- Home

Guides Guides

Export & Import – A Simple Guide

Export & Import – A Simple Guide

1. Introduction to Trade

a. What Do you Need to Consider when Moving Goods Internationally?

When goods move from one country to another, the following considerations need to be kept in mind.

- Physical movement of goods, which involve someone to undertake the transportation of the goods.

- Insurance of goods against any damage that may occur during transit. This will require a contract of insurance with an insurer and documents evidencing (insurance policy / certificate) that insurance has been affected.

- Regulations with the importing and exporting countries: licensing requirements, exchange control regulations, tariffs, quotas etc.

- Legal requirements within the origin and destination countries.

In International Trade, all or many of these considerations apply since there is scarcely any face-to-face contact between the buyer and the seller and the goods and money has to move long distances across natural and artificial barriers (cross country movement).

If you want to learn how to trade internationally in Singapore, have a look at our guide on Import/Export Procedures in Singapore and 6 Things to Keep in Mind when Starting an Export Business.

We also provide trade guides specifically for Malaysia and India.

b. Who is Involved in International Trade?

The various parties involved in international trade transactions are:

1. Buyer:

- Needs the goods to satisfy their requirements or the ones of ultimate consumers.

- Locates the person who will be able to supply the goods under terms and conditions acceptable.

- Enters into an agreement (Purchase / Sales Contract) for the supply of the goods with the seller.

2. Seller:

- Produces, manufactures or sources the goods to satisfy the requirements of the buyer

- Locates the person who is interested in buying the goods from them

- Enters into an agreement (Purchase / Sales Contract) for the supply of the goods (export of goods) with the buyer

3. Manufacturer:

- Actually produces or makes the goods (finished / semi-finished)

- May or may not be the actual seller of the goods to the buyer

4. Buyer´s Agent

- The person representing the buyer in the seller’s country

- Responsible for advising the buyer regarding the suppliers of the goods, their credit and trust worthiness, the price, market conditions, terms of payments

- Responsible to inform the buyer and seller regarding the regulatory requirements in the exporting and importing countries

5. Seller´s Agent

- The person representing the seller in the buyer’s country

- Responsible for advising the seller regarding the buyers of the goods, their credit and trust worthiness, the price, market conditions, terms of payment

- Responsible for informing the buyer and seller regarding the regulatory requirements in the importing and exporting countries.

- Acts as the “In Case of Need” if the buyer refuses to take the delivery of the goods, non-acceptance / non-payment for the goods, noting and protesting of unpaid Bill of Exchange

6. Banks

- Understands the sellers and buyers need and provide advice on how their interest could be protected best

- Handling documents covering the import / export of goods

- Establishes letters of credit (see chapter 3)

- Remitting / receiving payment

- Provide finance in respect of the import / export

7. Transporters

Assists in transportation / movement of goods from the seller’s premises to the buyer’s premises.

- By air: Airlines

- By Sea: Shipping Companies / Barges / Inland waterways

- By Land: Trucking Companies (Roadways) / Railways

- Others: Courier Agencies / Post Offices

The mode of transportation will depend upon the geographical location of the exporting and importing parties, the need of the buyer (the speed with which they require the goods), and the type of goods (perishable / non-perishable / high value items etc.).

8. Insurers

- Takes responsibility to cover the risk of damage to the goods during the journey from the warehouse of the seller to the warehouse of the buyer

- Insurance cover could be taken either by the seller or the buyer depending upon the terms and conditions agreed on

- The contract of insurance lists the various terms and conditions, risks and responsibilities of various parties to the contract of insurance

9. Others: Government Departments, Embassies, Consulates and Trade Organizations, Central Banks, Customs & Excise, Chamber of Commerce

- Exchange Control

- Export – Import Policy

- Licensing

- Trade Advice

- Tariffs / Trade Barrier

- Confidential Reports

- Central Banks – devaluation / revaluation / moratorium etc.

International transactions are complex and often additional parties need to be involved to verify the trustworthiness of trade partners. This process can be simplified significantly by using online escrows.

