- Home

Blog Blog

Payments Resources Payments Resources

Local Payment Methods in Australia: How PayID Works In an International Payment Gateway

Local Payment Methods in Australia: How PayID Works In an International Payment Gateway

Since 2018, the New Payments Platform (NPP) has helped make significant strides in Australia’s digital payments infrastructure, a fact evidenced by the country’s current status as the 13th largest eCommerce market in the world¹. With a CAGR of about 13% between 2021 and 2025, it is estimated that Australia will outperform the global average by 10%¹. One of the main instruments behind NPP’s success is the real-time payment method, PayID.

There is no shortage of payment providers that lure you in with honeyed deals and entrap you with hidden costs. Not with Omoney, though. We are committed towards making our pricing simple and transparent. We will even FX-match if you happen to find better rates! If you’re not convinced that why not contact us and see for yourself?

What Is PayID?

PayID, as its name suggests, is a linked ID-based payment method that allows one to conduct transactions without the need for lengthy user verification processes. It is part of the government-backed NPP initiative to foster a more digitalised economy and streamline online payments². Users would simply need to login to their respective mobile banking service to pay into another user’s PayID³ In this respect, this makes it similar to Singapore’s PayNow, which also seeks to encourage the digitalisation of their economy.

User Trends in PayID

Since the launch of the NPP, the Australian digital economy has seen a definite net increase. This is seen in the dramatic decrease in total merchant fees incurred over the last decade, with the most drastic decrease being from 2.5% to 1.5% of transaction values acquired⁴. Mobile transactions have also experienced a meteoric 250% rise in the past 2 years, which bodes well for both the success of the government’s initiatives, and the future of PayID as this general trend of lower merchant fees and higher adoption of digital banking would see PayID be more ubiquitous in its usage amongst the people⁴.

Need an all-in-one solution to solve your various SaaS-related payment issues? Then why not give Omoney a try! With easy API integrations and no hidden fees, settle your international payments for your Saas platform in one go. Unconvinced? See for yourself here:

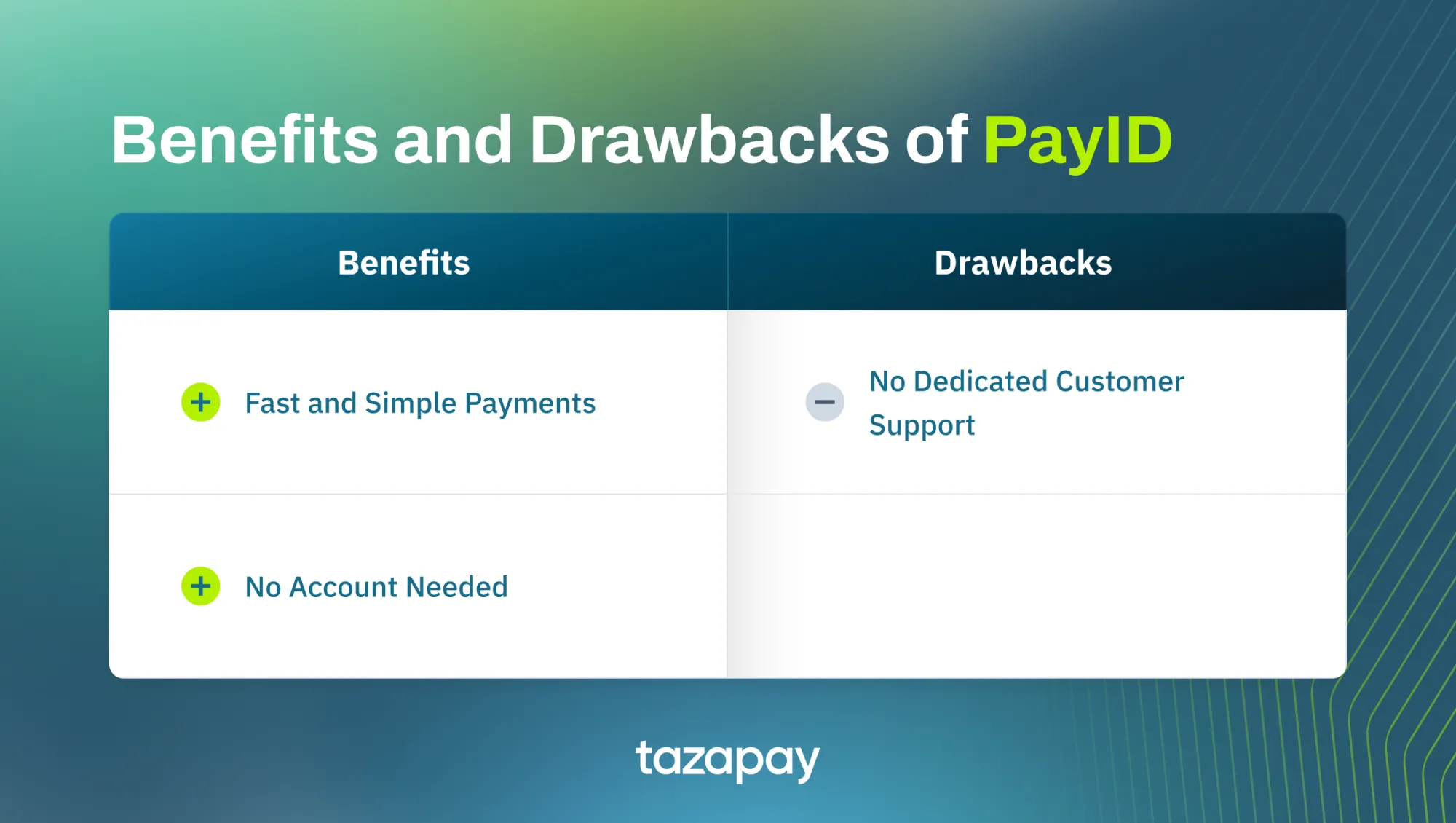

Benefits and Drawbacks of Using PayID for Online Payment Gateways

The perfect payment gateway does not exist, and that is a rule that has remained unchallenged for good reason, since there are bound to be flaws in any seemingly perfect gateway. Here are the pros and cons of PayID:

Benefits

- Fast and Simple Payments: Transactions made with PayID only require that either party knows of the other’s PayID, and accessing their mobile banking service of choice to complete the transaction. The transactions are also processed in real-time due to the infrastructure provided by the NPP.

- No Account Needed: Users are not required to make a dedicated account to use PayID, nor need a dedicated app for it. The unique ID itself is all the user needs.

Drawbacks

- No Dedicated Customer Support: Since PayID itself is more of a universal payment method across Australia and managed differently by NPP-participating banks, any payment issues related to PayID must be relayed to the user’s financial institution of choice, rather than directly to PayID itself³.

