- Home

Blog Blog

Product Info Product Info

How a 3DS-enabled Payment Gateway Helps Reduce Chargebacks on Your eCommerce Business

How a 3DS-enabled Payment Gateway Helps Reduce Chargebacks on Your eCommerce Business

A payment gateway usually comes with a slew of security features that ensure that your transactions and information are safe and secure. This usually comes in a variety of forms, with a common security feature present with card payment-enabled payment gateways is 3D Secure. Anyone that has ever made a card payment may have encountered this feature before and might have an idea as to what it is but not necessarily how it works. So, let us uncover how this works and how this could help merchants by reducing chargebacks.

What is 3DS in the eCommerce Payments Context?

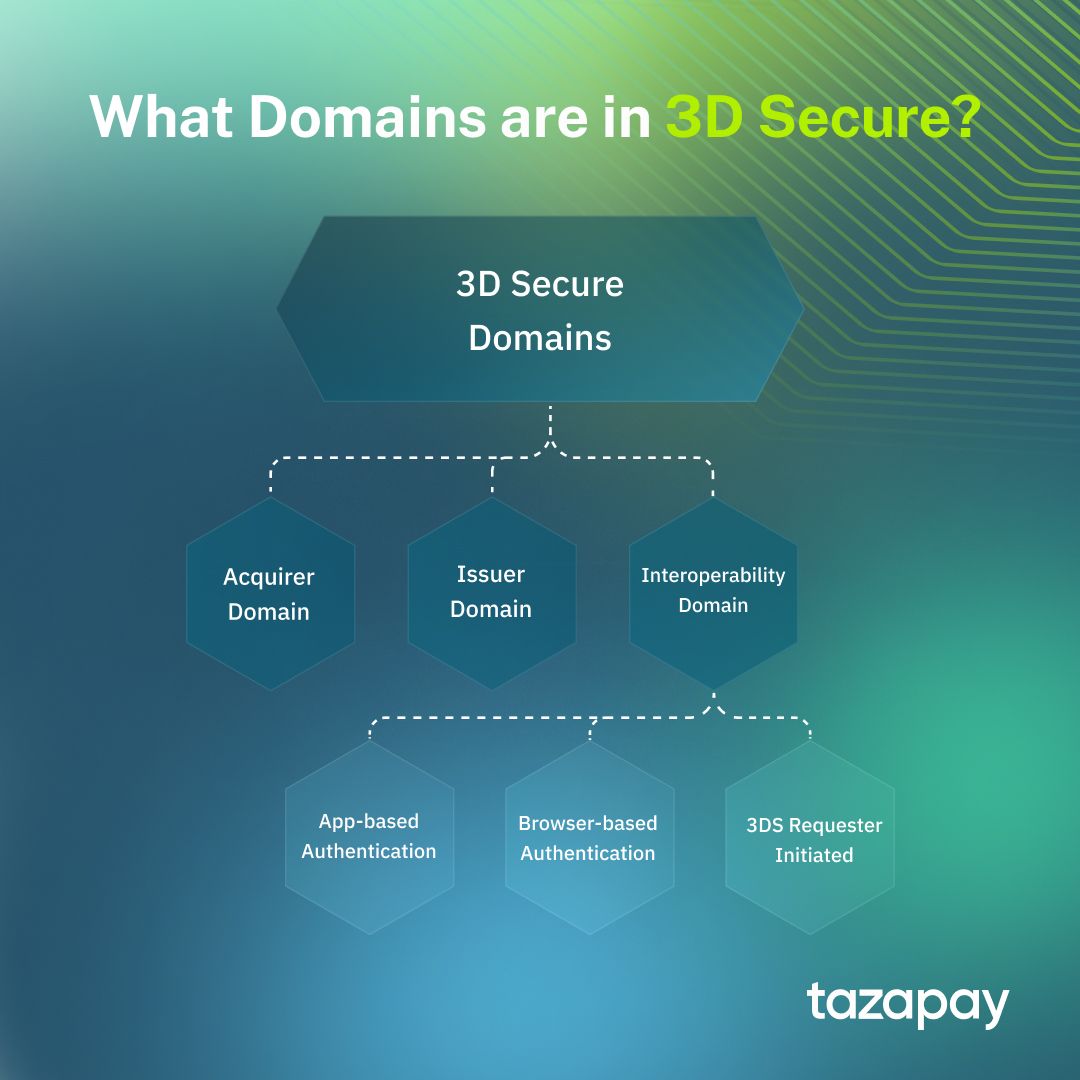

3DS, or 3D Secure, is an eCommerce authentication protocol unique to card payments based on a three-domain model, with the domains being the Acquirer Domain, the Issuer Domain, and the Interoperability Domain¹. It is normally used for both payment authentication and non-payment authentication. This authentication protocol can be initiated through three different device channels, which are app-based authentication, browser-based authentication, and 3DS requester-initiated authentication¹. How each device channel works is as follows:

- App-based authentication: Authentication during a transaction from a consumer that originates from an application provided by a merchant or digital wallet requesting authentication via 3D Secure Authentication Request¹. A common example of such a process would be the user authentication request during an eCommerce transaction within a merchant’s app.

