- Home

Blog Blog

Product Info Product Info

How Escrow Payments are Implemented Differently for B2C and B2B Transactions

How Escrow Payments are Implemented Differently for B2C and B2B Transactions

When it comes to transacting high-value payments, the parties involved - the buyers and sellers - will want to protect their own interests and business. Such payments would typically be handled via neutral third parties in order to hold the transacting individuals accountable.

One of these instances could be found in the form of escrow service providers, where the provider holds the buyer’s payment to ensure there isn’t any non-payment risk, while also ensuring that the seller fulfils their obligations by showing proof before releasing the payment to them.

In the current age of the digital revolution, many online payment platforms already integrate some form of an escrow system. However, this payment flow differs from B2C and B2B checkout.

Knowing the differences between B2C escrow and B2B escrow is essential to your own efforts in expanding your business so here are the details that you should know about.

What Happens in a B2C Escrow Payment?

The most fundamental aspect of any B2C transaction is that any buyer is a customer, and everything from pricing models to checkout structure must be designed with the customer in mind.

Thus, B2C escrow payments are no different either and adhere to this same fundamental principle.

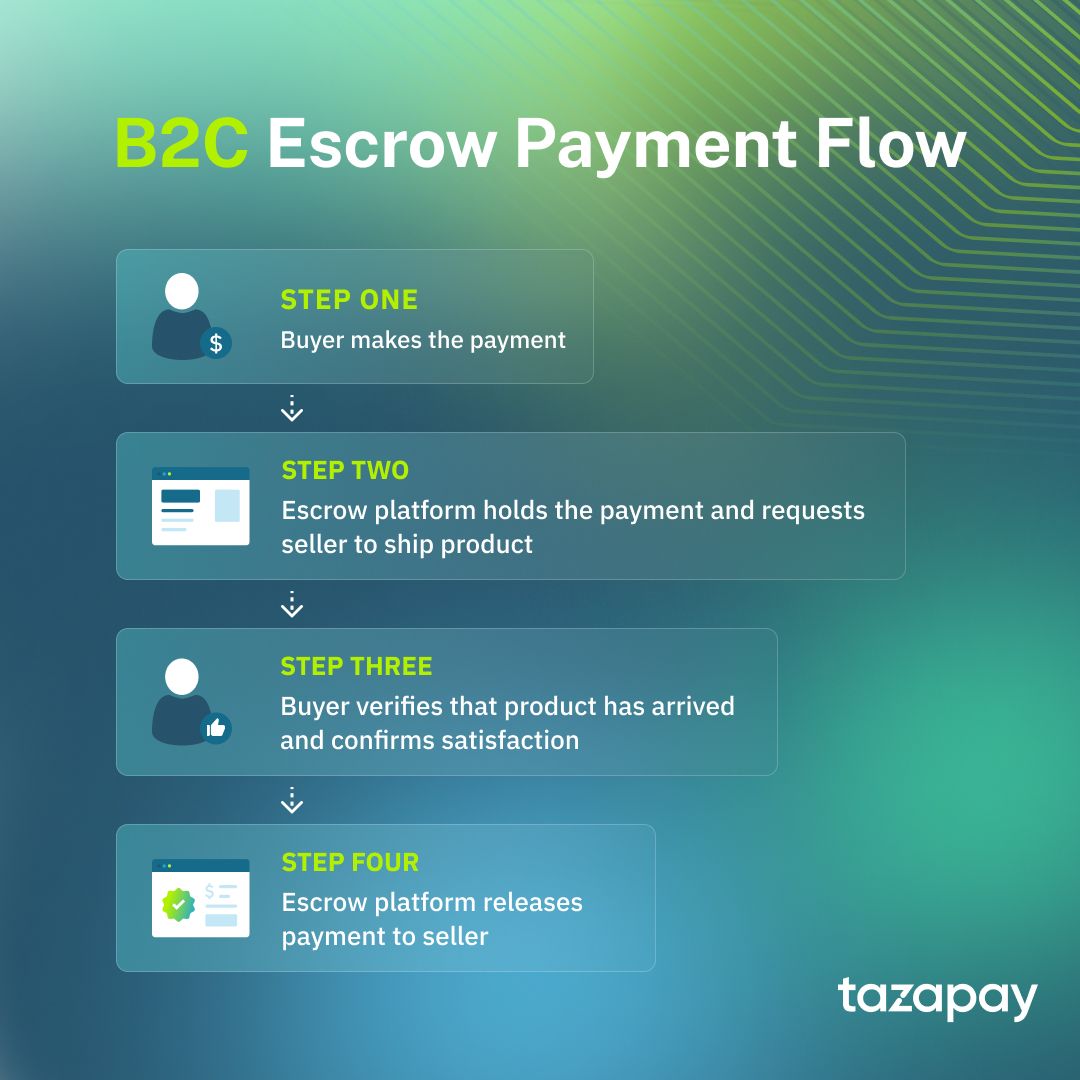

How this normally plays out is that the payment platform collects the payment as soon as the buyer pays for an item. The platform then holds the payment from the seller until the buyer verifies that the goods or services they’ve received are up to their satisfaction. The payment is then released to the seller with the currency already converted if that option is available.

