- Home

Guides Guides

International B2B Payments – A Simple Guide

International B2B Payments – A Simple Guide

1. Overview and process of B2B Payments

What are B2B Payments?

B2B (business to business) payments are transactions that take place between two companies, rather than between a company and a direct customer. Although a majority of international B2B payments are still handled through paper processes, never before have we seen such a fast move towards online payment solutions. This is due to several reasons:

- Online processing makes payments faster and more transparent

- Especially in international trade transactions, moving physical papers can be difficult

- In the past years, there has been a huge trend towards e-commerce. In 2020 only, retail e-commerce sales increased by over 20% and the e-commerce share of global retail is expected to reach 21.8% by 2024 (Statista, see image below).

- Initially focusing on smaller B2C transactions, an increasing amount of large goods and service transactions are traded online and between businesses. This is facilitated, among others, through online B2B marketplaces, which have recently started to conquer industries such as agriculture, metals and freelance services.

E-commerce goes hand in hand with online payments and a smooth payment process is key to success when trading with other businesses online. However, most payment gateways are not optimized for B2B transactions and the simple one-click checkout we know from B2C platforms is still not supported.

Additionally, B2C payment solutions work with higher fees and do not support B2B-specific requirements such as milestones, where payments are made step-by-step when parts of the order were delivered. Therefore, there is an urgent need for online payment solutions optimized for large digital B2B transactions.

How are B2B Payments Different from B2C Transactions?

The main difference is that for B2C transactions, customers pay directly at the point of sale. This means, as soon as the goods or services are provided, the payment is made. For B2B transactions, transactions usually require internal processing, elaborate contracts and sometimes even integration into the system for repeated payment. Key features of B2B payments as compared to B2C transactions are:

- Higher payment amounts and volumes

- More complex transactions, including for example milestones and extensive legal requirements

- Can be one-time or recurring transactions, but often happen on a more regular basis

What is the Process When Paying Another Business?

Other than in B2C payment, when paying other businesses in B2B, the process is a lot more complex. Depending on the industry, it usually starts with setting up a contract. Among other things, this contract must include

- Business name and contact information

- Client information, including responsible party or accounts payable contact

- Description and cost of work or services

- Deadlines when the work or services need to be delivered

- Payment options, such as forms of payment accepted by your business

- Payment terms, such as due date

Once the contract terms are agreed upon, the next step is the delivery. Unlike in B2C cases, payment is not made directly upon delivery of the goods or services but is usually delayed by 30, 60 or even 90 days. In many industries, this timeframe is essential to keep the business running. Only recently, there has been a great outrage, when Apple increased their extended terms with accessories suppliers from 45 to 60 days, which in turn meant they also had to renegotiate terms with their suppliers.