- Browser-based authentication: Similar to app-based authentication except the transaction originates from a website that utilises a browser¹. An example of browser-based authentication would be the OTP code requirement to authenticate the user upon checkout within a merchant’s website.

- 3DS Requester Initiated: Merchants, digital wallets, and others that initiate the 3D Secure Authentication Request protocol within a purchase flow are known as 3DS Requesters¹. The main purpose of 3DS Requester Initiated authentication is for the verification of an account’s validity or for cardholder authentication⁵. This is usually seen in recurrent transactions such as those found in subscription services to either receive authentication data when performing a transaction for each bill or as part of a non-payment transaction to verify that a user still has a valid form of payment for their subscription⁵.

How 3DS would function in a real life application is that 3DS-enabled payment gateway would require them to input their ID, password, and credit card information before the payment is authorized. With the exception of 3DS Requester Initiated domains, the user would then have to input a one time OTP before the final step of authorizing the payment.

2DS vs 3DS Card Payments

2DS, or 2D Secure, functions similarly to 3DS with the main difference being that the 2DS authentication protocol utilises a two-domain model rather than a three-domain one. Like 3DS, it also is used for payment authentication and non-payment authentication. How a 2DS authentication process would look is also similar to 3DS except it will only require the buyer to input their credit card number and expiration date, completely omitting the need for a one-time password (OTP) and a security check.

Considerations when Choosing Between 2DS and 3DS to Reduce Chargebacks

Choosing between 2DS and 3DS for chargeback reduction is actually a bit misguided since where the two differ is from a wholly security-based standpoint. Where they will differ is in the checkout experience, which we will discuss later.

Chargebacks, on the other hand, are charges that are returned to the payment card after the customer successfully disputes an item on their transactions report, or account statement³. This means that any of the features touted by 2DS or 3DS wouldn't actually have any tangible effect in reducing chargebacks on your eCommerce business.

Where they both shine, with 3DS outperforming the other, is in preventing most forms of fraud. However, one kind of fraud that neither of these could protect from is known as ‘friendly fraud’, where the malicious cardholder in question files a chargeback with no valid reason⁴. Neither 2DS or 3DS can defend against this type of fraud since the cardholder’s claim does not need to be tied to a fraud reason code as they could just as easily claim that their item never arrived⁴.

Therefore, when considering the steps you need to take to prevent or reduce chargebacks on your eCommerce business, the only relevance measures such as 3DS has is actually in the elimination of criminal fraud sources⁴. Much has been said about how 3DS, being more security-oriented, is insufficient to deal with chargebacks on its own. However, as demonstrated here, it can be an incredibly useful tool in supplementing your own efforts in reducing chargebacks.

That being said, it is important to be aware of the local market you wish to adopt 3DS in, since it does vary from country to country⁵. For example, American consumers still prefer 2DS payments, whereas most cardholders in Singapore are already opted into 3DS and are used to receiving an OTP to complete their payments. Depending on which market you're targeting, you may want to opt for one or the other to avoid steering people away and risking cart abandonment.

Now that you’re more familiar with 3DS and how it could work with a payment gateway to reduce chargebacks, you can go ahead and try adopting 3DS for yourself. If looking for a secure and robust payment gateway is your main concern, why not give Omoney a spin? It is fully accredited by the Monetary Authority of Singapore (MAS) and employs 256-bit encryption to ensure that any business you conduct is business secured.

Sources

- EMV® 3-D Secure | EMVCo

- What is the 2D Payment Gateway? Definition & Meaning - Ikajo Glossary

- What Is a Chargeback? Definition, How to Dispute, and Example (investopedia.com)

- Can You "Chargeback-Proof" a Transaction with 3-D Secure? (chargebacks911.com)

- Balancing conversion and fraud risk with 3-D Secure - Ravelin

Category

Product Info

How a 3DS-enabled Payment Gateway Helps Reduce Chargebacks on Your eCommerce Business

Related Articles

Omoney Named to the 2023 CB Insights' Fintech 100 List

Omoney Secures MPI Licence from Singapore's MAS, Bolstering Its Cross-Border Payment Capabilities