- Home

Blog Blog

Insights & Trends Insights & Trends

Online B2B Payment Trends in Singapore 2022

Online B2B Payment Trends in Singapore 2022

Singapore’s a digitally literate nation with an 88.9% internet penetration and a 97.9% financial inclusion rate amongst the 5.87 million people that make up the nation’s population.1 Because of this, the local online business environment has adopted digital means of payment like fish to water.

This is as evidenced by the fact that roughly 52.3% of all Singaporeans have purchased goods via the internet as of 2021, signaling an increase in the adoption of e-commerce among firms, with the smallest slice of the e-commerce pie belonging to the business services sector at about 3.6% of all e-commerce trade according to the Ministry of Trade and Industry in 2019.2

However, given the rise in overall e-commerce adoption, the business sector will inevitably expand further and evolve into the digital sphere.

Therefore, it pays to know the intricacies of Singapore’s payments ecosystem to ensure that your transactions remain seamless and localized if you're planning to expand into this market.

Singapore’s 2022 Digital B2B Payment Trends in a Nutshell

Online B2B payments in Singapore are conducted via three payment methods at present:

- Credit and Debit Cards

- Digital Wallets

- Bank Transfer

Our findings showed that, with the current online B2B payment methods listed, Singapore’s online payment trends that you should look out for are as follows:

- Digital Wallets Overtaking Credit Cards by 2024

- Enabling Local Payment Methods to Address Local Singaporean Banks’ Dominance Over Card Issuances in Payments

- The Gradual Displacement of Offline Transactions with QR Code Payments

With these trends in mind, you now know more on how to localize your business to stand out from the rest of your global competitors.

How Are Online Payments Done in Singapore Presently?

Digital payments in Singapore are currently conducted in three main methods of payment: credit and debit cards, digital wallets, and bank transfers. While these are the most common means of online payment in Southeast Asia, each with their own distinct payment gateways, here are the key differences that set them apart and how they affect Singapore’s e-commerce scene.

Credit and Debit Cards:

