- Home

Blog Blog

Payments Resources Payments Resources

Card Authorization Rates: a Consideration for Your eCommerce Business's Payment Gateway

Card Authorization Rates: a Consideration for Your eCommerce Business's Payment Gateway

Your eCommerce business is booming. It is as secure as it can ever be and has multiple localised payment methods to help decrease checkout abandonment. However, a customer attempts to pay by credit card, but leaves after being notified that his payment was not authorized. Card payments still remain one of the most popular payment methods in the world despite the emergence of newer payment methods. Therefore, it is important to take note of your eCommerce business’ card authorization rates and learn how to increase them.

What are Authorization Rates?

Authorization rates simply refer to the percentage of transactions that successfully pass through the authorization step of a card payment, resulting in a completed payment¹. Figuring out this percentage is as easy as dividing the number of successfully approved payments by the total amount of attempted transactions¹.

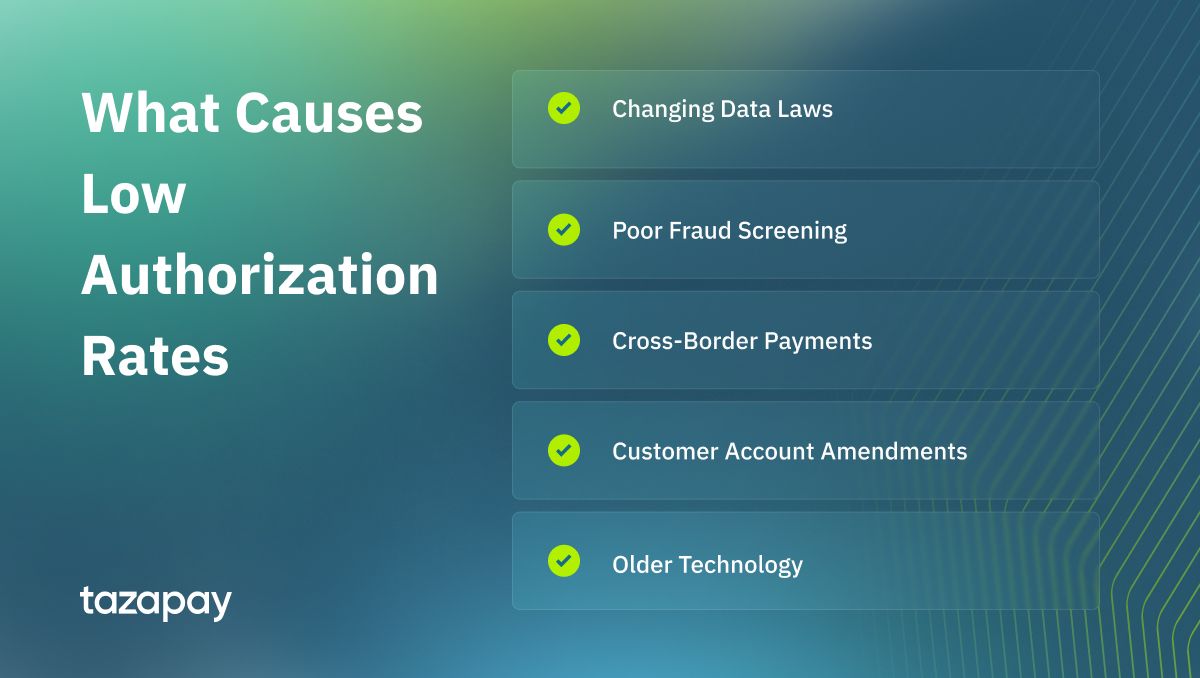

What Causes Low Authorization Rates?

Low authorization rates are worrying for your business since it means that there’s more going on than customers simply having their card declined by their bank.

So here are some causes for a denied transaction:

- Changing Data Laws: Countries introducing new data laws or updating pre-existing ones can lower your authorization rates if you are too slow to adapt, especially when it stipulates new requirements that could greatly complicate the authorization process².

- Poor Fraud Screening: Card declines are, in theory, a form of fraud prevention and are supposed to target potential fraud². However, if you have inaccurate fraud prevention in place, you might see far more declines than is necessary which then easily translates into lower authorization rates².

- Cross-Border Payments: These sorts of payments have a higher likelihood of being declined due to a variety of factors such as currency mismatches, the card not being recognised by the processing bank, and the limitations of the card issuing bank². Whatever the reason, it is a general rule of thumb that you opt for a robust payment provider that could easily help localise the payment process as much as possible.

- Customer Account Amendments: If your customer database does not automatically update periodically, then the low authorization rate might be due to the fact that the customer’s card information in your database is no longer accurate².

- Older Technology: As the world marches headlong into a bolder digitised global economy, so too does the technology used in card payments. As such, keeping an older card payment processing system around would lead to low authorization rates since they would lack the features that newer systems have in place today that help address most of the aforementioned causes for low authorization rates².

What Hidden Costs Does This Have on Your eCommerce Business?

First and foremost, the most obvious hidden cost to your eCommerce business from low authorization rates is the lost revenue from checkout abandonment. This will hurt your business especially if you're in the business of selling high-valued goods since these transactions are hard to come by as opposed to businesses that depend on the volume of low-value goods sold.

While having a multitude of localised payment methods can help mitigate this issue, most of the time a user paying by card is unlikely to have alternative methods of payment on-hand.

Another hidden cost incurred by having low authorization rates is the lowered overall customer satisfaction¹. A few declined card payments might not affect your business in the short term, but if not addressed, it will lead to a growing number of dissatisfied customers over time thereby negatively impacting your business’ image and brand².

How Can Low Authorizations Be Reduced?

Since the card authorization process has so many moving parts, the most optimal strategy you can adopt is reviewing the different factors within your control that may be causing these declines. By identifying and focusing on a specific reason for a decline, you would be able to determine and apply solutions much quicker than if you were to opt for a blanket solution. Here are some ways you could achieve this:

- Know Your Clientele: It might seem like a straightforward answer but knowing where your clientele comes from, and their preferred payment method can spell the difference between low authorization rates and high authorization rates. This is especially true if most of your clients come from multiple countries, since failing to know about this might lead to lower customer satisfaction when it could have been fixed with cross-border payment optimization.

- Know Your Transaction Meta-Tags: It is entirely possible that the customer's card is declined due to the processing bank being unable to find a matching established meta-tag for that particular type of transaction. This can be a simple mismatch that can be easily addressed such as a recurring payment being incorrectly flagged as an eCommerce transaction. Therefore, make sure that your transactions are properly tagged with the appropriate meta-tag.

- Know Your Data Laws: As mentioned earlier, failing to adapt in time with changes to data laws, new or old, can result in lower authorization rates. Make it a point to periodically keep abreast of any changes to the data laws of the market your business is in to ensure that you can adapt accordingly.

- Consider Your Payment Options: High-risk transactions are more likely to be declined, and this includes large transactions. Conversely, smaller amounts of money being transacted are much more easily approved. Explore looking into other payment options such Buy Now, Pay Later (BNPL) or installment payments to provide your clients with greater payment flexibility without having their cards declined.

Now that you are more aware about card authorization rates, you can strive to keep those rates as high as you can. While you’re at it, check out Omoney for a potentially safe, secure, and convenient payment provider that can cater to all your business needs whether it be an eCommerce platform or a SaaS platform.

Sources

Payments Resources

Card Authorization Rates: a Consideration for Your eCommerce Business's Payment Gateway

Related Articles

Local Payment Methods in Indonesia: How Dana Works in an International Payment Gateway