- Home

Blog Blog

Payments Resources Payments Resources

Local Payment Methods in Australia: How POLi Works In an International Payment Gateway

Local Payment Methods in Australia: How POLi Works In an International Payment Gateway

Australia is the 13th largest global eCommerce market with a revenue of USD 40.9B in 2021, putting it ahead of Brazil and behind Russia¹. With an estimated CAGR of 12.6%, Australia is a market that one can expect to have a diverse and competitive digital payments environment¹. One such example happens to be one of Australia’s most prominent payment platforms, POLi.

Choosing the right payment gateway can be tough and confusing. Is it secure? Does it have the market I want? Can I even localise there? With Omoney, you can have all of that and more as it not only grants you access into over 173 markets the world over, but also localise in more than 80 of them! Unlock the world in a single payment gateway today.

What Is POLi?

POLi is an online payment option which facilitates a Pay Anyone internet banking payment, also known as direct funds transfer, between the user’s bank account and merchant’s own². POLi is also a subsidiary of Australia Post, one of the leading courier service providers in the country, meaning that POLi payment transfers are powered by Australia Post’s pre-existing infrastructure².

User Trends in POLi

As of this year, local eCommerce has swelled beyond internet-only businesses and multinational companies as about three-quarters of all local businesses have earned part of their revenue from eCommerce sales, no doubt driven by pandemic lockdown policies³. This is evident in the increasing number of businesses adopting digital payments and the general shift in consumer purchasing behaviour towards online shopping beginning in 2020, with a recorded total spending of AUD 62.3B³. Cash is also slated to become obsolete as the digitalisation trend continues onwards with no sign of stopping despite regular retail returning to normal, which may prove to be a boon to anyone looking to incorporate POLi as their localised payment method.