2. Risks in International Trade

While the following elaborates on the risks associated with international trade, some of them could also be common to domestic trade.

a. Credit Risk (Default Risk, non-payment for the goods sold): Is the risk of default by the other party in performing their part of the contract. Credit risk is normally associated with the inability of the party to meet its payment obligation (Buyer, seller, issuing bank, confirming bank etc.)

b. Country Risk (Changes in rules & regulations, payment moratorium, currency inconvertibility, war, natural disaster, exchange control): Includes Political, Economic, Sovereign and Transfer Risks

- Confiscation or expropriation of machinery, goods or factories

- Violence caused by civil unrest, a coup, war

- Inability to convert local currency into foreign currency

- An embargo placed on imports or the arbitrary cancellation of an import licence after the exporter has shipped the goods or incurred costs in the manufacture of the goods

- An intervention by the government that makes it impossible to contract

- An unfair calling of a performance or similar bond

c. Currency/ Exchange Risk: The risk associated with the change in price (exchange rate) of one currency against another currency.

d. Legislative Risk (different laws): The risk that the government of a country could pass legislation that could adversely affect the business prospects of one or more companies operating in that country (e.g. Coke / Pepsi / IBM – Janta Government)

e. Political Risk: The risk that an investment’s returns could suffer as a result of political changes or instability in a country – military control, civil unrest, unstable government, frequent changes in legal laws etc.

f. Other Risks:

- Non-receipt of goods

- Delay in Payment

- Delay in delivery of goods

- Bankruptcy or insolvency of the seller / buyer / banks / insurance company / transport company (credit / confidential report)

- Quality of goods received different from the one ordered (Inspection Certificate)

- High Demurrage Charges

- Language / Local Customs / Business Practices

- Cost of Litigation / Dispute Resolution

A great way to mitigate many of these risks are digital escrows. They create trust and full transparency in international transactions. Some other documents used to address risks in international trade are outlined in the following.

3. Documents to Address Risks in International Trade

a. Confidential Report on the Buyer (Importer)

Since the smooth operation in international trade depends to a large extent upon a trustworthy, solvent and willing buyer, the exporter MUST make adequate enquiries about the buyer.

The extent and depth of the confidential check will depend both on the value of the exports, reputation of the buyer and also on whether a continuing relationship involving substantial trade with the buyer is envisaged.

Enquiries could be made through banks, chambers of commerce, other business associates, credit rating agencies (CRISIL, Standard & Poor, Dun & Bradstreet etc.)

Confidential report should ideally include the following:

- Integrity & trustworthiness

- Nature of Business

- Length of time or duration in business

- Financial position

b. Inquiry on the Buyer’s Country

The exporter can obtain information regarding the buyer’s country from international banks, government departments / agencies, chambers of commerce and financial press with particular reference to any regulations prohibiting / restricting / delaying the free movement of funds and or goods out of such country, the political environment, stability of the government etc.

c. Confidential Report on the Seller (Exporter)

Since the importer receives the goods from the exporter, it is essential that the seller is capable of delivering the goods in accordance with the quality, quantity and delivery dates agreed upon.

Enquiries could be made through banks, chambers of commerce, other business associates, credit rating agencies (CRISIL, Standard & Poor, Dun & Bradstreet etc.)

Confidential report should ideally include the following:

- Integrity, reliability & trustworthiness

- Nature of Business

- Length of time or duration in business

- Good reputation for quality and honoring delivery dates and other commitments

- Financial position

d. Inquiry on the Seller’s Country

The importer can obtain information regarding the seller’s country from international banks, government departments / agencies, chambers of commerce, and financial press with particular reference to any regulations prohibiting / restricting / delaying the free movement of funds and / or the goods out of such country, the political environment, stability of the government etc.

e. Inspection / Analysis Certificate

Buyer could get the goods inspected or analyzed by reputed inspection agencies (SGS, Intertek International, Cotecna and Bureau Veritas) before shipment to ensure that the goods being shipped are according to their placed order.

If you want to learn more about vendor vetting, also have a look at the following blogposts:

- Why is it Important to Vet Vendors when Engaged in International Trade

- Vendor vetting: 11 actionable safety tips

Many of the documents used to mitigate risks in international trade come with tedious processes and are not sufficient to really ensure the trustworthiness of the trade partner. Through digital escrows, full transparency can be created and up to $500 per $10.000 can be saved.

4. What Documents are Needed to Trade Internationally/ in Trade Finance?

a. Commercial Invoice

- Full name & address of the buyer and seller with their respective reference numbers

- Description of goods, quantity of goods, unit price, weight, total price, shipment terms, purchase order no. etc.