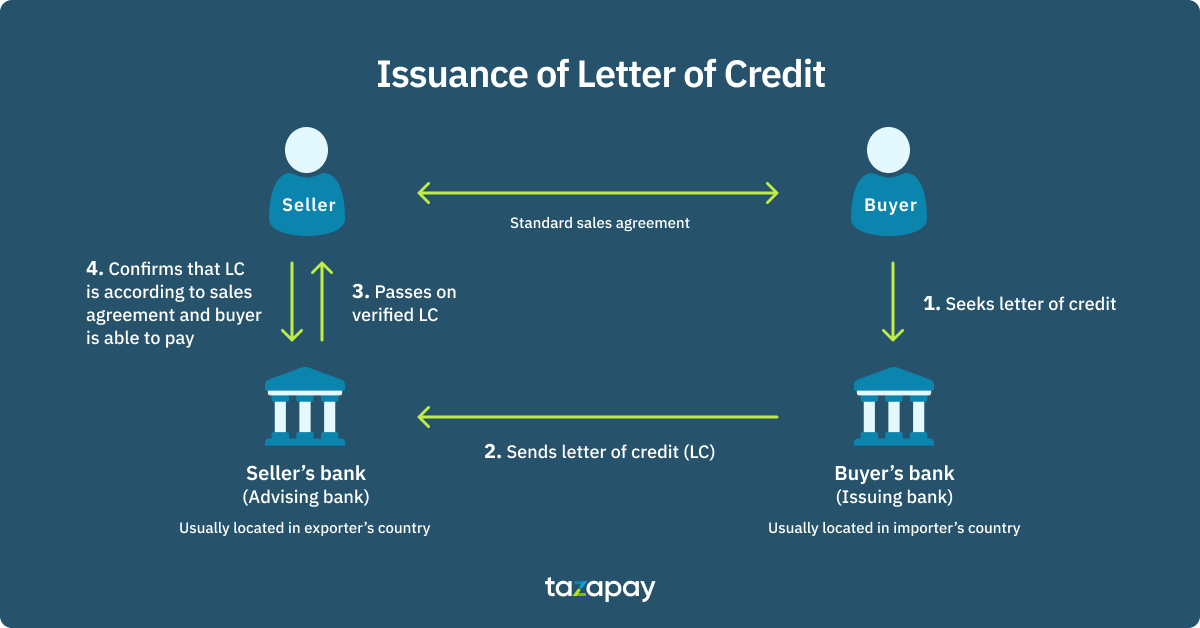

Especially in international payments, these steps become even more complex and there is a whole terminology in international trade specifying who is responsible for processes such as packaging, transportation and delivery. Additionally, trust often becomes an issue when trading with parties abroad and expensive safety actions such as vendor vetting need to be performed. In international trade, safety is often guaranteed through the payment provider who charges for taking the risk and paying in case of default. Traditional options such as the letter of credit (LC) are often expensive and include lots of paperwork. The issuance alone can take a long time due to the many stakeholders involved (see graphic below). A new, digital form of providing security without long waiting times and high cost are digital escrows. However, several B2B payment options exist, which we elaborate on in detail in Chapter 4.

What are some B2B-Specific Payment Practices?

As outlined previously, many additional things need to be considered when trading between businesses rather than with individuals. B2B has therefore established practices which are unique to their transactions. These practices include milestones, subscriptions and installments.

Milestones are particularly useful for very large transactions. Imagine for example an agreement to build a house. The supplier would probably spend years building without seeing any payment. Once the building is finished, the buyer would have to provide a huge payment amount all at once, which they have to raise, manage and store securely. To avoid these kinds of transactions which are disadvantageous for both buyer and seller, milestones are introduced. Thereby, payments are made step-by-step based on previously agreed upon milestones. For example, the construction company would receive the first payment once the basement of the building is completed, the next once the first floor is done and so on. In B2B transactions, milestones are very common and are often used to avoid that either the supplier runs the danger of providing a very laborious service or goods without receiving payment or the buyer would pay a huge amount without receiving compensation. Today, most digital payment solutions do not account for this B2B-specific practice. One payment method which does account for it is Omoney digital escrow, a simple and secure payment option specialized on international B2B transactions.

Subscriptions are used when trade parties have recurring transactions, which can happen quite frequently in B2B trade. They then agree upon regular payments, which makes the trade relationship and process easier for both parties. A major benefit is that waiting times for authorization are reduced. However, recurring transactions and subscriptions are not accepted in all markets and supported by few digital B2B payment methods. Additionally, other than for B2C subscriptions where the customer is strongly protected by law, in B2B subscriptions contract terms need to be clarified in advance depending on the business and transaction type and often lawyers need to be involved in the process.

Installments are, similar to subscriptions, step-by-step payments. The difference is that the payment is not necessarily coupled with the delivery of goods or services but is rather used to help the buyer distribute the payment burden over a longer period of time or the seller to have recurring cash flow even if the delivery happens all at once. For example, if the total payment amounts to $1 million, the buyer might choose to pay $500.000 upfront and $500.000 once the goods or services are provided. This gives additional security to both parties.

2. Trends in Digital B2B Payments

Digital B2B payments have seen a drastic increase in demand, not least due to the global success of e-commerce and accelerated digitization through the Covid-19 crisis. As per Acumen Research & Consulting, the global B2B Payments market is set to witness a growth of 6% CAGR over the predicted period from 2019 to 2026. It is expected to be valued at $63,084 billion by 2026. Comparing this enormous growth to the B2C landscape and assuming that a similar process will happen over the upcoming years in the B2B landscape, digital B2B payments are still only at the start. Several trends are influencing the B2B payment landscape, as we will elaborate in the following.

