- Home

Blog Blog

Payments Resources Payments Resources

Local Payment Methods: How Voucher-Based Payment Works in a Payment Gateway

Local Payment Methods: How Voucher-Based Payment Works in a Payment Gateway

As the world makes its slow yet uncertain recovery from the pandemic, the digitisation of marketplaces is growing at a rapid pace. However, in some countries, cash remains the undisputed king. To help usher the digital era into these markets, some have developed a creative hybridised use case that allows customers to make online payments at offline counters as a nice compromise for those that remain steadfast in physical payments.

Enter voucher-based payments: the bridge between the physical and digital payment methods.

Make use of Omoney's seamless API integration for checkout to expand your business in over 173 countries worldwide, with more than 80 of them enabled for local payment methods. Kickstart your digital business with us today!

What are Voucher-Based Payments? How Do They Work in Online Payment Gateways?

Voucher-based payments are a form of payment whereby the customer is issued a voucher during checkout for them to later bring to a physical location such as a retail counter, ATM, or convenience store to pay for their online purchases with cash¹. This voucher usually comes in the form of a set of codes along with a payment confirmation number and can be printed out to be used when making the payment or as an e-voucher to be presented. The vouchers also expire within a set period of time so customers must pay on time to be eligible for their purchases.

This unique hybrid payment method is usually common in countries where there is a sizable number of customers that lack cards or bank accounts such as Japan with 13% of their population sticking to cash payments² , and those like Mexico that experience low card authorization rates or have low international card penetration rates such as Brazil and Egypt. Payment methods like OXXO and Baloto in their respective countries are also the main driving force that is quickly modernising the payments landscape across Latin America - a move deemed necessary to deal with the challenges brought about by the pandemic lockdowns³. This is most evident in Brazil where e-commerce is practically synonymous with the boleto bancario, which is what the Brazilians call their voucher-based payment method⁴. Similarly in Africa, Egypt’s Fawry is helping in the digital transitioning process of the country’s market from physical to digital as 74.7% of its overall payment volume in 2020 is cash, and it’s also ranked the lowest in card penetration amongst the African nations at just 21.5% of the population in the same year⁵.

