- Home

Blog Blog

Payments Resources Payments Resources

Local Payment Methods in Europe: How Trustly Works in an International Payment Gateway

Local Payment Methods in Europe: How Trustly Works in an International Payment Gateway

Europe is home to some of the largest eCommerce markets in the world, boasting a total market revenue value of USD 602.20B in 2022, and a user penetration rate of 61.6% that same year¹. This amazing market health can be attributed to the fact that across Europe, the three main forces that drive e-payment adoption and development–regulatory nudging, consumer interest, and merchant interest–are all present in spades, thereby driving up digital penetration rates in the region². One notable digital payment ecosystem that is popular in Europe is Trustly, the Swedish-based international open banking payment method³.

Eager to grow your business but unsure where to expand to? Why not choose a digital payment platform that allows you to choose virtually any market in the world! With Omoney, experience seamless borderless payments as over 173 markets are now yours to pick and choose from. We also offer a selection of up to 84 localised markets at your disposal. Interested? Contact us today.

What Is Trustly?

As mentioned earlier, Trustly is an international open banking payment method, which means that it is a payment method that allows users to make transactions from their online bank account without needing a card or an app³. Users making payments with Trustly must input their bank credentials and an OTP into the Trustly payment screen first before they can proceed, making them akin to a multi-bank bank redirect in this regard⁴. The funds are transferred directly to the merchant’s bank account via a network of third party providers known as Payment Initiation Service Providers (PISPs) that executes transactions on the users’ behalf⁵. It is these PISPs that power Trustly’s strength as a payment method since they contain all of a user’s bank details, enabling a user to make payments regardless of bank, and checkout anywhere from digital to physical stores provided that they support the PISP⁶.

User Trends in Trustly

Being a global leader in open banking payments, Trustly boasts a reach of 525 million consumers and its network supports 6,300 banks, effectively bypassing card networks in all of Scandinavia, most of Central Europe, Great Britain and Spain⁷. Currently, Trustly is making a strong effort to make itself the payment method of choice in the iGaming scene⁷.

Given the highly banked population of Europe, and the fact that 74% of all transactions in the country are done digitally, it is safe to say that Trustly users are made up of a diverse age group, typically adults⁸. Suffice to say, Trustly’s growth for the time being is positive and tends to track with current payment trends in Europe.

Need an all-in-one solution to solve your various SaaS-related payment issues? Then why not give Omoney a try! With easy API integrations and no hidden fees, settle your international payments for your SaaS platform in one go. Unconvinced? See for yourself here:

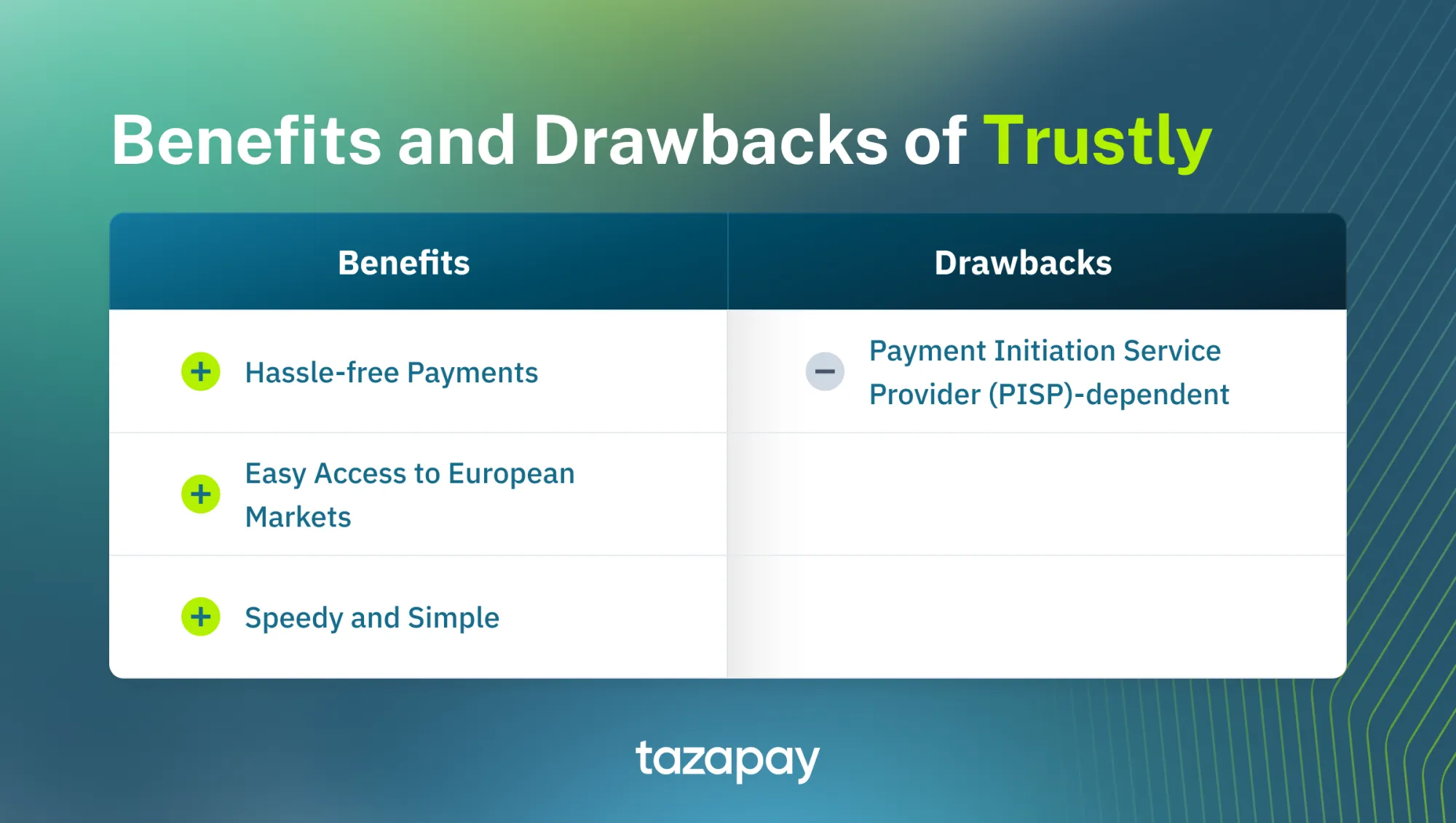

Benefits and Drawbacks of Using Trustly for Online Payment Gateways

Every payment method has their ups and downs. Here are the benefits and drawbacks of using Trustly:

Benefits

- Hassle-free Payments: Trustly’s open bank payment model makes it possible for users to make transactions regardless of what bank they use if it is part of the 6,300 bank network, allowing for hassle-free transactions.

- Easy Access to European Markets: The expansive international network fostered by Trustly across Europe, and the Payment Services Directive 2 (PSD2) EU payments legislation which allows for the widespread use of PISPs, means that it is easier than ever to penetrate the European market⁵.

- Speedy and Secure: Transactions are conducted in real-time, and all Trustly transactions are protected with two-factor authentication (2FA).

Drawbacks

- Payment Initiation Service Providers (PISPs)-dependent: Being reliant on PISPs means that despite its cross-border infrastructure, it is largely still regional within the confines of the EU since PISP usage is only widespread due to EU payments legislation, PSD2, being enforceable in the EU only.