B2B Transactions are Moving to Marketplaces

With technologies being more sophisticated and ready to scale, we see what drastically changed B2C business throughout the past decade is now also starting to impact B2B: transactions are increasingly moving to online marketplaces. They are oftentimes more convenient, transparent and scalable compared to manually administering supplier/buyer information. Therefore, some of the biggest industries have started trading through online marketplaces, and large transactions are handled on such platforms.

Segment-specific Marketplaces

B2B marketplaces are also emerging in traditionally manual industries like agriculture and there will be segment-specific marketplaces catering to different industries. Emerging B2B marketplaces are in engineering, chemicals and commodities among others. This development will have a long-term impact on the B2B payment landscape as well, that increasingly needs to cater to online marketplaces. Omoney offers an API integration for B2B marketplaces considering B2B-specific needs such as milestones, escrow and simple amendment of terms.

Digitization and Consumerization

The above trends drive more and more B2B merchants to need an online presence and focus on the consumer rather than businesses. Traditionally slowly built business relationships will increasingly happen through a professional online appearance and positive ratings. Additionally, issues after transaction completion will need to be solvable online.

Virtual Accounts and Real-Time Networks

Especially for established trade relationships and recurring payments, local payments via virtual accounts and real time networks will be essential. They will replace clunky and expensive wire transfers.

B2B Focus in Payment Providers

While currently most digital payment methods are not optimized for B2B transactions, we observe an increasing amount of payment providers catering to B2B merchants who are moving online. Future payment solutions will be optimized for business payments and therefore a lot cheaper for businesses.

B2B SaaS (software as a service)

As B2B companies are increasingly adopting online tools, SaaS is becoming ever more relevant encompassing every part of the business. Therefore, B2B SaaS companies will be a key part of the overall B2B economy and recurring payments will be a key feature needed in future B2B payment solutions.

Trade Compliance

While digitization comes with a great amount of advantages in B2B transactions, it also bears increased security risk, being vulnerable to hacks and scams from literally anywhere in the world. Therefore, trade compliance will become even more relevant and the banking industry will need to keep pace with the fast-changing landscape.A solution catering to all these trends by providing simple, secure and B2B-optimized payments is offered by Omoney. Through our API integration, we are able to provide a holistic B2B payment solution with the lowest possible fees for marketplaces and merchants.

3. What Should You Look Out for in Different Payment Methods?

A secure and non-complex B2B payment service provider can enable a business to focus on its core tasks and not engage too many resources to handle the payment process. While selecting a B2B payment method, especially for international transactions, it is critical that multiple challenges are being addressed. Namely, the decision should take into account factors such as speed, reduced costs, easy amendment, and simplicity. Some of the key aspects to consider include:

Enhanced Speed

B2B payments, especially B2B cross-border payments, take a while before getting processed. This is due to the complexity of this sector which involves several decision-makers, high-value transactions, and an exceedingly targeted customer base. Most of the time, the transacting businesses have contrasting ways of functioning, starting from the payment terms to selecting B2B payment methods, making it more time-consuming to get to a common ground.

- The B2B payment method selected should get rid of the entire paper trail and process invoices faster, for both the payee as well as the payer.

- Another factor that can speed up the entire processing is real-time payment processing. Unlike cheque payments and ACH, digitised B2B payment services should offer instant transfers and speedy payments.

- Onboarding a B2B payment service provider should translate into direct resource-saving both in terms of time and money. Time saved is money saved and both the client and the merchant reap its benefits. (Payment to Omoney’s Escrow is real-time and one can sign up and commence transacting instantly, thereby enhancing speed.)

Reduced Costs

Reducing costs is a prime concern for businesses when selecting B2B payment services. Businesses should choose a B2B payment method that presents an opportunity to optimise payments and bring down cash outflows.

- B2B payments and especially B2B cross-border payments involve a lot of intermediary fees and undisclosed foreign exchange rates that tend to significantly impact the total cash flow due to the nature of the high-value transactions involved in this trade.