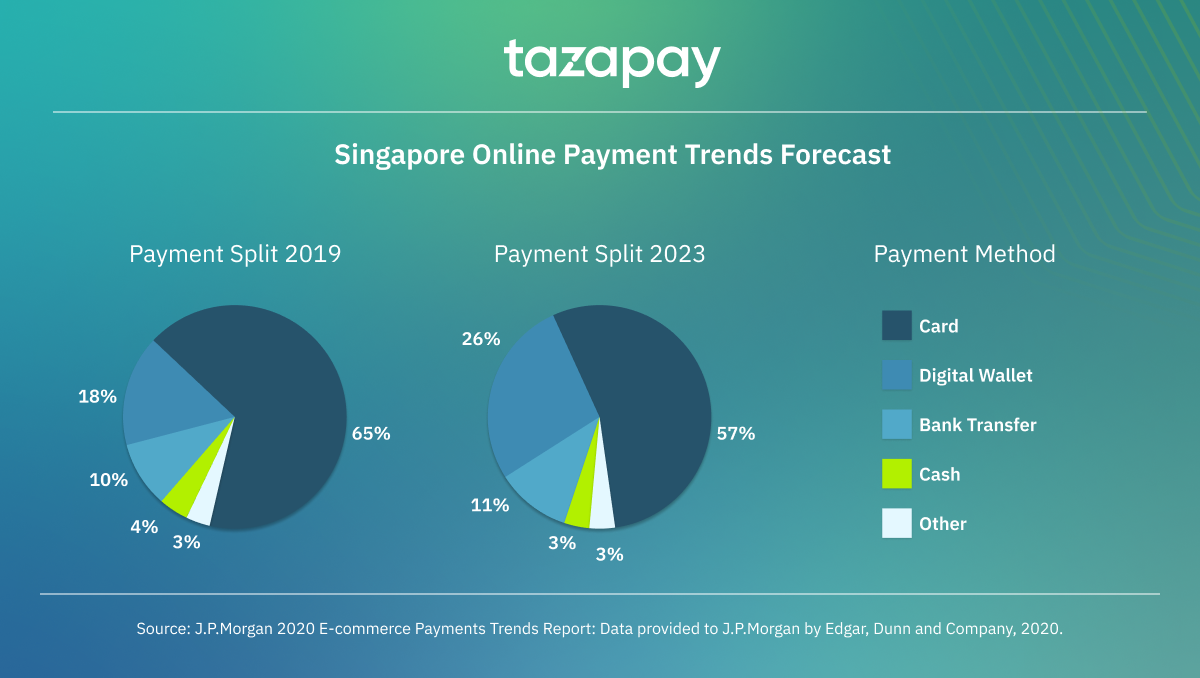

In the hierarchy of payment methods, payments via credit and debit cards are the most prevalent form of payment in Singapore, even more than their closest card-dominant counterpart in the region, Vietnam, at over 75% of all e-commerce activity compared to the latter’s 35% in 2020.3 This data is supported by JP Morgan’s own 2020 report on payment trends which saw card payments dominating the e-commerce scene, boasting 1.73 debit cards and 1.61 credit cards per capita and 65% of total e-commerce activity, indicating a 10% increase over the span of a year.4

This increase in card usage is found to be influenced by the COVID-19 pandemic as most Singaporeans found themselves shopping online more often, with a significant portion skeptical of returning to pre-pandemic shopping habits.

Here are the pros and cons to using card payments as a means of payment:

Pros:

Convenience: Cards are quicker to use, both physically and online. In physical stores, point of sales (POS) terminals act as payment gateways to accept card information whereas “checkout” portals serve the same purpose for their online counterparts. This makes it useful for everyday expenses and can be utilized over the phone and internet due to the ubiquity of official mobile banking apps.

Recognition: Regardless of what bank you use or where in the world you are, you are guaranteed to have a Mastercard or Visa. While there are other card issuers such as American Express, this worldwide presence ensures that the card holder can readily access their funds anytime, anywhere.

Quick cash access: There is always bound to be the occasional store or outlet that refuses your card or bank, which is why the ability to withdraw cash from an ATM is handy for those inevitable hiccups that require a supply of physical cash on hand.

Cons:

Debt: The convenience of using credit cards as a means of payment is also ironically one of its greatest drawbacks. An individual can easily find themselves drowning in debt from ever-growing interest charges if they aren’t careful.

Card fraud: The nature of the cards as payment methods also mean that the user is at greater risk of fraud since all a malicious actor really needs is a few pieces of information attached to your cards, which are usually your card number, CVV code, and expiry date. These are the pieces of information needed to make online purchases. A skilled scammer could also trick the user into giving up their one-time password (OTP) to them to get around most two-step authentication measures set by most banks for online purchases. There’s even less security involved with the physical cards themselves since, outside of ATM cash withdrawal and single purchases above a certain price threshold, criminals wouldn’t even need the PINs of their unsuspecting victims thanks to the widespread implementation of contactless payment gateways which can allow them to use their stolen cards by simply tapping them at POS terminals.

Digital Wallets:

Digital wallets, or e-wallets, are a software-based system that stores users’ payment information and passwords for numerous payment methods and websites securely. This means that a user can link their debit/credit cards to these wallets to authorize payments on their behalf across any number of digital platform-supported transactions from their phones, eliminating the need for a physical wallet. Evidently, with the spike in e-commerce due to the pandemic, digital wallets find themselves increasingly utilized by Singaporeans as illustrated by JP Morgan, Fintech Singapore and The Straits Times5 naming them as the nation’s second most used payment method. As of 2020, digital wallets make up 20% of Singapore’s e-commerce transactions.