- Terms of settlement – advance payment, collection (payment or acceptance), documentary credit etc.

- Shipment details – mode of shipment, name of carrier, port of loading and port of discharge etc.

- Issued by the seller and addressed to the buyer

b. Bill of Lading

- Evidence of receipt of goods for shipment & contract of carriage

- Negotiable document which evidences shipment of goods by sea and conveys title to goods

- Issued in sets

- Full Set – all the originals constitute a full set

- Consignor / Shipper – normally the beneficiary of the LC / seller of goods

- Consignee – normally the LC opening bank / buyer of the goods

- Freight Payable at Destination / Pre Paid

- Notify Party

- Port of Shipment

- Port of Destination

- Date of Shipment

- Shipped on Board

- On Board notation

- Clean Bill of Lading (no evidence of defective condition of goods / packing)

- Gives a strong title to the consignee since the original BL has to be produced for taking delivery of the goods

- Only one original is required to be produced for taking delivery of the goods. Once one original is produced, all other originals become null & void

c. Air Waybill

- Evidence of receipt of goods for shipment and contract of carriage

- Non – negotiable document and is not a document of title to the goods

- Consignor / Shipper – normally the beneficiary of the LC / seller of goods

- Consignee – normally the LC opening bank / buyer of the goods

- Freight Payable at Destination / Pre Paid

- Notify Party

- Port of Shipment

- Port of Destination

- Date of Shipment

- Goods will be delivered to the person named as the consignee in the AWB

- Delivery Order required to take delivery of the goods if goods are consigned to a Bank

d. Truck Receipt / Consignment / Delivery Note / Railway Receipt

- Document evidencing shipment of goods by truck or rail or other means of land transport

e. Certificate of Origin

- Indicates the country of origin of goods

- Normally issued by a Chamber of Commerce

- They are generally required for any of the following reasons:

- Quantum of Import duty to be levied: Some importing countries prohibit import of goods from certain countries and some countries encourage import of goods from certain specified countries and levy lower or nil custom duties

- Trade under aid agreements / Boycott of goods: Some donor countries often require recipients of aid to import goods from their own (donor) country or from a group of donor countries. Some countries prohibit the importation of goods from certain countries for political reasons

- Marketing: Often buyers prefer that certain goods originate from specific countries which have a good reputation for producing quality products; consequently, importers may require documentation to evidence the country of origin.

f. Sales / Purchase Contract

It is the agreement between the seller and the buyer for the purchase and sale of goods and normally will include the following:

- Description of goods

- Quantity

- Quality

- Unit Price & Currency

- Total Price

- Shipment Terms (FOB / CFR / CIF etc.)

- Date of Shipment

- Port of Shipment

- Port of Destination

- Credit Period

- Settlement Method (Sight / Usance)

- Documents required

g. Packing List

- Document which provides the packing of goods into packages / cartons etc.

- Number of packages / cartons

- Gross & Net weight

- Measurement of packages

- Indicates the shipping marks, if any

h. Weight List

- Indicates the total gross and net weight of the goods

i. Inspection Certificate

- Certificate which shows the result of inspection of the goods (quality, condition, contents etc.)

- Normally issued by reputed independent agencies (SGS, Intertek International, Cotecna and Bureau Veritas)

j. Bill of Exchange / Draft

A bill of exchange is an unconditional order in writing, addressed by one person (drawer) to another (drawee), signed by the person giving it (drawer), requiring the person to whom it is addressed (drawee) to pay on demand or at a fixed or determinable future date, a sum certain in money to or to the order of a specified person (payee) or to the bearer

- Unconditional order in writing

- Addressed by one person (drawer) to another (drawee)

- Signed by the person making it (drawer)

- Requiring the drawee to pay a specific amount of money

- Immediately or at a fixed date or determinable future date

- Or the bearer

The person who makes or signs the Bill of Exchange is the DRAWER. He is the person to whom money is owed i.e. the seller

The person to whom the Bill of Exchange is addressed is the DRAWEE. He is the person from whom the money is to be received i.e. the buyer

Bill of Exchanges are usually drawn in sets of two i.e. the first original bill of exchange and the second original bill of exchange. This is to allow the second bill of exchange to be used if the first bill of exchange is lost or destroyed or vice versa. Both the bills of exchanges are identical in nature (date, amount, tenor, drawer, drawee are same). If one of the bill of exchange is paid, the other bill of exchange becomes null & void and cannot be legally enforced.