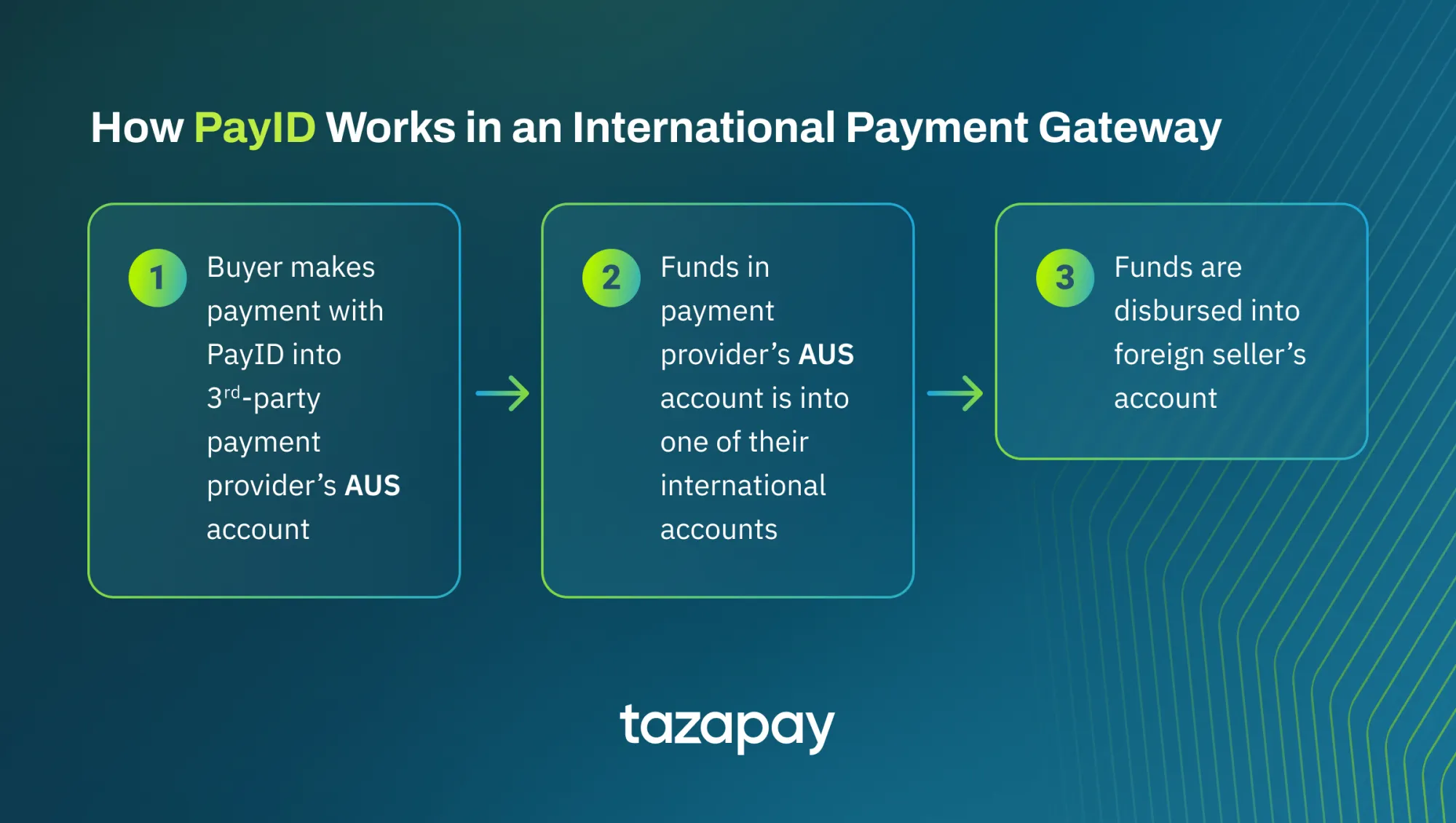

How PayID Works in an International Payment Gateway

At the time of writing, the NPP–and by extension, PayID, has only expanded to New Zealand, thereby limiting its international operability to the Oceania region⁵. Therefore, any plans to conduct international payments outside of this region must require a third-party payment provider to act as the international payment gateway.

In this scenario, payments made internationally with PayID must first be conducted through this third-party provider that offers PayID as a payment option. The transaction at this stage proceeds as usual. Then, upon completion of the transaction, the funds are transferred into the payment provider’s offshore accounts before being disbursed into the foreign seller’s account.

What are the Fees Required in Using PayID?

Currently, there are no hard-set fees for using PayID itself since those are managed by the participating banks on their own terms. However, regardless of this ambiguity, the usual fees that arise from making international transactions via third-party still apply, such as setup fees and FX costs. In instances like these, it’s best to check with the payment provider’s pricing page.

Now that you’re more knowledgeable about PayID, you may now boldly localise into the great eCommerce market of the outback. However, you might need better assurance so it’s best if you were to acquaint yourself with a reliable, secure and robust online payment provider such as Omoney, which boasts an impressive list of 173 countries to choose from and is secured with 256-bit encryption.

Sources

Category

Payments Resources

Local Payment Methods in Australia: How PayID Works In an International Payment Gateway

Related Articles

Local Payment Methods in Indonesia: How Dana Works in an International Payment Gateway