Benefits and Drawbacks of Using POLi for Online Payment Gateways

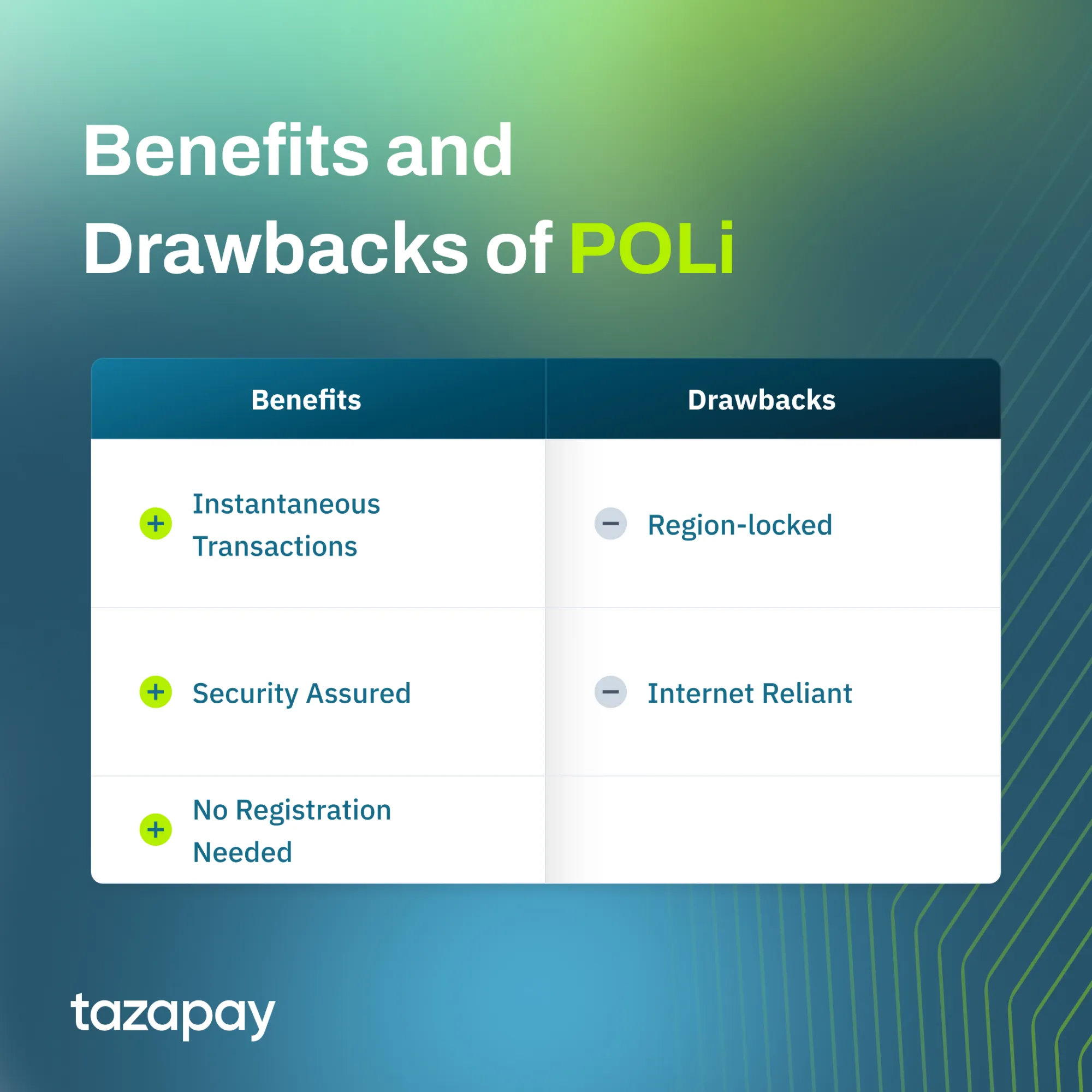

Whether it’s in the heart of Germany or in the enormous Chinese market, the one constant that remains is that no online payment gateway is perfect. So here are the pros and cons of using POLi:

Benefits

- Instantaneous Transactions: Transactions made with POLi, particularly with POLi PayID, are usually instantaneous and delays only occurring with transactions greater than AUD 1000⁴.

- Security Assured: POLi ensures that user privacy and security is maintained with regular security reviews and never storing sensitive information such as usernames and passwords. They also employ 2048-bit encrypted SSL certificates².

- No Registration Needed: Users simply need to choose POLi as a payment method upon checkout, removing the need for account registration with POLi².

Drawbacks

- Region-locked: POLi is only available in Australia and New Zealand, meaning that any transactions with POLi outside of those countries will require a third-party payment provider.

- Internet Reliant: Given the varying degrees of network stability in Australia due to its size and terrain, there may be instances where transactions may be difficult due to POLi being an online payment method.

Get payments from anywhere in the world with our payment links. We offer some of the best FX rates out there to provide the most optimised fees for your high-value transactional needs! Click here to take our services for a spin:

How POLi Works in an International Payment Gateway

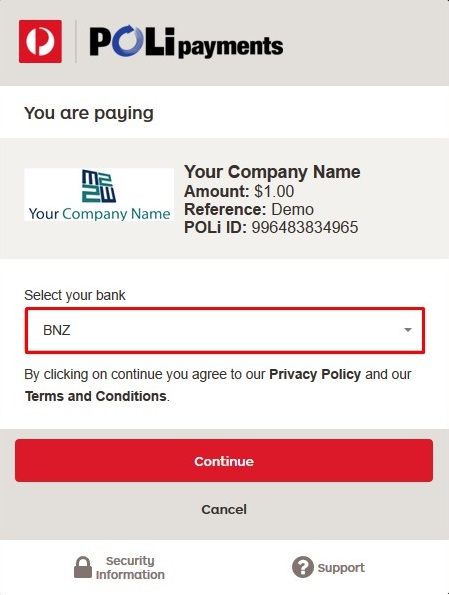

POLi operates in the same vein as its counterparts in Europe, where it allows users to make direct payments from any bank of their choice in Australia, making it a kind of multi-bank redirect.