- Accepting credit cards or opting for bank transfers hit merchants with significant processing fees ranging from 3 to 5 % as well as foreign exchange fees. Though these costs can be absorbed by legacy organisations with high turnovers, some of the smaller businesses will not be able to, in turn losing out to their competitors.

- When businesses pay bills using cheques or collect cheque payments, cash inflow and outflow management become time-consuming and difficult, thereby distracting them from growing the business. Managing finances in-house means a lot of time being spent and outsourcing the management means money being spent, so either way these forms of payment turn out to be expensive.

- A B2B payment method chosen for your business should be transparent about its fees and offer industry-leading foreign exchange rates. There should be no hidden costs and expenses that come as surprises. Omoney´s digital escrow is low cost and discloses all fees upfront. The processing fee is 1.8% for non-card payments and 3% for card payments, which proves beneficial as the transaction value goes up.

Simplifying Complexity

Businesses look out for B2B payment methods that offer increased speed, security, convenience, and ease of business. This drives disruption and innovation in the payments industry. Traditional forms of payments are often cumbersome and complex and even more so when payments are cross-border.

- Eliminating intermediaries and bringing down the steps involved in a B2B cross-border payment are some of the aspects to evaluate while narrowing in on a payment provider.

- Automation in the payment process and giving the parties involved increased flexibility is key when choosing a suited B2B payment solution. It leads to a reduction in intermediaries, reduced human error, and simplifies the process of making and receiving payments while protecting the interest of everyone involved.

- Making multiple options such as online payments and mobile payments available through one solution helps to reduce complexity when handling too many different payment providers. Omoney’s Escrow offers a collection of different payment methods such as debit/credit card, bank transfer and various local payment methods (for example PayNow in Singapore), all through one payment gateway.

Easy Contract & Payment Amendments

In the past, amending a contract usually involved a third party who had to adjust the contract accordingly. Nowadays, a B2B payment method should enable the change of terms easily if both parties wish to do so.

- Automation of B2B payments eliminates the dependency on a third party, paper cheques and paper invoices, which are slow and inefficient.

- A digital solution should bring down the time and money being spent on processing paperwork, tallying, reconciliation, and manual uploads.

- Businesses should be able to access payment trails and identify commonalities and trends in the cash flow with ease. This enables smarter decision-making about money being spent and saved.

- Being able to pull out payment information or backtrack a payment flow should not be cumbersome or time-consuming. Transparency enables easy money flow tracking and the ability to reconcile and enhance profitability.

Omoney escrow helps to get rid of some of the biggest and most common challenges of B2B payments. Omoney takes care of multiple things that most businesses look out for in their B2B cross-border payment methods such as:

- Safety against fraud

- Protection against cancelled or delayed shipment

- Accessibility to SMEs

- Elimination of complex paperwork

- Reduced cost, low transaction and exchange fees, and full transparency

- Easy amendment and trackability

Using Omoney’s digital escrow payment solution, all parties can transact securely in unfamiliar territories. In addition to a seamless payment experience, Omoney authenticates your trade partners free of cost and thereby helps your business grow its footprint across the globe.

4. Most Common International B2B Payment Methods

Unlike B2C payments, B2B transactions especially B2B international payments are quite complex. B2B cross-border trade entails larger quantities of goods that have a higher monetary value. The process involves multiple steps since factors such as trust, security, low processing fees, and transparent charges need to be carefully evaluated. These may not be factored in or given too much importance when a B2C purchase or sale is being made, as these purchases are mostly one-off purchases and the product values are not significantly high.

A B2C transaction involves consumers buying online or in-person and almost always paying at the time of checkout or point of sale. Services are rendered instantly and the payment follows suit. This instant transfer of money is made possible due to the instant authorization by digital systems on a low-cost single purchase. B2C payments are a simple transfer of funds.

B2B transactions, on the other hand, are quite different. B2B transactions tend to take place more frequently as the buyer repeats the purchase from the seller at regular intervals. Importers need a certain amount of goods or services every few months or weeks, thereby maintaining a consistent buying schedule. A robust B2B payments provider must be able to factor in these complexities, patterns and ensure a quick, secure and seamless experience.