k. Sight (On Demand) Bill of Exchange ****

Where the payment is to be paid by the drawee on demand or immediately.

l. After Sight Bill of Exchange

Where the payment is demanded after certain days from sight. E.g. 30 days after sight. This means 30 days after the Bill of Exchange is seen (sighted) by the drawee.

m. Fixed Date Bill of Exchange

Where the payment has to be made on a fixed date (already indicated) or where the due date could be ascertained from the face of the Bill of Exchange. E.g. 30 days after date (meaning the date of Bill of Exchange); 30 days after Bill of Lading date (date of B/L) meaning the date of Bill of Lading + 30 days

n. Insurance Policy / Certificate

This document covers the risk of loss of damage to the goods during transit from the seller to the buyer

Insurance Policy – incorporates all the terms and conditions of the actual contract of insurance and shows full details of the risks covered. The right under the policy can be assigned to a third party by endorsement and delivery of the policy instrument. The policy instrument is a document which can form the basis of a legal action.

Insurance Certificate – is merely evidence that cover has been effected under a separate open insurance policy already in existence. It does not provide a basis for legal action.

- Issued by an insurance company or their agents

- Insurance cover should be effective at least from the date of shipment.

- Document which provides the amount, terms and conditions of insurance of goods against any loss

- Description of goods covered

- Risks Covered

- Date of covering the risk

- Name of the insured party

- Insurance Company’s Agent at destination

o. Quality Certificate

- Document which evidences the quality of the goods

- Required by the importer to ensure that the quality of goods supplied is as per the requirement

p. Fumigation Certificate

- The Fumigation Certificate, also referred to as a 'pest control certificate' is the proof that wooden packing materials used in international sea freight shipping e.g. wooden pallets and crates, wood, wool etc have been fumigated or sterilized prior to the shipment.

- Fumigation certificates usually contain details such as purpose of treatment, the articles in question, temperature range used, chemicals and concentration used etc.

- It assists in clearance of an international sea freight shipment upon the arrival and avoids quarantine of the goods.

q. Phytosanitary Certificate

- Phytosanitary certificates are issued to satisfy the import regulations of some countries. They indicate that a shipment has been inspected and is free from harmful pests and plant diseases.

- Certificates are mainly required for regulated commodities such as plants, bulbs and tubers, or seeds for propagation, fruits and vegetables, cut flowers and branches, grain, and growing medium.

r. Analysis Certificate

- Certificate which provides the contents of the goods

- Required by the importer to ensure that the goods supplied is as per the requirement

5. Terms used in Trade

Acceptance

Refers to the commitment by an importer (or the issuing bank) to pay for the goods they received at a fixed future date, evidenced by their accepting a Bill of Exchange from an exporter.

Acceptance (Usance) Credit

- LC which includes a term bill of exchange which is accepted by the bank on whom it is drawn (Issuing / Advising Bank) and the proceeds are paid to the beneficiary at maturity

- Payment is not immediate

- Bill of Exchange is to be presented

- Payment is made on the maturity date (due date) of the Bill of Exchange.

- Provides a means by which the beneficiary may be able to obtain finance by discounting the bank accepted bill of exchange.

Advance Payment Guarantee

Guarantee issued by a bank on behalf of the seller in favour of the buyer to secure the payment received in advance.

Amendment

Any changes made to the terms and conditions of the original LC / Guarantee (which has already been issued) with the concurrence of all the parties.

Availability With

- A term used in a LC to indicate the bank nominated by the issuing bank to pay, accept, incur a deferred payment or negotiate documents under the LC

- Restricted LC

- Unrestricted LC

Available By

- Payment – immediate payment to be made to the beneficiary

- Acceptance – payment to be made to the beneficiary at a future date based on Bill of Exchange accepted by the drawee

- Deferred Payment – payment to be released to the beneficiary at various future dates (no Bill of Exchange is required)

- Negotiation – releasing / agreeing to release payment to the beneficiary against complying presentation

Avalize / Avalization (Co-Acceptance)

- The process by which a third party (usually a bank) which guarantees the undertaking of the drawee (the person on whom the Bill of Exchange is drawn) to pay on the due date.