Here are the pros of cons of using digital wallets as a means of payment:

Pros:

Seamless payment experience: Since digital wallets allow you to make payments with your smart devices, this essentially grants you a seamless purchase experience as you can either use the e-wallet app to pay directly or use your device to scan a QR code or scan the compatible NFC POS system to make a successful payment. This allows for a cash free buying experience that takes only seconds to complete. Furthermore, the ability to link your cards to them also means that you can quickly access any card of your choice on the fly should the need arise.

Utility as budgeting aid: Keeping to a budget is less of a bother since most digital wallet services also record your transaction history, making it easier to keep track of. Some e-wallets also offer rewards in the form of discounts and a points-based redemption system such as Singtel’s Dash, meaning that you can potentially save money while maintaining current spending habits.

Security: Digital wallets often come with password and biometric security measures, making them safer than cards in the event of theft or loss of the device containing the e-wallet. Many e-wallets are also created in the cloud thus allowing you securely regain access to your data even when using a new device. They also enforce secure transactions via randomly generated payment codes and real time OTPs for physical or online checkouts.

Cons:

Limited merchants: Unfortunately, digital wallets, being a relatively recent technology, are not as readily available as most merchants have yet to fully adopt them so you still need to have some cash or bring your cards to make some transactions. Furthermore, the fully digital nature of the technology also means that merchants that do support digital payments are usually within urban population centers and may be difficult for the older generations to utilise.

Dependency on devices: Given that the digital wallet is a software-based system, it’s best if you keep your physical wallet around lest you run the risk of failing to make your transactions due to a dead battery or from losing your smart device.

Safety and privacy concerns: Just because your e-wallet is mostly secure from physical intrusion does not mean it is insusceptible to cyberattacks. Hackers can potentially access all your stored cards and using a less reputable digital wallet can also run the risk of having your sensitive information compromised.

Bank Transfer:

Being third in Singapore’s hierarchy of popular payment methods, bank transfers, and bank transfer apps, account for 10% of the nation’s e-commerce transaction volume in 2020. This is a stark contrast to its neighbor, Malaysia, which sees 46% of its e-commerce transactions done via bank transfers. However, JP Morgan predicts that this figure will rise to 11% by 2023, suggesting a slow yet steady adoption of the payment method.

Here are the pros and cons of using bank transfers as a means of payment:

Pros:

Quick and easy: Bank transfers can be done anywhere, even the comfort of your own home, and take only a few moments to set up. Since the money is also transferred in real time, this means that the recipient can immediately use the transferred money as soon as it arrives, perhaps even on the same day depending on whether the transaction is made locally or internationally. Most banking institutions provide their own bank transfer apps for their online services as well, allowing for on-the-go transactions.

Accessibility: On top of the banks providing their own bank transfer apps, bank transfer services can be found all around the world, even in non-urban areas. In other words, you can conduct your transactions wherever you are even with no internet service if there’s a physical bank transfer service. You receive your money in your own currency too, making bank transfers highly reliable due to this level of accessibility and availability.

Secure: Unlike the other two payment methods listed, bank transfers have a reputation for its safety and reliability. This is because the sender must have sufficient funds in their account to initiate a transfer and transactions usually have a tracking ID to ensure that the money can be traced and are normally subject to international wire transfer regulations. In addition, the fact that bank transfers involve the banks directly means that there are fewer windows for malicious actors to prey upon, granting greater assurance that your money will be safely transferred to the recipient’s bank account as opposed to card-based payment gateways. Some online payment platforms, like Omoney, offer bank transfer as a convenient non-card-based payment gateway to securely conduct high volume transactions.

Cons:

Irreversible: Once a transaction is made, it is difficult to undo it. While international transfers could be reversed in certain situations, most of the time it is better to be absolutely sure that you are transferring your money to the right party.