Here are a few commonly used digital payment platforms:

PayPal

Statista found that more than 400 million active accounts use PayPal globally, deeming it an online payments leader. PayPal is accepted for both local as well as international payments across the world. It is a fully functional and reliable international payment gateway that accepts a range of credit and debit cards. These include Visa and MasterCard among others.

- PayPal ensures transactions are incurred securely and further strengthens this security through its 24*7 fraud monitoring, seller protection offering, and its in-built two-factor authentication.

- It is a chosen international B2B payments provider as it accepts 25 currencies in over 200 countries, making it ideal for businesses targeting a worldwide audience.

- It streamlines operations using its analytics and reporting tools and dispute resolution network.

The main disadvantage of PayPal is the high transaction fees it charges. The fee is 3.9% plus SG$0.50 for local transactions and 4.4% plus a fixed fee for international transactions. Since B2C purchases are of low monetary value, the transaction fee does not really impact the individual paying it; but for high value transactions, such as in international B2B transactions, the high transaction fees are not considered an economically viable option.

PayPal is thus considered more ideal for B2C transactions, globally as well as locally.

Stripe

Multiple businesses use Stripe globally to manage their online payments. Stripe is becoming a fast-growing and popular payments provider with businesses across all categories, be it a company with a high turnover or one that falls in the MSME group. Stripe’s main focus is mobile e-commerce, SaaS, non-profits, and platform-based choices.

- Stripe has a developer-friendly integration platform format that allows customization as per the customer buying experience. Through its simple payment interface that supports recurring and instant payments, it facilitates seamless payment processing.

- It accepts major debit and credit cards as well as mobile payment options. It offers payment options such as Android, Google, and Apple Pay- features that are not offered by PayPal.

- Its financial reporting module streamlines and simplifies the transaction settlement and reconciliation process.

While Stripe has many advantages as a payment provider, it has the same drawback as PayPal, which is a high transaction-based fee structure - 3.4% + SGD $0.50 for credit and debit cards, 2.2% + SGD$0.35 for digital wallets, and 3.3% for options such Google Pay, Apple Pay and Grab Pay. For high-volume cross-border transactions, these add up to a significant amount.

Another major drawback of Stripe is that it only offers the feature of international payments to buyers in the U.S., thus being an impractical B2B international payment option for other countries.

Stripe is thus a more conducive option for local and B2C payments.

TransferWise (now Wise)

Wise is a global payments enabler at a mid-market rate that does not levy any unexpected fees. It has eased the online payment landscape with its secure, fast, and easy-to-pay platform that does not require too many details. It is easy to navigate and user-friendly.

- A Wise account is free, though there is a fee involved to add funds and for foreign exchange conversions. However, this entire process is very transparent as the site has a calculator so nothing is sprung upon you.

- For B2C transactions, Wise has features such as two-factor authentication to secure accounts and protect transfers; it offers data protection and anti-fraud facilities.

- For B2B transactions, it enables efficient and swift transfers. It provides global services such as multi-currency banking, cheaper invoice payments, cash management, employee payments, money transfers, and business debit cards.

Though it is very transparent, user-friendly, and encourages both local as well as cross-border payments, it has certain limitations. These include the lack of options for digital wallets, the need to have a Wise Account to receive funds, and its debit card not being available in each country. Additionally, Wise does not offer protection, which means that if there's a fraudulent counterparty, the payment might be lost.

When it comes to cross-border trade, apart from the basic transfer of funds, businesses need some extra hand-holding – basic assistance to navigate the country’s export and/or import requirements, trade partner verifications, offering payment protection against delayed or cancelled shipments, and other such features that secure and ease the full B2B transaction. These kinds of services are unfortunately not offered by the above options.

The payment platforms evaluated above are great B2C options but are not ideal as B2B payment platforms. Drawbacks such as high transaction fees (PayPal), limited international acceptance (Stripe), and limited relevance to international trade (Wise) do not make these options practical for B2B international payments.