- Done in respect of usance collection documents

- An avalized documents is as good as a documents under a LC

- The seller will be able to mitigate the risk of default by the buyer by getting the Bill of Exchange avalized (co-accepted) by the buyer’s bank

- Once the Bill of Exchange is avalized (co-accepted), the buyer’s bank is committed to make payment to the seller on the due date irrespective of whether the buyer has money in their account or not

Bank Guarantee

- An unconditional undertaking by the Bank

- To pay fixed sum of money to another party

- Within a specified time period

- Subject to making a demand and submission of required documents

Bid (Tender) Bond Guarantee

- A guarantee issued by a Bank on behalf of a seller (Bidder) in favour of the buyer to support the sellers bid or tender for a contract.

- Usually for 3 % to 5 % of the contract amount

Bill of Exchange

- Unconditional order in writing drawn by the seller asking the buyer to pay a specific amount of money immediately or at a future date

- Unconditional Order

- Drawn by the Seller (Drawer)

- Drawn on the Buyer (Drawee)

- Specific amount

- Immediate payment / payment on a future determinable date

Cash Against Documents (CAD) or Documents Against Pay (DP)

A collection arrangement wherein shipping documents are released to the buyer only against payment.

Case of Need (Seller’s Agent)

In case of any issues with the goods or the payment in the country of the importer, the exporter will find it very difficult to co-ordinate with the shipping company, insurance company, collecting bank or finding an alternate buyer.

Case of Need is the person (normally the agent of the exporter located in the country of residence of the importer) who will be able to look after the interest of the seller in respect of the following:

- Persuading the buyer to accept or pay

- Liaising with the collecting / presenting bank handling the collection

- Assist in clearing / storing or insuring the goods

- Finding an alternate buyer in case the original buyer refuses to accept delivery of the goods

The exporter has to clearly state the powers that has been granted to the case of need.

Carrier

Person or a company hired for the transportation of goods e.g. shipping company, airlines, railways etc.

Collection

Seller sends the documents relating to the shipment through his or her bank to the buyer’s bank requesting them to release the documents to the buyer against payment (DP) or against acceptance (DA).

Collection Letter (Instruction)

- Covering letter accompanying the collection documents prepared by the seller or seller’s bank (Remitting Bank) addressed to the buyer’s bank (Collecting / Presenting Bank) providing the following details:

- Reference Number

- Currency & Amount of document

- List of documents enclosed and their numerical count

- Release of documents against payment / acceptance

- Collection of charges (seller or buyer) – Waive / Do not waive

- Interest charges - Waive / Do not waive

- Details of Bank where funds to be remitted

- Case of Need

Confirmation of LC

- Confirmation is the undertaking of another bank (usually in the country of residence of the beneficiary), in addition to the undertaking of the issuing bank, to pay / accept complying documents

- The confirming bank will confirm the LC only if the issuing bank specifically requests that bank to add confirmation to the LC.

- Confirmation Charges – either paid by the applicant or beneficiary

- Why is confirmation required? To mitigate credit risk & country risk

Consignee

The party on a transport document to whom the goods are addressed for delivery (normally the buyer / Collecting bank / Issuing bank)

Consignor

The party on a transport document on whose behalf the goods are being shipped (normally the seller / beneficiary)

Documents Against Acceptance (DA)

Collection arrangement wherein the shipping documents are presented to the collecting bank with an instruction to deliver the same to the buyer against acceptance of the Bill of Exchange.

Documents Against Payment (DP) / Cash Against Documents (CAD)

Collection arrangement wherein the shipping documents are presented to the collecting bank with an instruction to deliver the same to the buyer against cash payment.

Deferred Payment Credit

- Payment is not immediate

- Drawing amounts are to be paid at a future determinable date in accordance with the documentary credit

- Bill of Exchange is not drawn

Discounting

The purchase of accepted term Bill of Exchange at a discount to allow funding to the seller until the maturity date.

Discrepancy

Where documents presented under a letter of credit do not comply with the terms & conditions of the credit, the UCP and ISBP.

Dishonour

The refusal to pay or accept a bill of exchange or any financial document

Drawee

The party to which a Bill of Exchange is addressed for payment or acceptance.

Drawer

The party that issues a Bill of Exchange and is the receiver of the money.

Expiry Date (Bank Guarantee)

Is the last date by which the beneficiary can present a valid claim to the Bank. After the date of expiry, the beneficiary does not have any claim on the BG issuing bank.

