- Home

Blog Blog

Payments Resources Payments Resources

Local Payment Methods in Europe: How Sofort Works In an International Payment Gateway

Local Payment Methods in Europe: How Sofort Works In an International Payment Gateway

Europe is one of the largest e-commerce markets in the world, with a combined total market revenue of USD 602.20B in 2022, and a projected market volume of USD 1304.00B by 2027 according to predicted annual growth rates¹. It is also home to some of the most dynamic digital markets in the world, including Germany, which happens to be the 4th largest after the UK². This impressive growth is only possible due to the burgeoning digital economies within the region, creating an environment ripe for robust digital payment infrastructures to prosper. One of these European digital payment systems that will be highlighted today is the German-based Sofort, a pan-European payment service provider.

Transparency is an integral aspect of any respectable merchant of any repute yet it is also in short supply. This is especially true when it comes to pricing. Here at Omoney, we are committed towards making our pricing simple and transparent. If you’re not convinced that why not contact us and see for yourself?

What Is Sofort?

Sofort is a payment service provider based in Germany that allows users to pay using their own online banking details and have transactions processed in real-time³. They have operations in over 13 European countries, which is made possible due to them being powered–and acquired–by Klarna Kosma’s open banking PISP-based infrastructure⁴. This would make payments made with Sofort to be similar to those made with Trustly, as the payment process largely involves direct banking facilitated via PISPs which allows users of differing banks to make payments with ease.

User Trends in Sofort

The 2022 European E-commerce Report states that 75% of all European internet users have purchased goods and/or services this year, with the overwhelming majority of those users hailing from Western Europe⁵. B2B e-commerce appears to make up the bulk of the European e-commerce market since it easily holds a market share of roughly 63.1%, though this isn’t to say that B2C is lagging behind as online retailers have dramatically increased in number during the pandemic with over 87% of internet users in the region being e-shoppers in 2020⁶. However, this has since dipped a bit into 85% this year, which is still a healthy sign for Sofort’s business prospects⁵.

Need an all-in-one solution to solve your various SaaS-related payment issues? Then why not give Omoney a try! With easy API integrations and no hidden fees, settle your international payments for your Saas platform in one go. Unconvinced? See for yourself here:

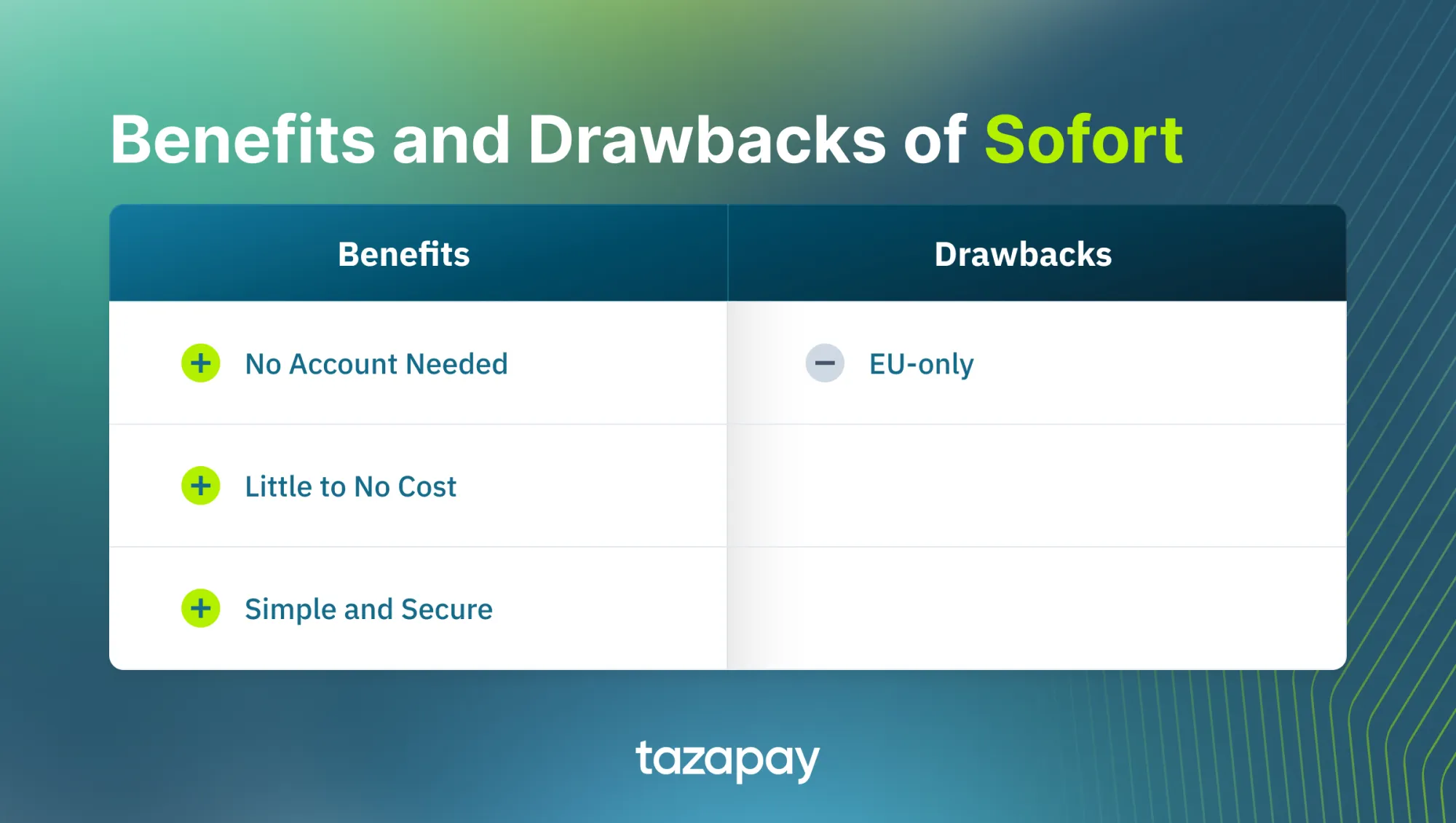

Benefits and Drawbacks of Using Sofort for Online Payment Gateways

While many strides in technological improvement have seen major upgrades in the online payment gateway market, none are perfect so it’s best to consider their benefits and drawbacks before making a decision. Here are the pros and cons of using Sofort:

Benefits

- No Account Needed: Users can make payments directly from their bank account without having to create an account with Sofort at all, allowing for greater convenience.

- Simple and Secure: Payments made via Sofort can be made anywhere within Sofort-supported countries, and all transactions are encrypted with 256-bit encryption as well as requiring the user to input their PIN and TAN, making it both simple and secure.

- Little to No Cost: Users can make most payments with Sofort at no cost at all, whereas merchants integrating with Sofort are only charged standard rates per transaction.

Drawbacks

- EU-only: Sofort is only available in the EU, and accepts mainly euros as the preferred currency. Moreover, only European banks are recognised by Sofort, meaning that any prospective user with a non-EU bank account needs to have an EU bank account to reap the benefits of Sofort.

How Sofort Works in an International Payment Gateway

Sofort being a pan-European payment gateway means that it is already an international payment gateway in some respects since it is supported in 13 countries, which are Austria, Belgium, Finland, France, Germany, Italy, Norway, Poland, Spain, Switzerland, The Netherlands, and the United Kingdom⁴. However, while this list reliably encompasses the bigger markets in each quadrant of the EU, it does not include those within the EU that do not support Sofort, nor any markets outside the EU. This means that for any transactions made outside of Sofort’s list of supported countries, a third party payment service provider will be required as the international payment gateway to facilitate them.

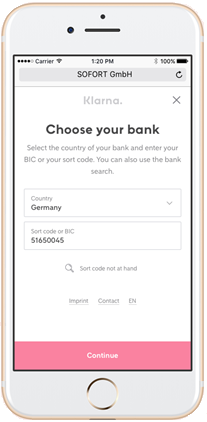

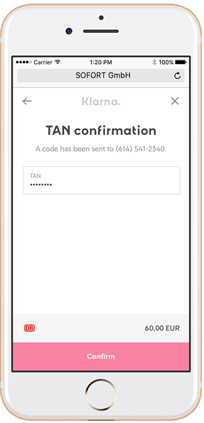

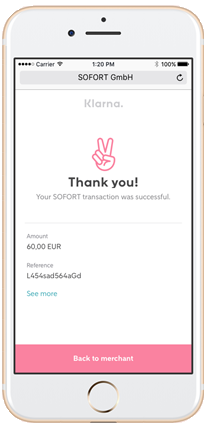

How Sofort payments normally work is that the user would access their bank account directly via Sofort and input their PIN and TAN in order to checkout. Once the user’s credentials have been verified, the funds are transferred from the user’s bank account straight into the merchant’s own.