A more comprehensive example of this escrow payment system at work is as follows:

- An online shopper in Singapore lands on an eCommerce brand store based in China

- When the shopper pays for a shirt from said store, it is done via a payment gateway in SGD

- The escrow system then holds onto the funds as the seller ships the goods to the buyer

- The platform then pushes the funds to store in China once the buyer confirms the receipt of goods upon arrival to their address.

As demonstrated by this example, B2C escrow is often simpler than their B2B counterparts since the payments are on a one-off basis and with little in the way of negotiations in payment terms.

We already see this type of escrow system being implemented in notable eCommerce websites like AliExpress, Shopee, and Lazada, though they’re usually branded as a form of buyer protection to ensure that their money only goes through if the product arrives or is to the buyer’s satisfaction. This branded buyer protection is also commonly made known upon checkout and may have the option to upgrade or improve upon the readily available ‘protection’ such as Shopee’s Extend Shopee Guarantee which offers to extend the duration of the funds being held in exchange for a small fee to the buyers.

What Happens in a B2B Escrow Payment?

The clients of a B2B business are completely different from that of B2C since they are exclusively between business entities. As such, B2B transactions typically involve more back-and-forth since businesses tend to purchase in bulk and act slowly to make informed decisions. Any purchase they make will affect them to a greater degree than the average customer in a B2C environment. This also means that they are less likely to make emotionally-driven purchases either.