Expiry Date (Letter of Credit)

The last date by which the seller (Beneficiary) can present documents to the advising / nominated or issuing bank. After the date of expiry, the beneficiary does not have any claim on the LC issuing bank.

House Airway Bill (HAWB)

- It is the airway bill issued by a air Freight Forwarder / Consolidator. This acts as contract of carriage between the shipper and the forwarder.

- The forwarder gains profit by consolidation and putting together cargoes from different shippers under one MAWB to earn a more favourable bulk quantity freight rate and charges the shipper a higher freight rate.

- The freight forwarder assumes the risk and obligations of being the carrier.

- The forwarder obtains a separate Airway Bill from the carrier which is called the Master Airway Bill (MAWB).

INCO (International Commercial) Terms 2010

- These are official trade shipping terms agreed by the International Chamber of Commerce, Paris

- There are 11 Incoterms which come into force on 01st January 2011

- Each Incoterm defines the responsibilities of buyers and sellers for the delivery of goods under sales contract

- They are authoritative rules for determining how costs and risks are allocated to the parties

Irrevocable Letter of Credit

This is a letter of credit that cannot be cancelled or amended without the concurrence of the parties to the LC (buyer, seller and the banks)

Issuing Bank

The bank that issues a letter of credit at the request of the applicant

Latest Shipment Date

A date indicated in the Letter of Credit by which the seller has to ship the goods to the buyer

Letter of Credit (LC)

An irrevocable undertaking by which the issuing bank guarantees payment to the beneficiary if shipping documents complying with the terms and conditions of the letter of credit are presented to them or any other bank nominated by them

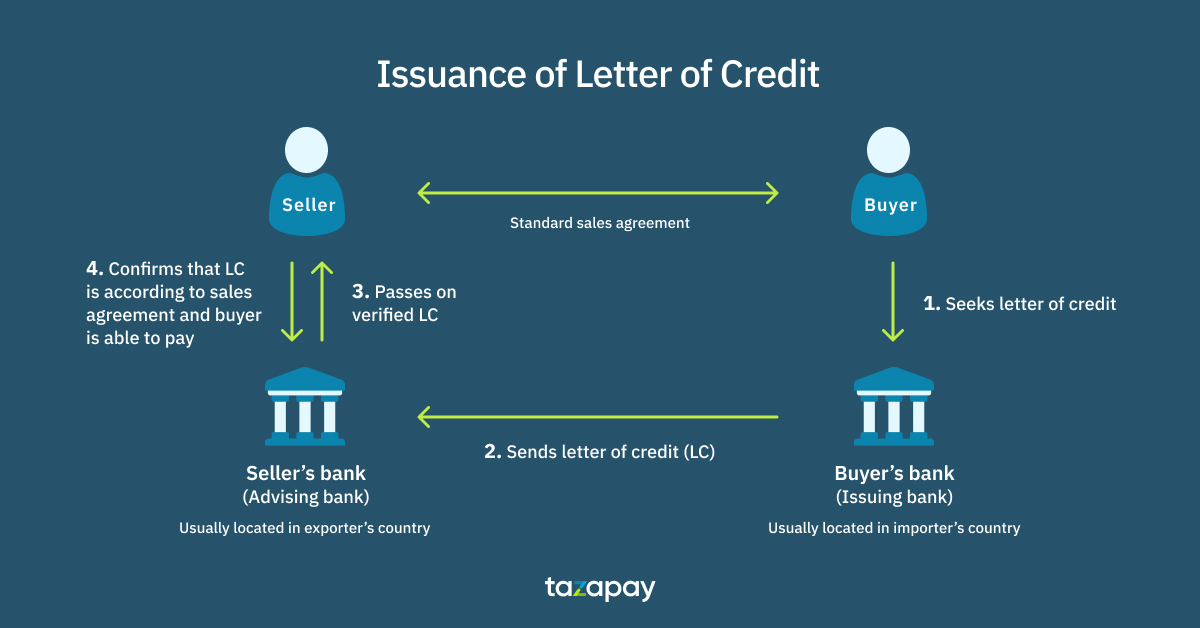

Learn more about the different types of documentary credit in our guide. The following graphic shows the steps of the process for issuing a letter of credit.

Letter of Credit Available by Acceptance

A Letter of Credit available at the counters of the issuing or nominated bank by acceptance of a Bill of Exchange and amount to be paid to the beneficiary (seller) at a future determinable date.