How Trustly Works in an International Payment Gateway

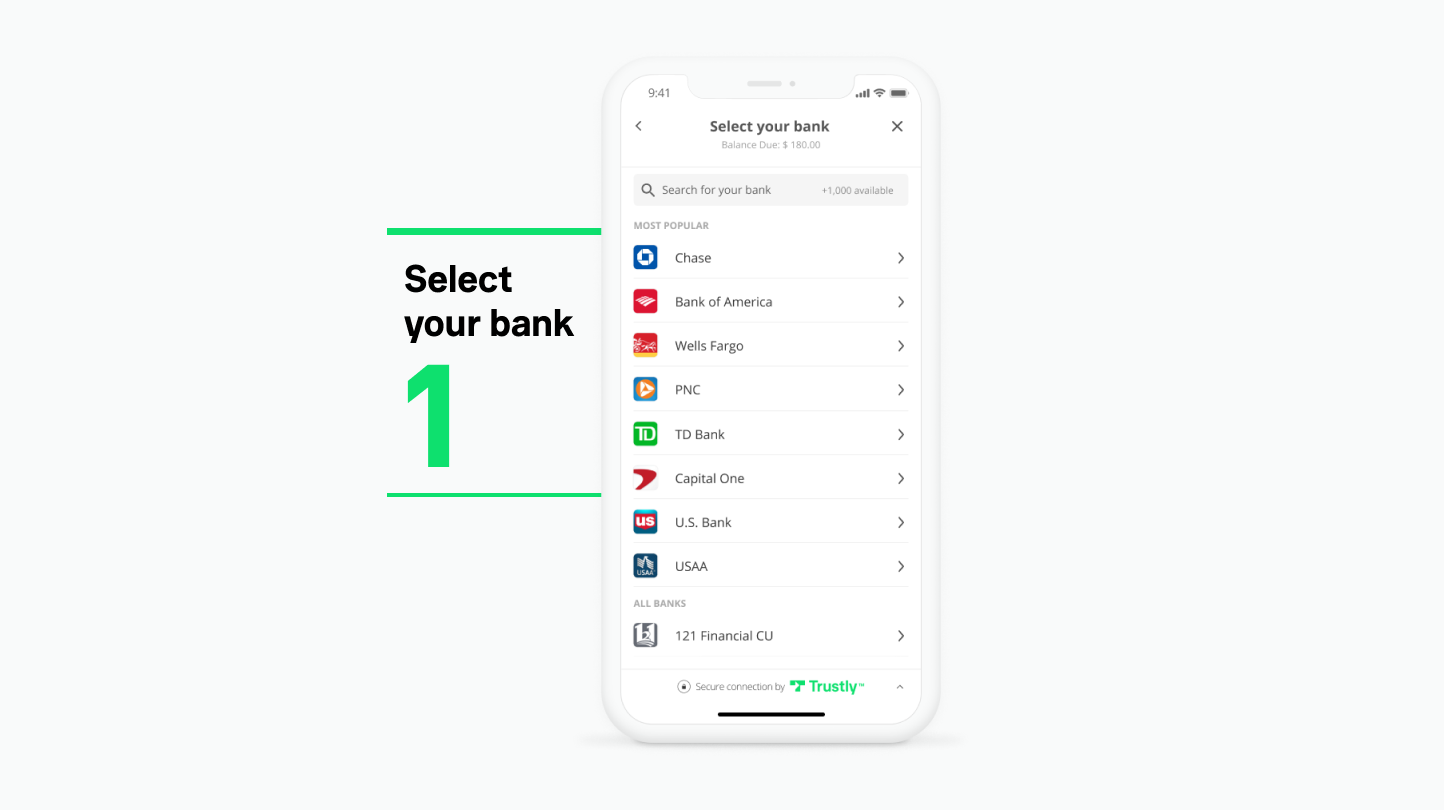

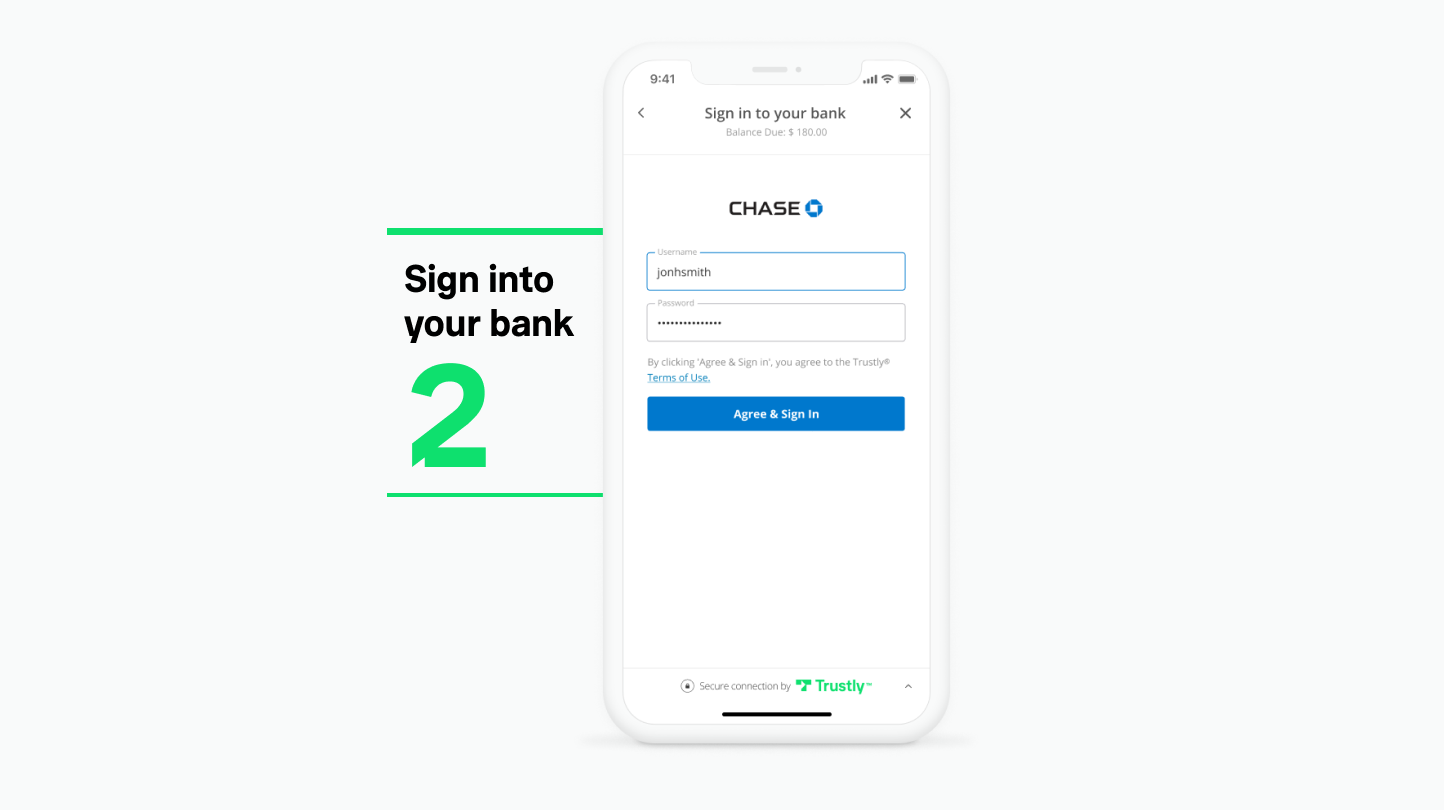

At the time of writing, Trustly has payment solutions across 29 European countries, including the United Kingdom⁴. Cross-border payments made within Trustly’s coverage work the same way wherever they are in the EU: the user is directed to the Trustly payment screen where they would be prompted to select the bank they use from a list.