An option to consider addressing the drawbacks above is Omoney’s Escrow service, which is optimized for international B2B payments as it protects the interest of all parties involved, does not disburse funds till services or goods are rendered, protects the buyers against delayed and cancelled shipments, and offers increased assistance such as partner verification. One need not worry about high transaction fees as Omoney limits it to 1.8% per transaction, capped at $250. So as your export or import value rises, you have nothing to worry about.

Other popular international B2B payment options

Credit Cards

Credit cards are a widely accepted and popular mode of payment especially when it comes to B2C businesses and consumer transactions.

- The speed, convenience, and ease of use offered by credit cards make them an increasingly accepted form of payment across businesses.

- Credit cards have great acceptance and are a chosen payment option both locally and globally. It is an appropriate way for traders to accept payments especially for subscriptions, local purchases, and B2C and B2B e-commerce.

- Credit cards offer enhanced cash flow management as payments are faster as compared to traditional methods such as checks. They allow quick transfer of money resulting in the working capital being up to date.

One major shortcoming of credit cards is that they are not perfect for large ticket items, which are common in international B2B payments. Firstly, high processing fees need to be paid by the person receiving the payment. They also have a high foreign exchange rate and these two combined could prominently inflate the total cost.

Secondly, security is a major concern when it comes to credit cards. There is a constant fear of cyber fraud; the fraudulent charges are disputed and the sellers bear the brunt of these high-value unauthorized transactions by getting charged back. Data theft and phishing can put both the card member as well as the merchant at risk. In most cases, the merchant bears the brunt of the financial loss. When it comes to B2B international transactions, the adverse financial impact could be quite significant as opposed to low-value transactions.

Electronic Fund Transfers (EFTs)

Electronic Fund Transfers are the direct transfer from one bank account to another through computer-based systems and usually without human intervention. EFTs are an often preferred payment option when large sums of money are involved. This method is increasingly becoming popular globally and is preferred over making payments via cheques. It digitally moves money from one account to another account.

- The main benefit offered by an EFT is its speed. EFTs are a more swift, more efficient, and less costly way as compared to paper cheque transactions that take time and are unreliable.

- It offers ease of payment through relaxed accessibility to funds, no requirement of a debit or credit card, the option to set up automatic payments, and universal acceptance of this form of payment.

- Businesses can put their funds received to use immediately, as no hold is required on EFT funds. Money moves quickly and there is no waiting period or clearance needed from the bank.

While EFT transactions offer many benefits, they do have two prominent shortcomings. Firstly, EFTs require sensitive information to be revealed to the business with which you are dealing. If this information does not reach the intended party, it is vulnerable to major security breaches.

Secondly, EFT may be one of the fastest options for B2B international payments, but it is often accompanied by high intermediary fees and hidden foreign exchange rates.

With an Escrow Provider such as Omoney, both the issues faced in the above B2B payments options are taken care of. Firstly, the problem of security is addressed – recognized regulators take Omoney's guarantee. For instance, Rapyd is Omoney’s payment enabler in Singapore, which is controlled by the Monetary Authority of Singapore (MAS). Depending on the country it operates out of, it will have a recognized regulator. The funds received by Omoney are safeguarded by authorized banks and segregated from business funds.

Omoney also secures all the parties involved. It offers seller security by ensuring that the buyer doesn’t deny or withhold money once the terms of the agreement have been met. Similarly, it protects the buyer, by holding their funds securely till the seller fulfils their contractual obligation. Protection against cancelled and delayed shipments is also offered.

There are high fees and charges involved in credit card payments as well as EFTs, whereas Omoney is very transparent about its 1.8% processing fees as well as guaranteeing the best FX rates.

Letter of Credit

A Letter of Credit (LC) is yet another widespread mode of payment used in international trade by importers and exporters. An LC is issued by a bank that takes the guarantee for the buyer, that payment will be made on time to the seller for the services rendered. If the buyer is unable to fulfil his financial responsibility, the burden of making the payment either partially or fully lies with the bank.

- An LC will help businesses expand globally as it gives them the confidence to trade in unknown territories.

- It is a customizable option as the conditions of both the parties involved can be put forth and then mutually agreed upon.

- It protects the seller as the importer’s creditworthiness is transferred to the bank which will have to make a payment once the contractual obligations are met, regardless of whether the buyer is capable of it or not at that time.