Benefits of Paying with Voucher-Based Payment Providers

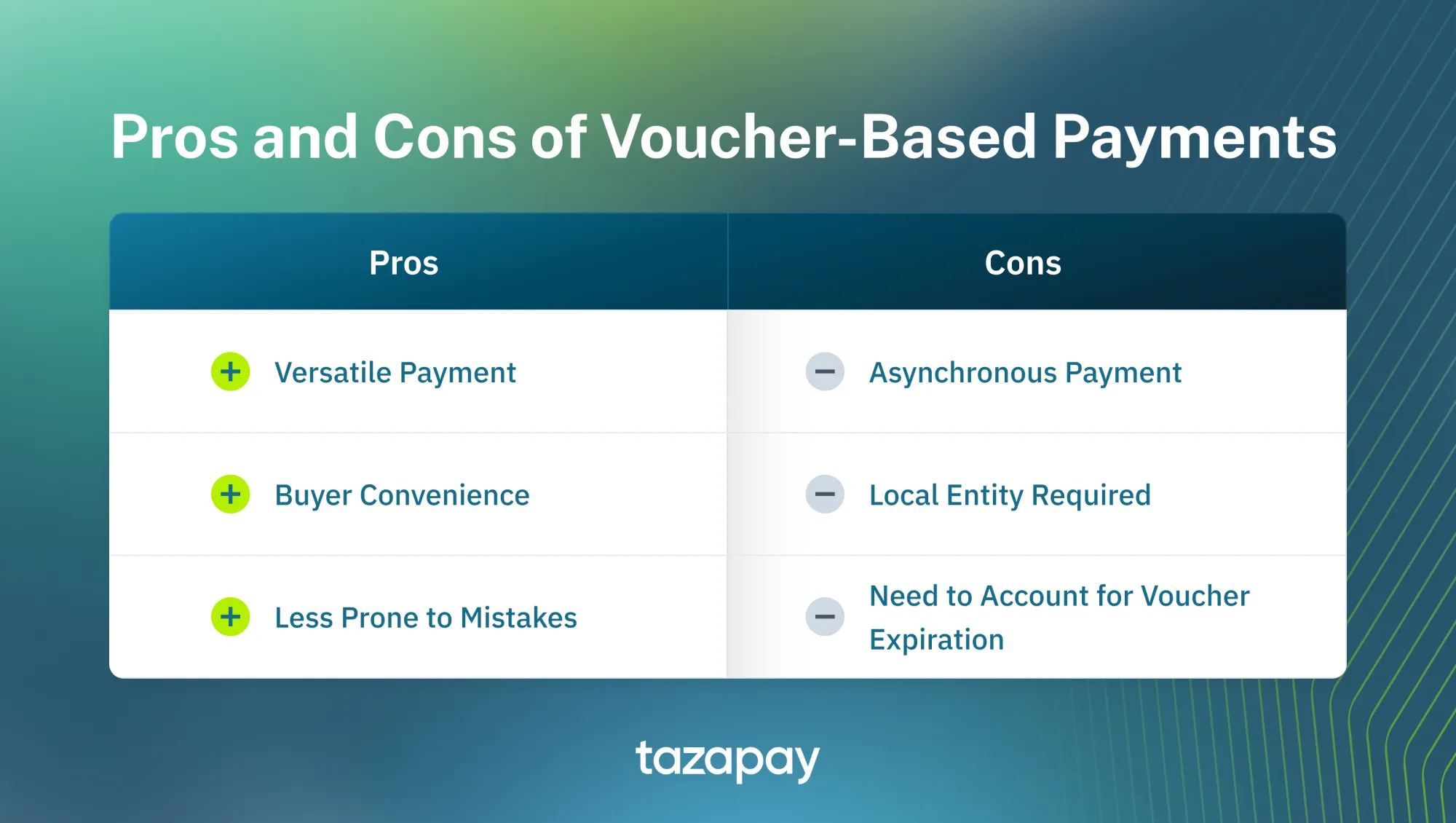

With such record improvements in the digitisation process of the markets that utilise it, the benefits of utilising voucher-based payment providers cannot be understated. From what we have gathered, the benefits are thus:

- Versatile Payment - The hybrid nature of the voucher payment method helps to address the problem of cash-sticky users by allowing them to pay with cash whilst simultaneously catering to digital natives.

- Less Prone to Mistakes - The information and verification codes that are present on the generated voucher provides not only the exact amount needed to pay, but also acts as a means of fraud protection since the codes on it serve as a mark of authenticity.

- Buyer Convenience - On top of being able to cater to both physical and digital payment methods, voucher-based payment providers are typically connected to a large network of collection centres and partnering banks. This combination serves to cater to the vast unbanked population in the countries these payment providers hail from, and address the low penetration rate that are present in these markets⁶.

Drawbacks of Voucher-Based Payments

Of course, there is no such thing as a perfect payment method. Being a hybrid payment method also comes with the risk of it not being fully able to cater to neither the digital natives nor the cash-sticky customers to the fullest. The drawbacks that can be found are as follows:

- Asynchronous Payment - Due to the fact that it helps to attract the unbanked population, your online business will have to deal with payments coming later. Unlike other payments that are synchronous such as bank redirect and cash, where the payment is processed during checkout itself, voucher payments can only be processed once the buyer pays at the counter. This can be anywhere from a few minutes to right before the voucher expires since it is dependent on the buyer’s due diligence and their distance from the nearest associated physical store. Therefore, this is a terrible fit if your business model revolves around immediate shipping as soon as the order is received since payment may not come until later, if at all.

- Local Entity Required - Being able to bridge between the unbanked and the banked also means that all payments will be made in the local currency. This forces any budding business to have a local entity present to collect payments for them though this can be circumvented by having a payment platform that can do the same. These include the likes of Omoney, who can collect payments via the voucher-based method and then disburse the amount to your bank account after converting the buyer's local currency to your own.

- Need to Account for Voucher Expiration - Any online business looking to adopt voucher-based payments must account for the fact that vouchers will expire after a certain time period, thereby making it a requirement to have measures in place to promptly inform customers to place their order again and get a new voucher.

Now that you have more knowledge on voucher-based payments, you may now go ahead and try your hand at penetrating markets that utilise them. They are small in number but have large markets so you might want to account for potential heavy competition against those that already have established themselves there. However, with a payment platform that does localise in those markets, you would have an easier time dealing with it. One such payment platform to consider is Omoney. With localised payment methods enabled in over 80 countries, you can be sure that it will be a boon in your efforts in localising your business.

Sources

- What is a Voucher-Based Payment? Accept online payments vs Ikajo

- E-commerce payments trends: Japan (jpmorgan.com)

- Business Reporter - Finance - How a newly digitalised Latin America is modernising cash and the local payments ecosystem (business-reporter.co.uk)

- Boleto: a rising payment method in Brazil and essential for e-commerce (labsnews.com)

- Country Survey: Egypt - Cards International

- Egypt: share of online payment methods by type 2021 | Statista

- Country reports: payments market data for Sweden, Egypt and Belgium - Cards International

- Preferred Payment Methods Brazil (thepaypers.com)

Category

Payments Resources

Local Payment Methods: How Voucher-Based Payment Works in a Payment Gateway

Related Articles

Local Payment Methods in Indonesia: How Dana Works in an International Payment Gateway