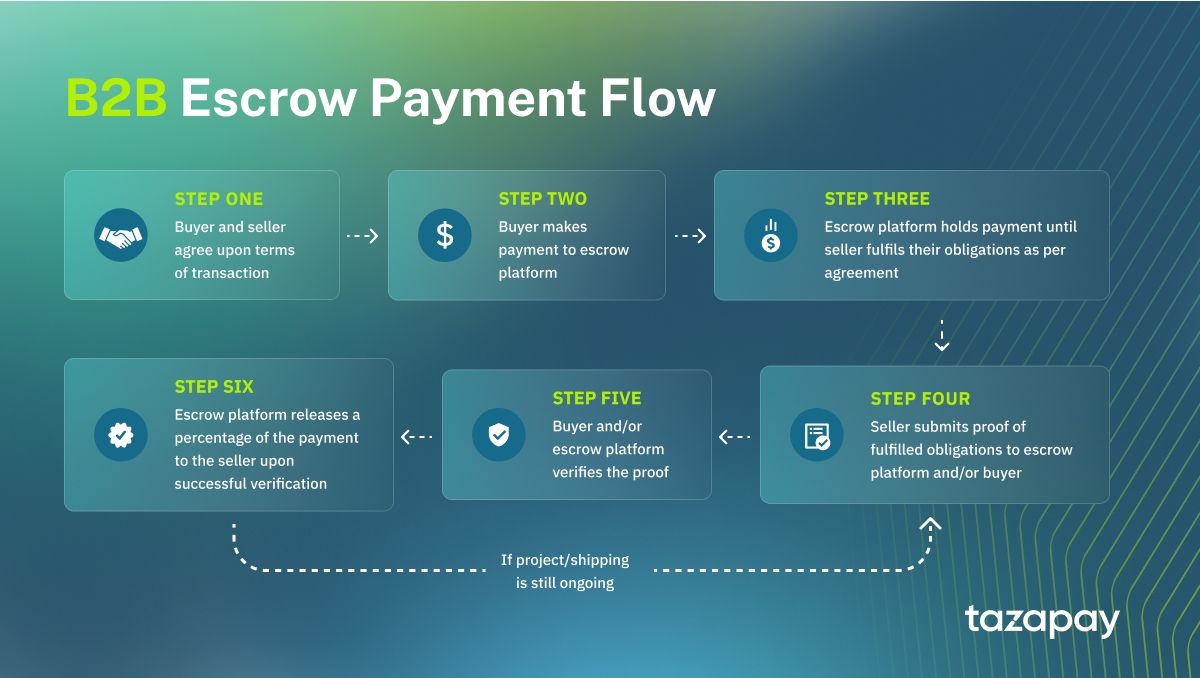

In terms of escrow payments, this translates to having both parties–the buyer and seller–agree to the terms of transaction before using an escrow service. To cater to this variability, escrow providers will allow greater customizability of the release terms in the escrow itself . Such customizable features that a B2B-centric escrow provider may provide include the disbursement of a percentage when goods are shipped and the seller has uploaded their proof of shipment, or milestone payments as projects get completed in stages.

How a B2B escrow system functions typically starts off with the escrow platform holding onto the payment after the buyer pays to the escrow platform. Then, the seller must fulfil their obligations in accordance with the agreed upon terms of transaction and present proof of said fulfilled obligations. Once the buyer and/or the escrow platform verifies the proof, only then will the platform convert the currency of the held payment before releasing the payment to the seller by the agreed percentage share. This step gets repeated until the entire payment is disbursed to the seller.

To better elucidate this process, here is an example of how this works:

- A Singapore-based importer wishes to deal with an India-based saree exporter

- The importer purchases 50 rolls of saree in SGD to the escrow platform

- The exporter ships the goods and uploads the commercial invoice and air waybill to the escrow platform

- The escrow platform verifies the document and releases 30% of the payment in INR to the exporter in accordance with the agreed-upon terms of transaction

- When the shipment arrives safely at the importer’s doorstep, the importer verifies the receipt with the escrow platform

- Upon successful verification, the escrow platform converts the remaining 70% of the held payment into INR before releasing it to the exporter.

As the example shows, B2B transactions involve a layer of complexity and to account for this, each transaction’s checkout may be in the form of different payment links, or be more similar to a B2C checkout at first glance if the B2B platform has an integrated payments provider like Omoney.

Moreover, B2B escrow platforms tend to have a more robust settlement and dispute resolution mechanism due to higher value transactions compared to B2C transactions. These escrow platforms typically have dedicated account managers to oversee large ticket transactions in 5-7 digits and follow up with relevant parties to ensure a seamless transaction.

Thus, this concludes the differences between B2C escrow and B2B escrow, and how they’re implemented respectively. By knowing more about how escrow platforms work, you now are better informed in choosing an option that protects your business better.

One such option that you could consider would be Omoney, which currently operates in over 173 countries and is accredited by the Monetary Authority of Singapore (MAS) so you can be assured that your transactions will be professionally handled and kept safe throughout.

Category

Product Info

How Escrow Payments are Implemented Differently for B2C and B2B Transactions

Related Articles

Omoney Named to the 2023 CB Insights' Fintech 100 List

Omoney Secures MPI Licence from Singapore's MAS, Bolstering Its Cross-Border Payment Capabilities