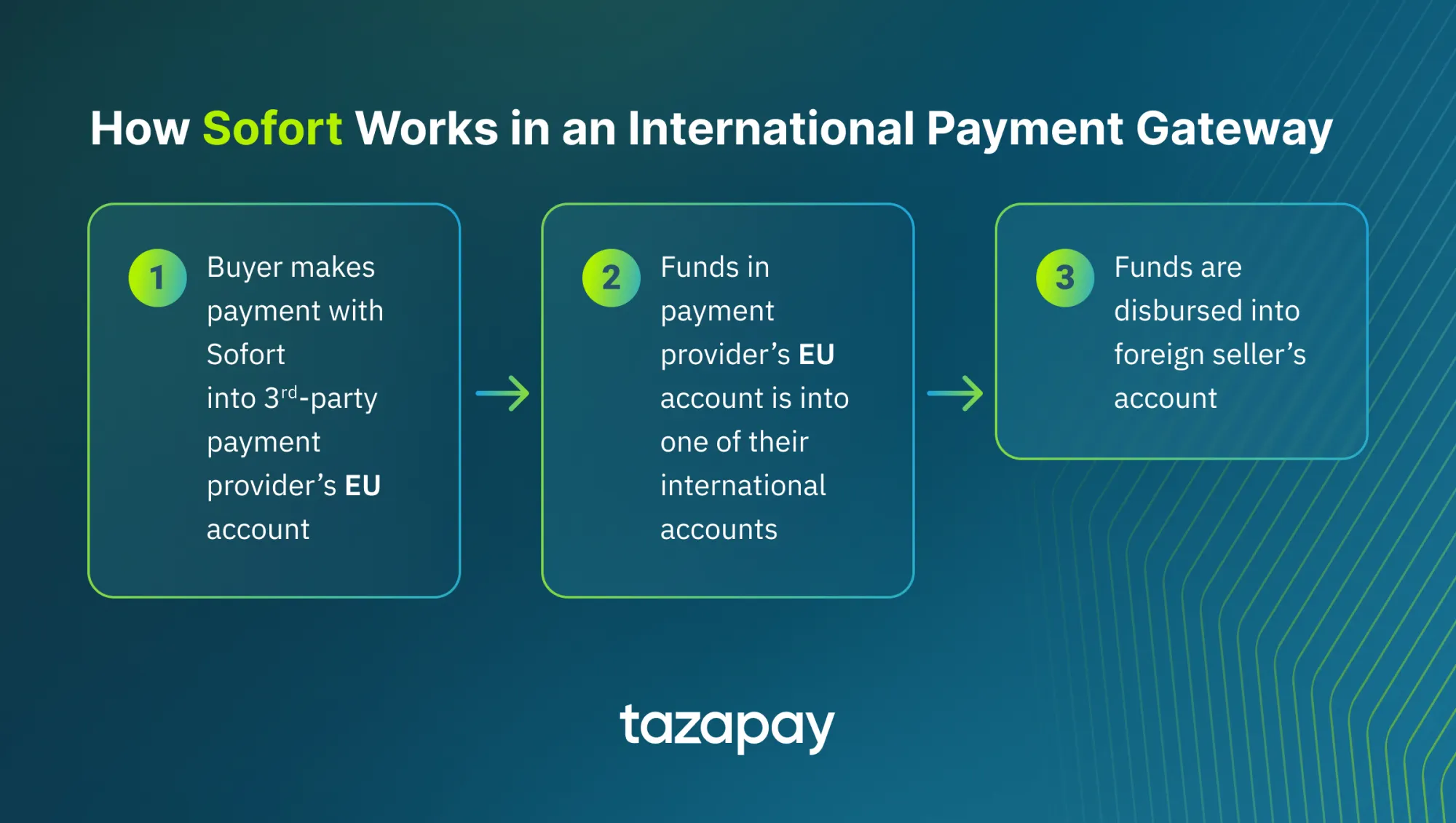

In the event of an international transaction outside of the EU, the buyer would first pay through their merchant’s third-party payment provider of choice to select Sofort as their chosen payment method upon checkout. The payment process at this stage would proceed normally until checkout is finalised, by which after that the funds would be transferred from the user’s bank account into the third-party payment provider’s local bank account. Then, the funds would be moved into the payment provider’s international accounts before being disbursed into the foreign seller’s bank account.

What are the Fees Required in Using Sofort?

Currently, there are no fees for using some of Sofort’s payment services, which includes the app itself, and some of the BNPL options offered. However, since Sofort is itself a payment gateway, it means that there are different methods and rails that Sofort uses to process transactions. As it stands, Sofort’s transaction fees typically range anywhere between €0.10 + 1~2% to €0.25 + 3.29%.

Of course, when using Sofort as a payment method in a third-party payment provider acting as an international payment gateway, there are other costs that come into play such as setup fees, FX costs, and potential hidden costs.

Now that you’re better informed about Sofort, you can now consider it for your endeavours in penetrating the European market. In order to improve your odds even further, you should opt for a robust and reliable third-party payment provider to act as your international payment gateway. One such payment gateway is Omoney, which boasts access to over 173 countries and is secured with 256-bit encryption to ensure that every transaction is safe and secure.

Sources

Category

Payments Resources

Local Payment Methods in Europe: How Sofort Works In an International Payment Gateway

Related Articles

Local Payment Methods in Indonesia: How Dana Works in an International Payment Gateway