Singapore’s Online Payment Trends to Look Out For in 2022

As alluded to earlier in the section on Singapore’s current popular payment methods, the trends between the three are dynamic and quickly shifting by the year, especially ever since the pandemic hit. Our findings show that, with the current online B2B payment methods listed, Singapore’s online payment trends that you should look out for are as follows:

Include Digital Wallets as a Payment Method as they are set to Overtake Card Payments by 2024

Currently, digital wallets sit at a modest 20% in terms of adoption by Singaporeans as a means of payment though according to the Straits Times, this is expected to change come 2024. While the pandemic can be attributed to this increase in its usage, the main reason has to do with the fact that digital wallets accounted for 44.5% of the world’s e-commerce transaction volume last year thus setting the trend. This factor, combined with Singapore’s tech-literacy and fast adoption of new e-commerce technologies, contribute to this observation as well, with data from JP Morgan supporting it with its own 2020 report predicting the growing number of transactions made via digital wallets.

International payments may be affected by this trend since it may drive down the cost of payment acceptance for non-card payment options which, apart from Singapore’s PayNow QR being free until 2022, has typically been higher than that of cards. Therefore, it’s recommended to opt for B2B payment gateways that include e-wallets as a checkout option.

Enable Local Payment Methods to Address Local Singaporean Banks’ Dominance Over Card Issuances in Payments

As Singapore gradually transitions to an endemic approach to COVID-19, the rate of digital payment method adoption has continued growing. However, local banks still dominate the financial cards and payment landscape due to the three leading local banks (DBS Group Holdings Ltd, United Overseas Bank Ltd, Oversea-Chinese Banking Corp Ltd (OCBC)) being responsible for the issuance of a significant majority of all credit and debit cards in local circulation at present.6

The continued success of the banks can be attributed to their financial stability and decades of built-up trust amongst the populace, thereby making it advantageous to have a B2B payment gateway that has local payment options to tap into. This is because it would allow global players to quickly build up rapport with the locals by making their businesses more accessible and reputable via the connection with familiar banks and payment methods.

Allow the use of QR Code Payments as they are Gradually Displacing Offline Transactions

Cash is increasingly being displaced by QR payments among Singapore’s small merchants. This is the result of the country’s own ongoing initiative in building up the infrastructure for cashless payments which includes the establishment of a common standard for QR code payments by the Singapore Payments Council in September 2018.

Cash is increasingly being displaced by QR payments among Singapore’s small merchants. This is the result of the country’s own ongoing initiative in building up the infrastructure for cashless payments which includes the establishment of a common standard for QR code payments by the Singapore Payments Council in September 2018.7

However, the adoption of this payment technology is now increasingly being considered by larger businesses looking to emulate the success of China’s AliPay and other equivalents. However, one important element to consider is the cost of payment acceptance for digital wallets. While Singapore’s PayNow QR transactions are to be set at a fixed rate of SGD0.20 from 2022 onwards, other e-wallets have higher acceptance costs than this. Thus, it is important to find a payment gateway, like Omoney, which offers the option to pay via QR code payment methods.

Setting up a business in a country like Singapore can seem challenging initially, as you may need to account for the complexities of social commerce to keep your business relevant. With these trends in mind, you now know more on how to localize your business to stand out from global competitors.

Payment trends never remain constant, especially not in Singapore. With operations in over 173 countries, Omoney is committed to keeping abreast with the latest online payment solutions. Want to know more? Contact us today!

Sources

- We Are Social: Digital Landscape in Singapore 2021

- Ministry of Trade and Industry: Economic Survey of Singapore

- Fintech News SG: E-commerce Payment Trends in Southeast Asia

- JP Morgan: 2020 E-commerce Payments Trends Report: Singapore

- The Straits Times: Digital Wallets to Overtake Credit Card amid e-commerce boom

- Euromonitor: Financial Cards and Payments in Singapore

- IBS Intelligence: QR Code Gradually Displacing Cash in Singapore

Category

Insights & Trends

Online B2B Payment Trends in Singapore 2022

Related Articles

The Online B2B Payment Landscape in India for 2022

Online B2B Payment Trends in Singapore 2022