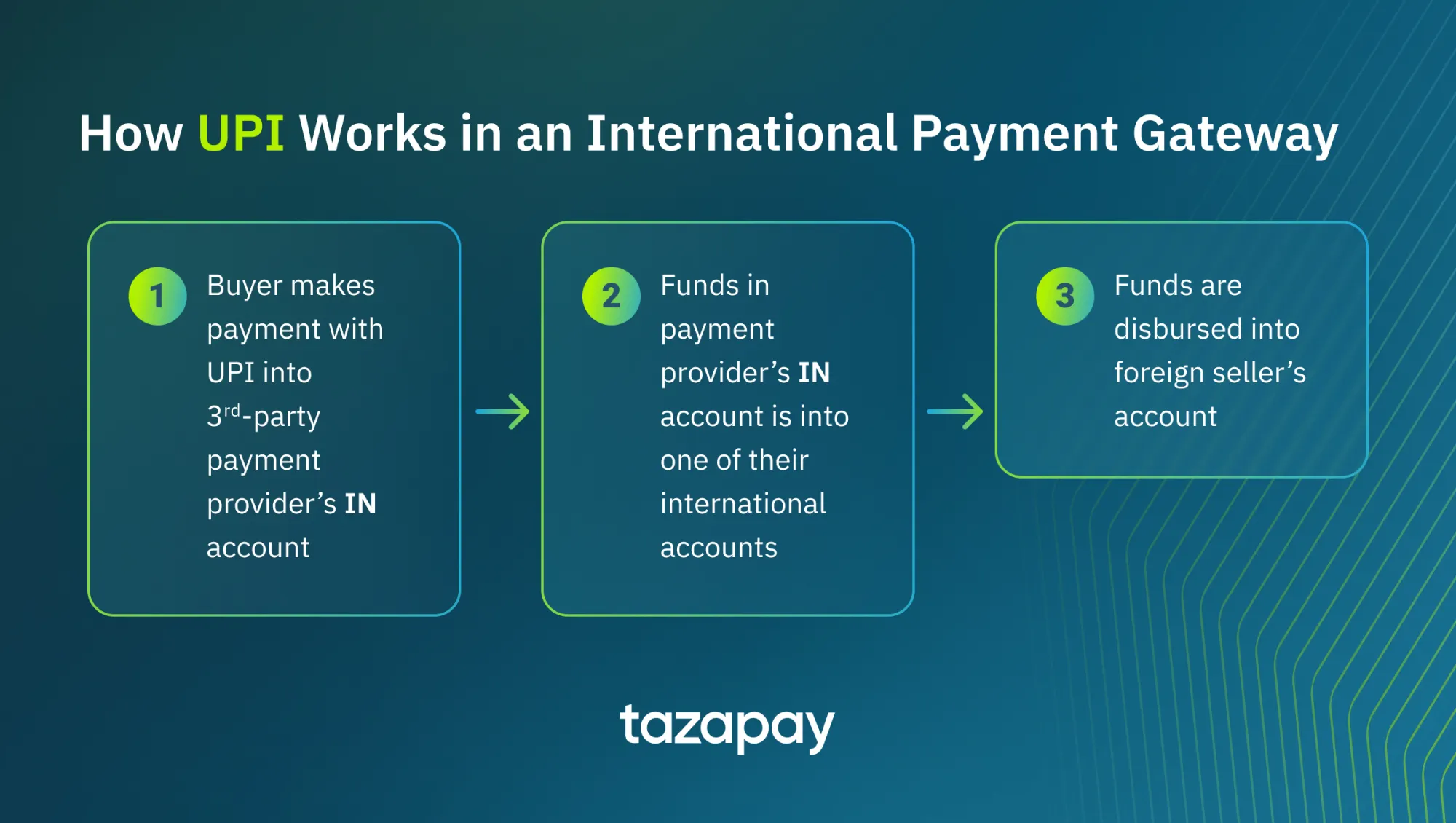

How UPI Works in an International Payment Gateway

At the time of writing, UPI remains mostly local, with only Nepal and Singapore being available for cross-border transactions though the NPCI is planning on including 9 more Asian markets to that list, and in talks to have UPI available in 30 other countries⁶. That being said, for the time being, any international transactions that need to be made with UPI outside of those listed countries must be done through a third party provider to act as their international payment gateway.

How such a payment would work is that the funds from the user would be transferred into the payment provider’s Indian bank account via UPI.

This can be done through either scanning the QR code or barcode that leads to the checkout amount being paid by the user within the UPI app.

Then, these funds are moved into one of many international accounts owned by the payment provider before being disbursed to the foreign seller’s bank account. No two third party payment providers are the same so keep an eye out for one that offers an extensive list of localised markets to choose from.

What are the Fees Required in Using UPI?

For transactions done locally, currently there is no charge incurred on UPI transactions since the Indian government has mandated a zero-charge framework for UPI transactions from January 1, 2020⁷. This information is accurate as of October 2022.

That being said, any international transactions made with the use of third party payment providers would still incur all the usual fees and costs that come with them, such as setup fees, platform fees and FX costs. There are a myriad of payment providers out there so your best bet would be to find one that offers hassle-free integration and matching FX rates to current market rates like Omoney.

Now that you know more about UPI, localising into India may not seem so daunting of a task anymore. Still, if you’re still unsure about your odds, then why not even those odds with Omoney? Omoney not only offers UPI as a payment method but also an entire selection of 84 localised markets accessible with only a single account. Opportunity waits for no one, try Omoney today!

Sources

- The G20 Digital Economy Agenda for India | ORF (orfonline.org)

- Unified Payment Interface (UPI): Definition and How It Works (investopedia.com)

- UPI - How does UPI work & Know the Complete Information (bankbazaar.com)

- Unified Payments Interface (UPI) Product Statistics | NPCI

- The Ever-Expanding Reach Of India’s Unified Payments Interface (UPI) (forrester.com)

- NPCI-International-Press-Release-LIQUID-GROUP-TO-POWER-UPI-QR-ACCEPTANCE-IN-10-ASIAN-MARKETS.pdf

- Charges on UPI transactions? What govt said explained in 10 points | Mint (livemint.com)

Category

Payments Resources

Local Payment Methods in India: How UPI Works In an International Payment Gateway

Related Articles

Local Payment Methods in Indonesia: How Dana Works in an International Payment Gateway