Letter of Credit Available by Deferred Payment

A Letter of Credit available at the counters of the issuing or nominated bank with a commitment to pay the seller at a determinable future date. Bill of Exchange is not drawn in case of deferred payment credit.

Letter of Credit Available by Negotiation

A Letter of Credit available with the issuing or nominated bank which is authorized to negotiate and make payment to the beneficiary

Letter of Credit Available by Sight Payment

A Letter of Credit available at the counters of the issuing or nominated bank with a commitment to make immediate payment to the seller on presentation of credit complying documents.

Marine Insurance

A policy issued by an insurance company to insure goods against damage / loss in transit.

Maturity / Due Date

The date on which a Bill of Exchange or Letter of Credit becomes due for payment.

Negotiation

Negotiation means the purchase by the nominated bank of the drafts (drawn on a bank other than the nominated bank) and / or documents under a complying presentation, by advancing or agreeing to advance funds to the beneficiary on or before the banking day on which reimbursement is due to the nominated bank

Negotiable Instrument

A negotiable instrument is any document which enables one party to transfer their rights / claim to another party by endorsement and delivery e.g. Bill of Exchange, Promissory Note, Cheques etc.

Open Account

An arrangement by which the seller ships goods directly to the buyer and the buyer makes periodic payment to the seller as per agreement. No banks are involved at the preliminary stages. Banks are involved only at the time of making the payment.

Partial Shipment

- When the total quantity to be shipped is shipped in lesser quantities and in more than one instalment

- Partial shipment is permitted if the LC is silent regarding the partial shipment.

- In case partial shipment is prohibited, the LC should clearly state so

Performance Bond / Guarantee

A guarantee issued by a bank, on behalf of the seller (Contractor) to the buyer, to support the ability of the seller to perform under the contract.

Period of Presentation

The number of days given to the seller (beneficiary) from the date of shipment to present the shipping documents to the advising / nominated or issuing bank.

Promissory Note

A signed undertaking from one party (drawer / promissor) addressed to another party (promisee) promising to pay a certain sum of money at a specified future determinable date.

Revolving Letter of Credit

A letter of credit in which the value of the Letter of Credit is automatically reinstated upon utilization. The letter of credit may revolve by time, value or both. Is normally used when the seller is shipping goods on a regular basis to the buyer over an extended period of time

Silent Confirmation

Confirmation to a letter of credit is added at the specific request of the issuing bank. A silent confirmation is adding confirmation to the letter of credit by the advising or any other bank at the request of the beneficiary without the specific authorization and knowledge of the issuing bank.

Standby Letter of Credit (SBLC)

A letter of credit issued to protect the seller from non-payment by the buyer as agreed between them. As per the agreement, the seller ships the goods directly to the buyer and the buyer makes direct payment to the seller at agreed dates. If the buyer defaults in making payment to the seller, the seller invokes the SBLC to get the payment.

Transferable Letter of Credit

- A letter of credit wherein the beneficiary (first beneficiary) transfers the letter of credit in full or part to one or more beneficiaries (second beneficiaries).

- The letter of credit has to clearly indicate that the same is transferable to make it a transferable letter of credit.

Transhipment

- Transhipment is the process of unloading from one form of transport (vessel, aircraft or truck) and reloading to another form of transport during the course of journey of the goods from the port of shipment to the port of destination indicated in the letter of credit.

- If the LC is silent, transhipment is permitted

- If transhipment is to be prohibited, the LC should clearly state so

Uniform Customs and Practices 600 (UCP 600)

Uniform Customs and Practice for Documentary Credit, ICC Revision 2007 developed by International Chamber of Commerce (ICC), Paris are the rules that govern the operation of Letter of Credit transactions worldwide.

Uniform Rules for Collection 522 (URC 522)

Uniform Rules for Collection 522 developed by International Chamber of Commerce, Paris are the rules that govern the operation of documentary collection worldwide.

Visible and Invisible Trade

Visible trade is the import and export of physical goods. Invisible trade is the import and export of services (software, BPO, technology, design, architect’s fees, insurance, banking, transport etc.)

Warranty Bond / Guarantee

A guarantee bond issued by a bank on behalf of the seller (contractor) in favour of the buyer to secure any claims by the buyer on the seller for any defect in the goods during any agreed warranty / maintenance period.