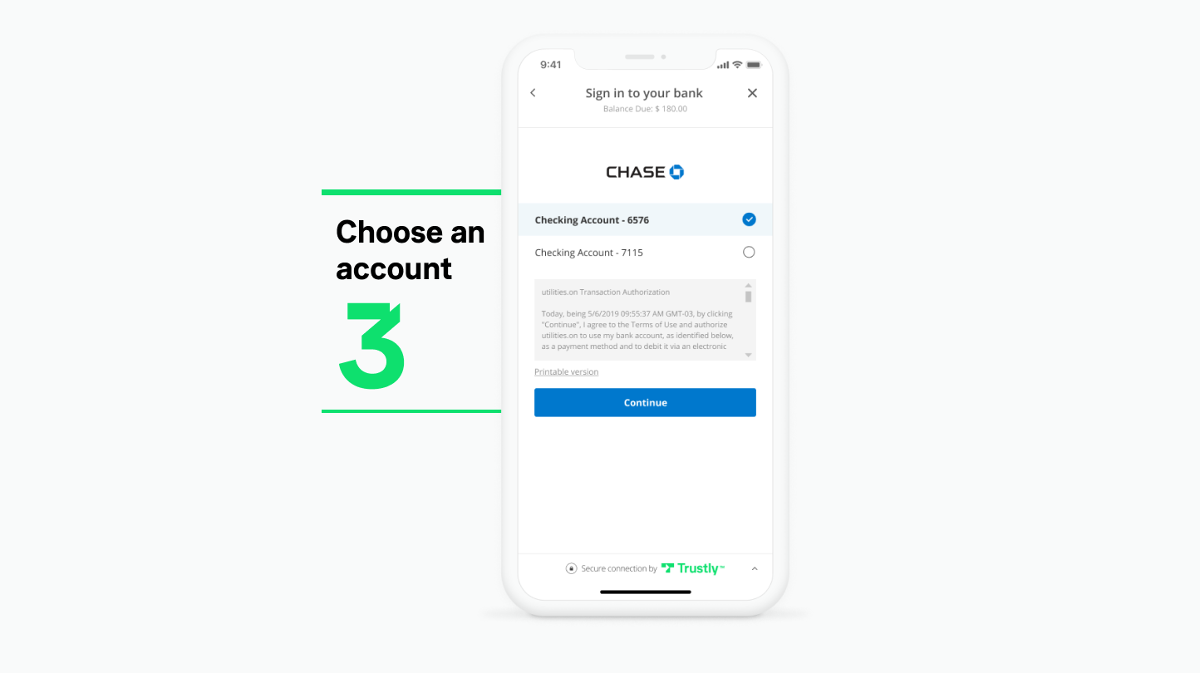

From there, the user must input their bank credentials and an OTP before proceeding to checkout. The funds are taken directly from the user’s bank account via PISP and is transferred to the merchant’s account in the same way.

However, for international payments made outside of the EU, Trustly users must use a non-PISP third party provider to act as the international payment gateway.In this instance, the checkout process should remain largely the same except rather than the funds being transferred directly to the foreign merchant, the funds are first transferred into the payment provider’s EU account before being disbursed into their foreign account. From there, the funds are moved into the foreign merchant’s bank account.

What are the Fees Required in Using Trustly?

Currently, there are no setup fees when using Trustly but they do have a standard transactional fee of 1.5% with a minimum of EUR 0.8. However, this is not inclusive of other fees incurred when using Trustly outside of the EU such as setup fees for the third party payment provider, FX costs, and platform fees. Be sure to be on the lookout for payment platforms that offer you the best possible rates, like Omoney.

Now that you are more knowledgeable about Trustly, you may now be certain about penetrating the European market through Sweden’s payment services provider. However, should you wish to have other avenues of penetration, opt for a payment platform that can offer you a wide selection of markets to choose from like Omoney? With over 80 localised markets accessible with only a single account, the possibilities for localising your business is plentiful. Don’t delay, try Omoney today!

Sources

- eCommerce - Europe | Statista Market Forecast

- Interview: The Global Trend Towards Online Banking e-Payments. (trustly.net)

- What is Trustly - online bank transfer? (worldremit.com)

- What is Trustly? Full Payment Method Definition - Ikajo

- Open Banking Explained | Trustly

- PISP (Payment Initiation Service Provider) | Compello

- Alternative Payments Blog - Payment Methods

- E-commerce statistics for individuals - Statistics Explained (europa.eu)

- Are payments in Sweden safe? (riksbank.se)

Category

Payments Resources

Local Payment Methods in Europe: How Trustly Works in an International Payment Gateway

Related Articles

Local Payment Methods in Indonesia: How Dana Works in an International Payment Gateway