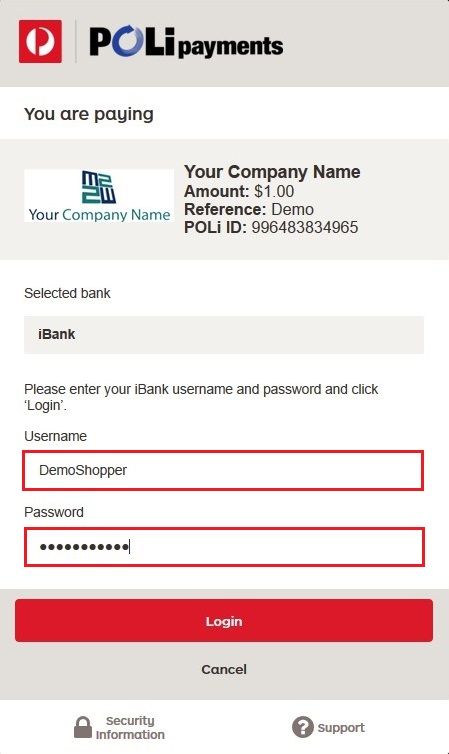

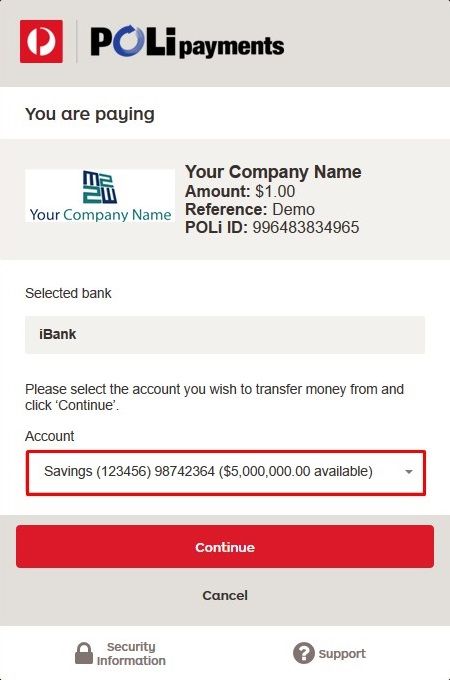

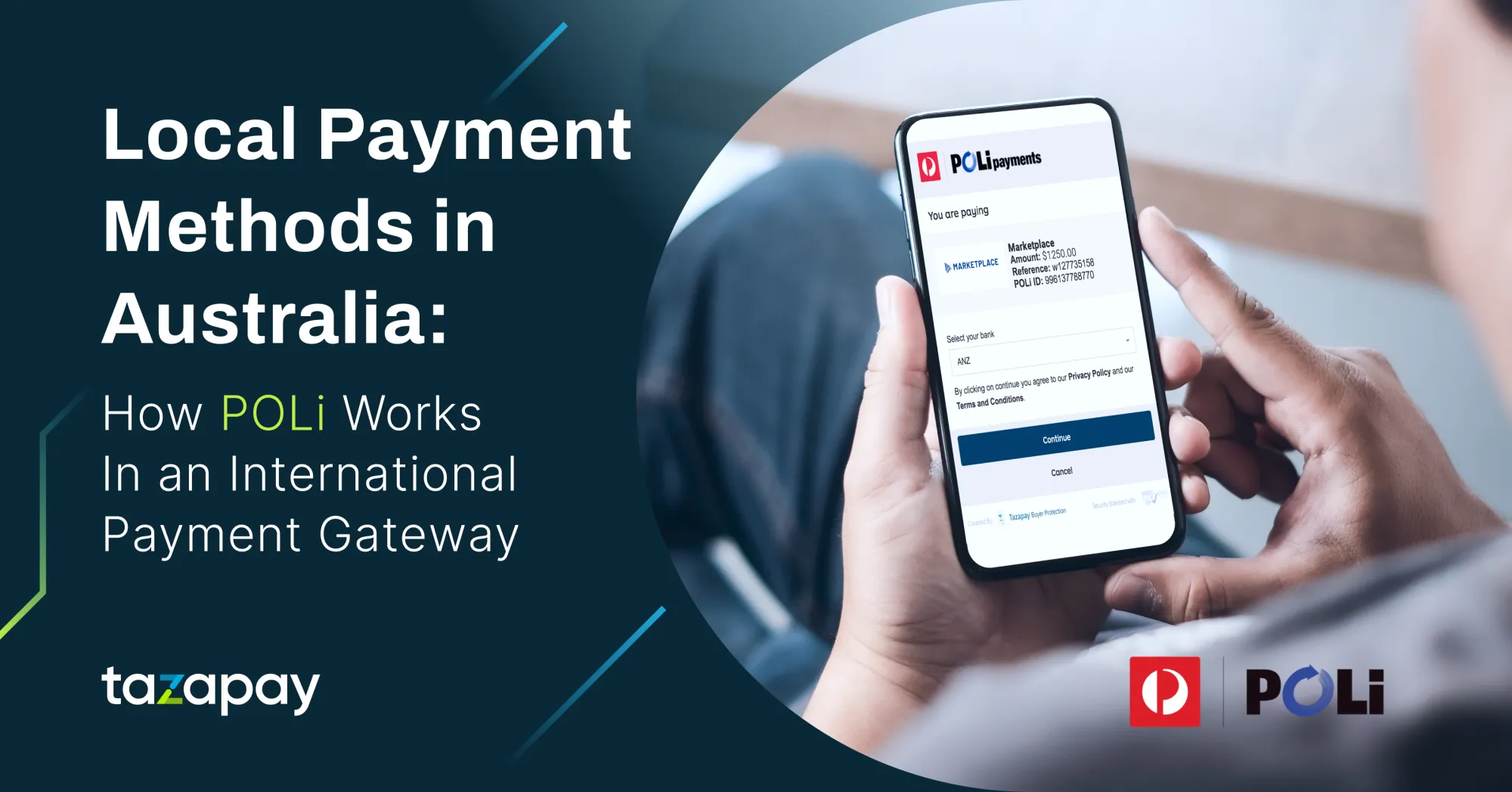

Within Australia and New Zealand, a typical transaction would see the user choosing their bank from POLi upon checkout before inputting their user credentials to complete the transaction from their end. The funds would then be sent straight to the local merchant’s account.

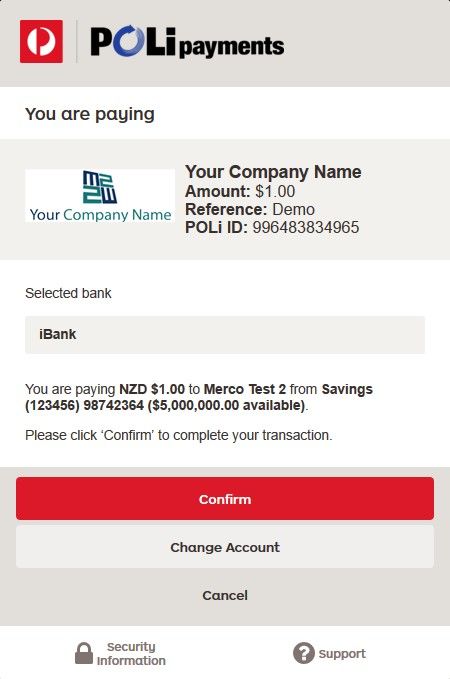

For transactions outside of that region, one needs to utilise a third-party payment provider to act as the international payment gateway. In such a transaction, the user would select POLi as their payment method of choice via the third-party payment provider, then complete the transaction as they would in a normal local POLi transaction. From there, the funds would be transferred into the payment provider’s local account and sent to its international account. Then, the funds would be disbursed into the foreign seller’s account.

What are the Fees Required in Using POLi?

POLi has endeavoured to make their services free to use, but currently they charge 1% per transaction with a hard cap of 3%⁵. Their PayID payments have a flat fee of AUD 0.95 regardless of transaction value⁵.

For payments made via third-party payment providers, the usual costs that come with them apply, including setup fees, FX costs, and potential hidden fees so it is important to be diligent in researching potential payment providers so that you can get the most bang for your buck.

Now that you’re more knowledgeable about POLi, you can be more assured in your endeavours in penetrating the Australian market. If you need more assurance however, why not give Omoney a go? It is an online payment provider that not only boasts an extensive list of 173 markets to choose from, but also guaranteed to be safe and secure thanks to 256-bit encryption and regulated by the Monetary Authority of Singapore (MAS).

Sources

Category

Payments Resources

Local Payment Methods in Australia: How POLi Works In an International Payment Gateway

Related Articles

Local Payment Methods in Indonesia: How Dana Works in an International Payment Gateway