No doubt, the letter of credit has its own set of advantages which is why it is used for B2B international payments. However, it does also have major drawbacks. The process of LC issuance and amendment are yet to be digitized, each party involved works with paper-based documents and this results in a manual paper-based dealing which is very slow and tends to incur increased operating costs. Any amendment in this mode of payment delays the entire transaction. Paper-based processes are slowly becoming redundant; in today’s day and age, businesses are shifting towards digital payment options that ensure speed and efficiency.

A preferred alternative to the LC is Omoney’s Digital Escrow service platform. Omoney’s escrow services are a safe and cost-effective alternative that protects both the buyer and the seller involved. This end-to-end digital platform is easy to set up and one can start transacting instantly post signing up. It does not involve cumbersome paperwork; it is easy to amend without any additional cost and is very transparent about its fees.

Once Omoney is mutually chosen by both the buyer and the seller, it receives the buyer deposits making the buyer’s intent and capability to pay apparent. Once the contractual obligations are fulfilled by the seller, Omoney transfers the owed amount to the seller’s account. It is backed by recognized regulators and simplifies cross-border trade with its digital, legitimate, and secure offering. While there are other International B2B payments providers and B2B payment platforms, Omoney overcomes the shortcomings of all making it the ideal choice for international B2B payments. From secure transactions, ease of use, buyer and seller protection to digitized transactions, regulatory compliance, and partner verification Omoney is an uninterrupted international B2B payments provider.

5. Risks in International B2B Payments and How to Avoid them

Trading internationally is a very lucrative option, but it is not risk-free. There are many factors such as partner verification, compliance, and regulations that need to be factored in when getting into cross border-trade.

Organizations often find themselves struggling to:

- Bring down the risks of delayed shipment and damaged goods;

- Ensure trade-compliant money movement across borders;

- Evaluate the ideal cross border payments solution offering limited amendment, processing, and foreign exchange fees

- Verify their trade partners to prevent fraud

In addition to the above struggles of finding the ideal B2B payments partner, one has to be well-versed with the import and export procedures of the country they are trading with. Once businesses find robust solutions to mitigate the risks involved in the B2B trading landscape, it becomes one of the most profitable businesses to be in.

Common Risks Faced during the Process of International B2B Payments

1. Unclear payment terms leading to multiple amendments

Sometimes situations which are not clarified in the contract arise during the course of the trade. Words such as ‘will’ and ‘may’ in an agreement lead to ambiguity. For instance, a statement like the ‘the seller may accept’ versus the ‘the seller will accept’ – while the statement with ‘will’ is definite, the one that uses the term ‘may’ is open to interpretation. If the payment terms are unclear, there is a lot of disagreement between the concerned parties to reach a definitive term.

Things that one may assume are obvious, may not be so to the other party. Open-ended statements and unclear terms can often lead to disagreement about what complies and what doesn’t comply as per the contract. This ambiguity in the payment terms can lead to numerous amendments in the contract resulting in payment delays and increased amendment fees.

2. Fraud

There are many risks and frauds that international trade is prone to. One of the major issues faced by traders is dealing with first-time unknown vendors. If there is a lack of trust or the vendor verification has not been conducted extensively, one could possibly fall prey to scammers. A vendor is a key part of the supply chain and it is important to ascertain their trustworthiness. If your business partner is not vetted properly, it increases the chances of an unreliable operation, data breaches, financial frauds, substandard goods, and more.

The mode of B2B International payment, if not ideal, could also open you up to cybercrime. If payments are made via credit cards or bank transfers, they are vulnerable to data theft and phishing activities, which put both the buyer and seller at risk. Fraud is a major concern when it comes to certain international payment solutions. If the data is intercepted or sensitive information is stolen; the fraudulent charges can be disputed and sellers can be charged back. The financial brunt of these transactions is quite high due to the nature of the trade involved.

3. Hidden charges

While some international payment solutions may appear simple at first sight, they often have a lot of undisclosed charges. High processing fees, an overvalued exchange rate, intermediary fee, and high amendment fees are a few charges that can really inflate the entire cost of the goods. This can have an adverse impact on the seller as the processing fee is borne by them. If the cost is passed on to the buyer in the form of increased prices of the goods, they may find it economically prudent to purchase from elsewhere. This can lead to a loss in business for the exporters. One must have clarity about every fee or charge that is a part of the international payment solution.

4. Delayed shipment

Unforeseen incidents like delayed shipments have an adverse effect on B2B international payments. Firstly, the onus of whom this delay will be pinned to becomes a grey area. If the goods are not delivered on time, the seller does not get paid on time leading to cash flow trouble. If the buyer has made an advance payment and not received the goods due to a delay in shipment, not only is it a monetary loss for them but there is a ripple effect.

The long shipping time leads to limited or no stock availability, money remains tied up, and not only do the exporter and importer get adversely impacted but the entire value chain is in a mess.

The end customers, shopkeepers, and retailers all suffer and there is a chance that future business can be hampered due to the inability to live up to the delivery timelines promised. If the item being transported is perishable, there is even the risk of complete loss of goods. If the shipment is delayed as a result of being stuck at a port, one incurs detention, demurrage, and storage charges; raising the total cost of the transaction.

5. Damaged goods

Damaged packages, poor handling during transit or at the port, or increased transit times for perishable goods are certain unforeseen accidents that can have a negative impact on both the importer's and exporter’s funds. These damaged goods lead to the question of responsibility. Who will bear the financial brunt of these damaged goods?

Damaged goods may be destroyed before delivery, without either party being at fault. In such circumstances, the party that bears the risk of loss suffers the obligation of paying for the destroyed goods. These considerations need to explicitly be spelled out in the contract and adhered to. No one should have to suffer financial penalties if not obligated by the contract.

Though there are quite a few risks involved in B2B international payments, there are ways to mitigate them.

Mitigating the Risks in Cross-Border Payment

A trusted Escrow service provider such as Omoney helps alleviate the above risks. It enables the secure transfer of money while protecting the parties involved. Omoney is backed by technologically advanced security, keeping the funds safe and facilitating secure and stress-free transactions between two parties.

How can the Buyer Avert these Risks?

Buyers or importers can be protected against damaged goods and delayed shipments as Omoney only releases their money after the seller has fulfilled their contractual obligations. Once the shipping terms and other timelines are met, then the money is dispatched to the seller. If the goods fail the inspection when they reach the buyer, the money stays protected.

How can the Seller Avert Payment Risks?

Omoney assures the seller about the ability and intent of the buyer to pay. This is because, in an escrow arrangement, the buyer’s funds reach the escrow account before the seller ships the items. There is no worry about delayed payments or the buyer going bankrupt as the money comes beforehand.

How can one Avoid the Risk of Unclear Payment Terms?

The timelines and conditions are pre-set in the escrow agreement and mutually agreed upon by both parties. Therefore, there is no ambiguity when it comes to payments.

How can Omoney Prevent Fraud?

Omoney protects the parties involved in two major ways, Firstly, Omoney offers an efficient vendor screening process to help a business curtail vendor-related risks. It does a diligent background check, so parties can transact and do business securely. Through multiple sources, Omoney authenticates a partner and prevents situations of fraud, non-fulfillment of terms, delayed or non-delivery of goods, and non-payment of funds.

Omoney also prevents financial fraud by being a secure and robust B2B payments solution. It is backed by recognized regulators based on the country it operates in. It is a digitized and secure platform that segregates customer funds from its business funds, thereby, facilitating safe B2B international payments.

How does Omoney Address the Issue of Hidden Charges?

With Omoney, fees are transparent and paid upfront, they amount to a 1.8% processing fee which is capped at $250. There are no hidden costs that will be sprung upon you during the course of the trade. As for foreign exchange rates, Omoney guarantees to match the best rate.

Common cross-border payment risks such as payor risk, enforcement risk, and KYC risk are eliminated when using a trusted escrow service provider such as Omoney. One needs to be prepared to deal with the risks involved, thus, making it imperative to partner with a reliable and consistent payments provider such as Omoney. It protects your B2B Payments and overseas trade while eradicating the risk for both the exporter and the importer.